- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

BP Forays Into EV Charging Market by Acquiring Amply Power (Revised)

BP plc (LON:BP) BP (NYSE:BP) announced that it acquired Amply Power for an undisclosed amount as part of plans to help the world reach net-zero emissions by 2050.

The acquisition represents BP's first major foray into the electric vehicle ("EV") charging market in the United States, one of the largest automotive markets globally.

Amply Power is an EV charging and energy infrastructure provider for fleets, which operate trucks, transit and school buses, vans, and light-duty vehicles. Per the terms of the deal, Amply Power will continue operating independently as part of BP's business portfolio.

BP is planning to accelerate electrification in the fleet segment, which is crucial to reducing emissions from the transport sector. In 2019, emissions from the transport sector accounted for nearly 29% of total U.S. greenhouse gas emissions, making it the largest contributor to greenhouse gas emissions in the United States.

Amply Power offers a unique opportunity to develop BP's EV business in the U.S. as it brings a fast-growing customer base and an accessible digital platform. The acquisition fits well with BP's plan to enhance next-generation mobility solutions as well as provide the fastest and reliable network of charging and digital solutions for customers.

Energy companies are increasingly investing in EV chargers as demand for the same is expected to grow significantly in the future. BP, which has EV charging stations in the U.K., Germany and China, aims to expand its global network of EV charging points to 70,000 by 2030. This indicates an increase from about 11,000 today.

BP has been expanding its charging businesses worldwide as electrification is the basis of its approach to mobility. The company continues to invest in new forms of infrastructure and technology to serve the fleet customers.

Company Profile & Price Performance

Headquartered in London, the U.K., BP is a fully integrated energy company, with a strong focus on renewable energy.

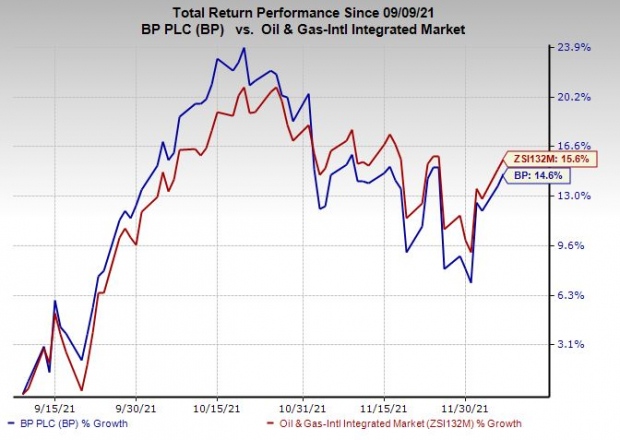

Shares of the company have underperformed the industry in the past three months. The stock has gained 14.6% compared with the industry's 15.6% growth.

Zacks Rank & Key Picks

BP currently flaunts a Zack Rank #3 (Hold).

Investors interested in the energy sector might look at the following companies that presently flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

Callon (NYSE:CPE) Petroleum Company CPE solely focuses on the exploration, and production of oil and gas resources in the Permian Basin. CPE boasts an impressive footprint throughout the core of the Permian Basin, which is the highest-producing shale play in the United States. Callon Petroleum, currently valued at $2.9 billion, entered the basin in 2009. It has been strengthening its foothold in the region since then.

In the past year, shares of Callon Petroleumhave gained 283.7% compared with Zacks Exploration and Production Industry's growth of 94.3%. CPE's earnings for 2021 are expected to surge 222.7% year over year. CPE currently has a Zacks Style Score of A for both Growth and Momentum. CPE witnessed six upward revisions in the past 60 days.

Devon Energy Corporation (NYSE:DVN) DVN is an independent energy company engaged in the exploration, development and production of oil and natural gas. Devon's strong U.S. operations are spread across the key oil assets of Delaware Basin, Eagle Ford, Anadarko Basin, Williston Basin and Powder River Basin. At 2020-end, Devon Energy proved reserves of approximately 752 million barrels of oil equivalent.

In the past year, the stock has soared 201.2% compared with the industry's growth of 94.3%. DVN is also projected to see a year-over-year earnings surge of 3877.8% in 2021. DVN witnessed nine upward revisions in the past 60 days. DVN's free cash flow at the end of third-quarter 2021 was $1.1 billion, up eight-fold from the fourth-quarter 2020 levels. The company will continue to prioritize free cash flow generation in 2022 and deploy a major portion of the same to dividends and share buybacks.

Eni SPA E is among the leading integrated energy players in the world. Its upstream operations involve the exploitation and production of oil and natural gas resources. Through midstream activities, the company transports and stores hydrocarbons. Eni also engages in refining hydrocarbons and distributing the end products in 71 nations. Apart from providing natural gas, the company generates and sells electricity.

In the past 60 days, the Zacks Consensus Estimate for Eni's 2021 earnings has been raised by 45%. It is also projected to see a year-over-year earnings surge of 733.3% in 2021. Eni currently has a Zacks Style Score of A for both Value and Growth. Eni beat the Zacks Consensus Estimate three times in the last four quarters and missed once, with an earnings surprise of 0.43%, on average.

(We are reissuing this article to correct a mistake. The original article, issued on December 8, 2021, should no longer be relied upon.)

Zacks’ Top Picks to Cash in on Artificial Intelligence

This world-changing technology is projected to generate $100s of billions by 2025. From self-driving cars to consumer data analysis, people are relying on machines more than we ever have before. Now is the time to capitalize on the 4th Industrial Revolution. Zacks’ urgent special report reveals 6 AI picks investors need to know about today.

See 6 Artificial Intelligence Stocks With Extreme Upside Potential>>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BP p.l.c. (BP): Free Stock Analysis Report

Devon Energy Corporation (DVN): Free Stock Analysis Report

Eni SpA (E): Free Stock Analysis Report

Callon Petroleum Company (CPE): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Related Articles

The big US stocks dominating markets and investors’ portfolios just finished another earnings season. They reported spectacular collective results including record sales, profits,...

“Quality” stocks with strong fundamentals tend to be rewarding places to stash hard-earned money. Since 2009, investing in a basket of quality stocks over a standard index has...

Palantir Technologies (NASDAQ:PLTR) continues to sell off. On March 6, PLTR stock fell over 10% on nearly double the daily volume, bringing its 30-day decline to over 27%. A drop...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.