- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

BlackBerry (BB) Up On Q3 Earnings & Sales Beat, View Intact

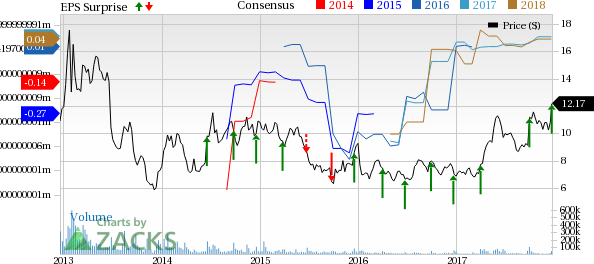

Shares of BlackBerry Limited (NYSE:BB) have gained 12% to $12.17 at the close of trading on Dec 20 following the release of third-quarter fiscal 2018 (ended Nov 30, 2017) earnings report. The company reported earnings per share (excluding 55 cents from non-recurring items) of 3 cents, comparing favorably with the Zacks Consensus Estimate of a loss of a penny. Moreover, the bottom line expanded 50% year over year. Results were boosted by robust software sales.

Results in Detail

Total revenues (on a reported basis) in the quarter under review were $226 million, down 24.9% year over year. While total adjusted revenues came in at $235 million. The Zacks Consensus Estimate for the metric was pegged at $216 million.

Segment-wise, Enterprise software and services generated approximately 45.1% of the revenues while BlackBerry Technology Solutions contributed 18.3%. Licensing, IP and other raked in 21.3% of the sales, whereas Handheld devices contributed 3.8%. Services access fees revenues accounted for the balance. Also, the company had around 3,000 enterprise clients on board in the reported quarter.

Geographically, North America has contributed 58.9% of the total revenues. While Europe, the Middle East and Africa have notched up 30.5% of the revenue pie. Similarly, Latin America and the Asia-Pacific regions have yielded 1.3% and 9.3%, respectively, of the total revenues in fiscal third quarter.

Quarterly operating income (on an adjusted basis) came in at $16 million compared with $12 million in the year-ago quarter.

The company exited third-quarter fiscal 2018 with cash and cash equivalents of $529 million compared with $734 million at the end of fiscal 2017. Long-term debt in fiscal third quarter was $816 million in comparison to $591 million at the end of fiscal 2017.

Outlook

The company’s guidance for fiscal 2018 remains unchanged. It continues to expect revenues (adjusted) in the range of $920-$950 million. The company hopes that this metric for the stipulated period will lie in mid to high end of the range, given its strong performance so far in the fiscal. The Zacks Consensus Estimate for fiscal 2018 revenues stands at $930 million. Software and Service revenues are estimated to rise between 10% and 15% for fiscal 2018. Also, BlackBerry maintains its prior view of profitability (on an adjusted basis) as well as projects a positive free cash flow during the same time frame.

Zacks Rank & Key Picks

BlackBerry carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the same space are Vodafone Group (LON:VOD) PLC (NASDAQ:VOD) , PLDT Inc. (NYSE:PHI) and SK Telecom Co., Ltd. (NYSE:SKM) . While Vodafone sports a Zacks Rank #1 (Strong Buy), PLDT and SK Telecom carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of Vodafone, PLDT and SK Telecom have gained more than 27%, 9% and 29%, respectively, in a year.

Zacks’ Best Private Investment Ideas

While we are happy to share many articles like this on the website, our best recommendations and most in-depth research are not available to the public.

Starting today, for the next month, you can follow all Zacks' private buys and sells in real time. Our experts cover all kinds of trades… from value to momentum . . . from stocks under $10 to ETF and option moves . . . from stocks that corporate insiders are buying up to companies that are about to report positive earnings surprises. You can even look inside exclusive portfolios that are normally closed to new investors.

Click here for Zacks' private trades >>

PLDT Inc. (PHI): Free Stock Analysis Report

SK Telecom Co., Ltd. (SKM): Free Stock Analysis Report

Vodafone Group PLC (VOD): Free Stock Analysis Report

BlackBerry Limited (BB): Free Stock Analysis Report

Original post

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.