- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Broadcom Unveils 7nm IP For Deep Learning ASIC Platform

Broadcom Limited (NASDAQ:AVGO) recently announced the first-ever silicon-proven 7nm intellectual property (IP) targeting application-specific integrated circuit (ASIC) platform for deep learning and networking.

The IP cores are built on Taiwan Semiconductor Manufacturing Company’s (NYSE:TSM) 7nm process technology. The on-die computation required for training and inference of deep learning applications is expected to benefit from ultra-high density logic and memory of the 7nm ASIC platform.

The combination of CoWoS packaging and HBM2/3 PHY caters to high bandwidth memory interface required for next generation training in deep learning, high performance computing (HPC) and routing applications.

The platform’s SerDes cores (112G and 56G SerDes) are beneficial for switching and routing applications and inter-node connections in HPC applications and deep learning. The IP portfolio also supports SoC integration for 5G requirements.

We believe this to aid Broadcom’s top-line growth going ahead.

Growth Factors

Broadcom stock has gained 55.8% year to date, substantially outperforming the 40.5% rally of the industry it belongs to. The growth can be attributed to the company’s robust top-line growth and steady execution.

Broadcom benefits from strong demand of its wireless solutions. Higher dollar content at the company’s large North American smartphone customer’s (Apple (NASDAQ:AAPL)) next-gen platform (iPhone) is also a positive for the company. Robust industrial re-sales are also tailwinds.

Notably, the company’s recent acquisition of Brocade Communications Systems is expected to boost Broadcom’s position in the storage area networking space.

Broadcom is currently eyeing Qualcomm (NASDAQ:QCOM) . The latter has already turned down the recent takeover bid of $130-billion (includes $25 billion of net debt) on grounds of inadequacy as it is currently a leading player in the chipset market. However, the company is planning to raise the bid amount for Qualcomm, per Reuters.

We believe that Broadcom’s product portfolio, enhanced by the offerings of its acquired entities, is a major tailwind. However, increasing competition from industry peers like Intel (NASDAQ:INTC) and Sumitomo remains a concern.

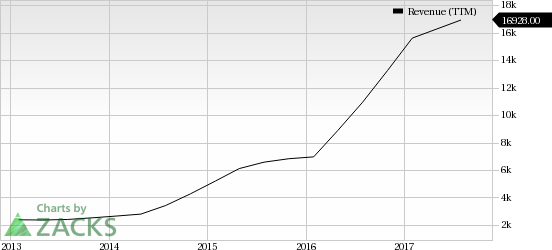

Broadcom Limited Revenue (TTM)

Zacks Rank

Broadcom has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

QUALCOMM Incorporated (QCOM): Free Stock Analysis Report

Broadcom Limited (AVGO): Free Stock Analysis Report

Intel Corporation (INTC): Free Stock Analysis Report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

When looking for dividend stocks, high dividend yields are one important factor to consider. Even if a company’s dividend yield isn’t nearing double-digit percentages, finding...

Whenever Wall Street authoritative figures, such as a large institution or individual investor, decide to shift a view on a specific stock or industry, retail traders can...

The long-run expected total return for the Global Market Index (GMI) fell in February, sliding to an annualized 7.1% vs. the previous month’s 7.4%. The downward revised forecast...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.