- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Brexit Monitor: No No No No No No No No

No support for any version of Brexit

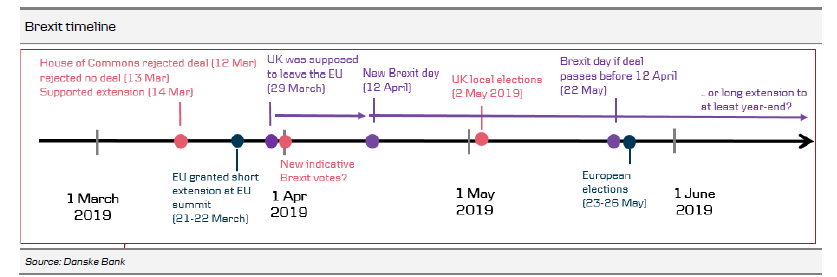

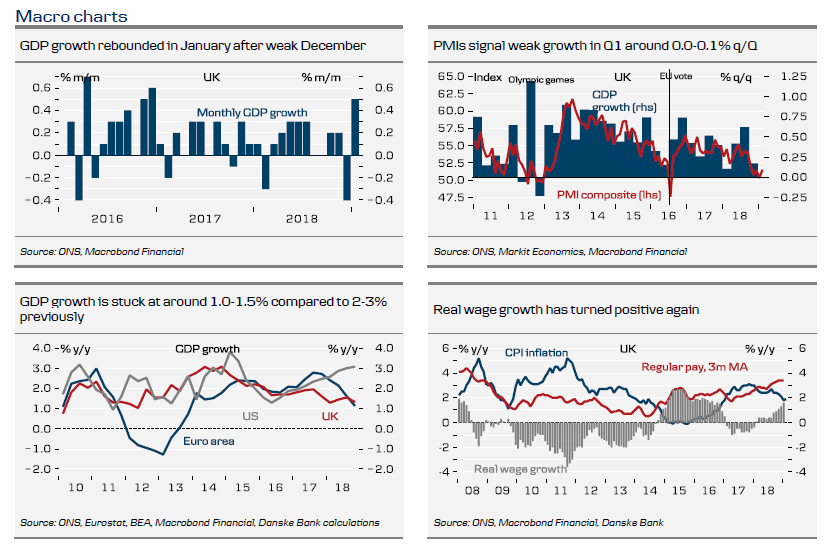

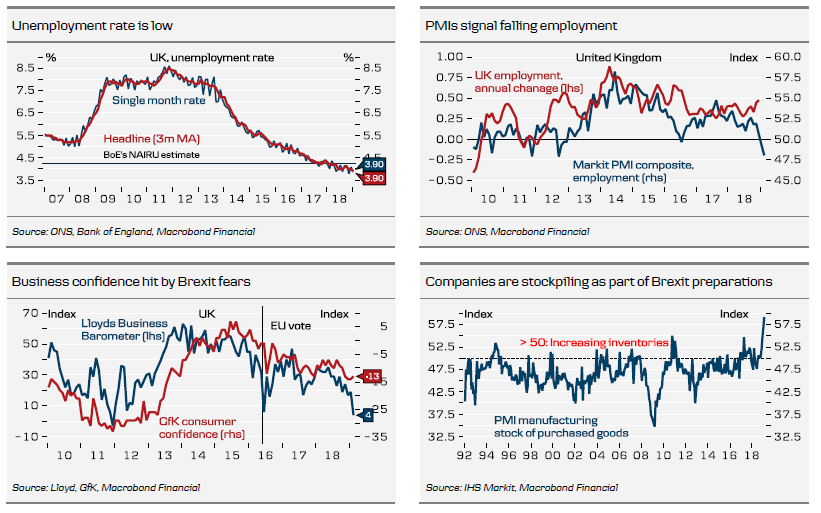

While a lot seems to happen every day, we still do not know what is going to happen with less than two and a half weeks until the new Brexit day on 12 April. None of the Brexit options has won support from a majority in the House of Commons. The main headache is that there is no majority for anything in the House of Commons and Brexit is an example of a Condorcet Paradox , as preferences are cyclic (X beats Y, Y beats Z but Z beats X). The problem with the indicative votes is that the House of Commons had voted many of the proposals down already in one way or another, so it was difficult to see why the results should be different. The situation is bizarre but the population is just as divided as the politicians, see Sky Data (twitter).

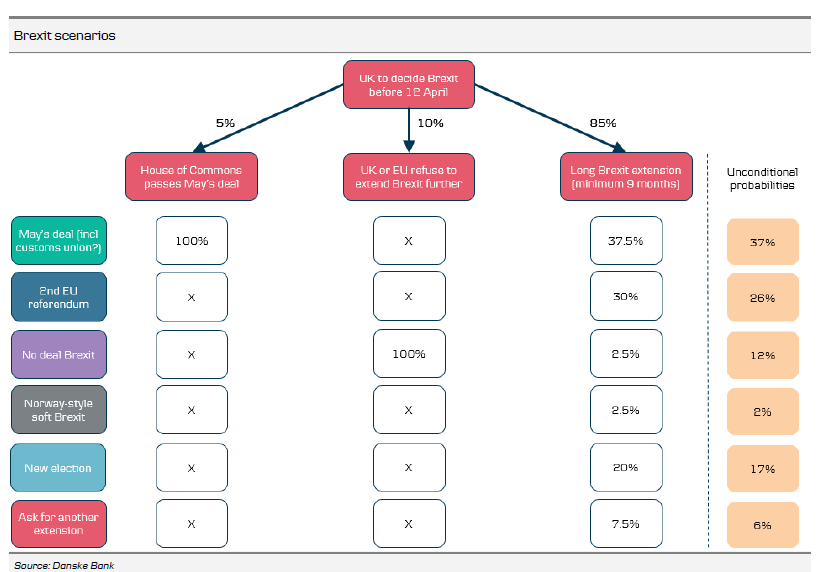

Still, we have learned something and perhaps it was not a total waste of time. In our view, there seem to be four possible ways forward now: May's deal, no deal, a second referendum or May's deal including a permanent customs union. See our game tree on the next page. Next step is likely a new round of indicative votes but on fewer options on Monday 1 April.

A large majority voted against no deal and at least a small majority in the Commons will likely support a long extension if necessary (the problem here is whether the EU27 leaders will accept a long extension if the UK has no idea what for? We think yes but uncertainty remains, as the decision has to be taken unanimously). The very soft Brexit options (joining the EEA or Norway plus customs union) were voted down, so they are out of the question (in line with our long-held view - why not stay instead then?). The two options with most votes in favour (but without a majority) were a second referendum and a permanent customs union (268 and 264 votes in favour, respectively, versus 242 for May's deal last time). Neither SNP nor LibDems voted in favour of a customs union, which they might do at a later stage. Also a few Labour voted against or abstained. The problem is, however, that it may trigger a general election, as it would make it impossible for the UK to strike its own trade deals.

Over the past couple of weeks, it has become increasingly clear that the Brexiteers are afraid of losing Brexit altogether and are looking for a reason to support May's deal. This is in line with our long-held view that if the pressure is big enough, many Brexiteers would surrender, as they start realising Brexit is unlikely to get cleaner/harder but only softer. The price was May's promise to resign soon, which came earlier than we had thought. The problem is that DUP soon afterwards stated that it still cannot support the deal, so it is likely dead on arrival, if it is brought forward for another vote soon. Even if, May would still need support from some Labour MPs, as there are still die-hard Brexiteers and remainers inside the Conservative Party who are going to vote against her deal no matter what. If May's deal passes without DUP's support, DUP may pull its support for the government, which could trigger a snap election.

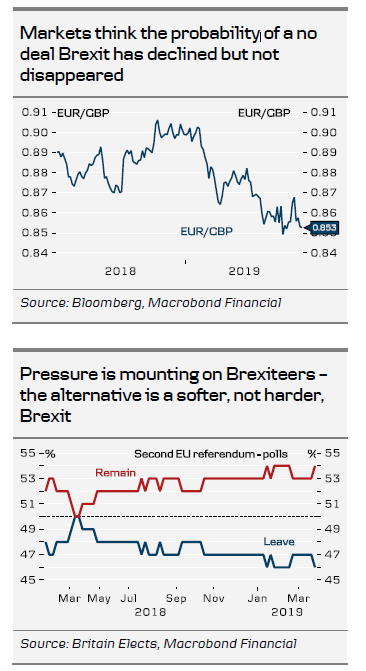

In the current situation, we believe EUR/GBP is stuck in the 0.85-0.87 range. If we get more clarification that we are heading for May's deal or her deal including a customs union, we expect a move lower to around 0.83. In case of a no-deal Brexit by accident, we still expect EUR/GBP to move towards 1.00. A snap election would also send EUR/GBP higher, at least back to the old 0.87-0.90 range.

Related Articles

Bitcoin plunges over 20% from its ATH Crypto liquidations reached $773,28 million over the past 24 hours BTC ETFs experience record outflows this week Trump’s trade tariffs...

In a week marked by intense market fluctuations, Bitcoin has plunged to new lows, while investor sentiment has shifted dramatically. Key indicators show a significant decline,...

Bitcoin remains under intraday bullish pressure with room for more gains, especially if we consider that NASDAQ 100 made a nice intraday subwave (iv) pullback which can push the...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.