- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Box (BOX) Q3 Loss In Line With Expectations, Revenues Beat

Box, Inc.’s (NYSE:BOX) fiscal third-quarter 2018 adjusted loss was 13 cents per share, in line with the Zacks Consensus Estimate. The loss was 18.2% wider on a sequential basis but 7.7% narrower than the year-ago quarter. The reported loss was toward the lower end of the guided range.

Revenues came in at $129.3 million, surpassing the consensus mark of $128.6 million. Revenues surpassed the guided range, increasing 5.2% sequentially and 25.8% year over year.

The company’s top line gained traction driven by strength across international markets especially Europe and Japan, growing add-on products and positive contribution from its strategic partnership with Microsoft.

Box is currently working on enriching its cloud content management and AI platforms. It has made some notable partnership extensions in this regard during the quarter with Apple (NASDAQ:AAPL) and Microsoft (NASDAQ:MSFT) .

The company launched Box Skills, a new AI toolkit that enables customers to apply machine learning tools such as video indexing, computer vision and sentiment analysis from Alphabet’s (NASDAQ:GOOGL) Google Cloud, IBM (NYSE:IBM) Watson and Microsoft Cognitive Services, to content stored in Box. The company also unveiled Box Skills Kit, a software development kit (SDK) that enables developers to build custom skills for Box.

The company introduced Box Graph, an intelligent network of content that uses machine learning to suggest relevant content to users. It also unveiled Box Relay, a workflow automation tool co-developed with IBM that enables users to build, manage and monitor their workflows.

The company’s rich technology partner ecosystem has been a strong driving force behind its growth and we expect this to continue going forward.

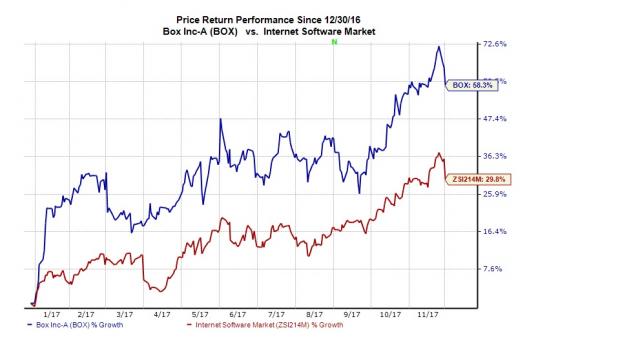

The stock has rallied 58.3% year to date, significantly outperforming its industry’s gain of 29.8%.

Here are the numbers in detail:

Billings and Deferred Revenues

Billings were $141.5 million, up 25.8% year over year. Deferred revenues were $253 million, up 31.4% year over year.

Margins and Net Income

Non-GAAP gross margin was 73.3%, down 29 basis points (bps) year over year. Box’s operating expenses (general and administrative, sales and marketing, research and development) of $137.4 million increased 21.1% year over year. As a percentage of sales, all expenses decreased.

Non-GAAP net loss was $17.4 million compared with $17.8 million in the year-ago quarter. On a GAAP basis, the company recorded net loss of $42.9 million or loss of 32 cents per share compared with net loss of $38.2 million or loss of 30 cents per share a year ago.

Balance Sheet and Cash Flow

As of Oct 31, 2017, cash and cash equivalents, and accounts receivables balance were $172.9 million and $95.9 million, respectively compared with $165.3 million and $107.9 million as of Jul 31, 2017.

Long-term debt was $40 million, flat with the previous quarter. During the quarter, cash provided by operations was $14.1 million and capital expenditure was $3 million.

Outlook

For the fourth quarter of fiscal 2018, Box expects revenues between $136 million and $137 million. On a non-GAAP basis, the company projects loss per share in the range of 7 cents to 8 cents. GAAP loss per share is expected in the range of 26 cents to 27 cents per share.

Box has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Box, Inc. (BOX): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Original post

Related Articles

• Trump’s trade war, U.S. jobs report, and last batch of Q4 earnings will be in focus this week. • Costco's earnings report is seen as a potential catalyst for growth, making it a...

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.