- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Big 5 Sporting (BGFV) Gains 12% In A Month: Will It Sustain?

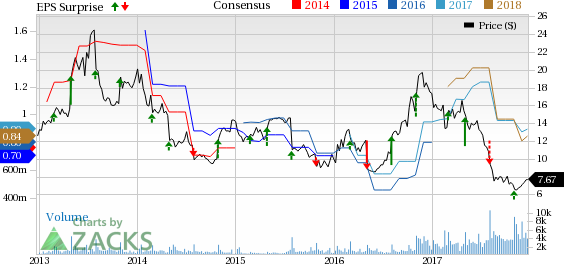

Big 5 Sporting Goods Inc. (NASDAQ:BGFV) is regaining strength driven by store penetration strategies, impressive growth plans and financial strength. However, the company is not immune to the troubles in the sporting goods industry.

The cumulative effect of this El Segundo, CA-based company’s strategies and a decent third-quarter fiscal 2017 is visible in its stock performance. Notably, the stock has gained 12.1% in the past month, outperforming the industry’s growth of 9%. Additionally, it has improved 20.9% since reporting third-quarter fiscal 2017 results on Oct 31.

Aptly, the stock currently retains a Zacks Rank #3 (Hold) and a VGM Score of A. That said, let’s find out the reasons behind the upsurge and possible deterrents.

Growth Initiatives – Store Expansion

Big 5 Sporting has been focused on expanding store base and introducing technological advancements to enhance services for patrons. The company leverages an extensive network of stores to effectively penetrate into its target markets, directed toward generating healthy sales and capturing market share. As part of its store expansion strategy, Big 5 Sporting expects to open three new stores in the fourth quarter, resulting in roughly six new stores in 2017. We believe that these moves will place it well for future growth.

Efficient Merchandising Strategy

Big 5 Sporting’s unique strategy of offering exclusive branded merchandise sourced from leading manufacturers provides it with a competitive edge over its rivals in a cut-throat specialty retailing industry. Further, the company leverages its strong vendor relationships to source overstock and closeout merchandise at substantial discounts. This helps it achieve the dual objectives of boosting gross margin while offering compelling value to customers.

Owing to efficient merchandise strategy, the company delivered 51 basis points (bps) improvement in merchandise margins in the third quarter, resulting in a gross margin expansion of 20 bps. Further, management expects merchandise margins to continue gaining from the closure of rival firms.

Deterrents – Dismal Sales Surprise Trend & Outlook

Big 5 Sporting has displayed a dismal sales surprise trend. While the company posted in-line earnings in the third quarter, the top line lagged estimates for the second straight quarter. Sales were mainly hurt by negative comparable store sales (comps), a tough and promotional retail backdrop, and weakness in its firearm related business. Further, cycling of benefits from the closure of nearly 200 rival stores in third-quarter 2016, impacted top-line growth.

Looking ahead, the company anticipates the holiday season to be characterized by a tough and highly promotional retail environment. The company notes that comps have declined in the low-mid single digit so far in the fourth quarter due to a slow start to fall-related product sales as the weather remains warmer in its key markets, as well as low demand for firearm related products. The company anticipates this weakness to persist, projecting fourth-quarter comps to decline in the low-single digit range. It also envisions earnings in the band of 16-28 cents per share compared with 35 cents earned in the prior-year quarter.

Looking for Some Trending Picks? Look at These

Hibbett Sports Inc. (NASDAQ:HIBB) has a long-term earnings growth rate of 2.2% and a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Five Below, Inc. (NASDAQ:FIVE) has a long-term earnings growth rate of 26.5% and a superb earnings surprise history. Further, the company carries a Zacks Rank #2 (Buy).

KAR Auction Services, Inc (NYSE:KAR) , which carries a Zacks Rank #2, has delivered positive earnings surprises in the past three quarters. It has a long-term earnings growth rate of 13.4%.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Big 5 Sporting Goods Corporation (BGFV): Free Stock Analysis Report

Hibbett Sports, Inc. (HIBB): Free Stock Analysis Report

KAR Auction Services, Inc (KAR): Free Stock Analysis Report

Five Below, Inc. (FIVE): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.