- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Bed Bath & Beyond (BBBY) Posts Earnings And Revenue Beats

Bed Bath & Beyond Inc. ( (NASDAQ:BBBY) ) just released its third-quarter fiscal 2017 financial results, posting earnings of 44 cents per share and revenues of $3 billion.

Currently, BBBY is a Zacks Rank #4 (Sell) and is down 2.32% to $24.00 per share in after-hours trading shortly after its earnings report was released.

Bed Bath & Beyond:

Beat earnings estimates. The company posted earnings of $0.44 per share, beating the Zacks Consensus Estimate of $0.36.

Beat revenue estimates. The company saw revenue figures of $3.0 billion, topping our consensus estimate $2.90 billion.

Total revenues were relatively flat year-over-year. Comparable-store sales increased about 0.3%. Comps from customer-facing digital channels “continued to have strong growth,” while comps from stores “decline in the low-single-digit percentage range.”

The company declared a quarterly dividend of $.15 per share, to be paid on April 17 to shareholders of record at the close of business on March 16. Management also said that its full-year earnings guidance of $3.00 per share has not changed.

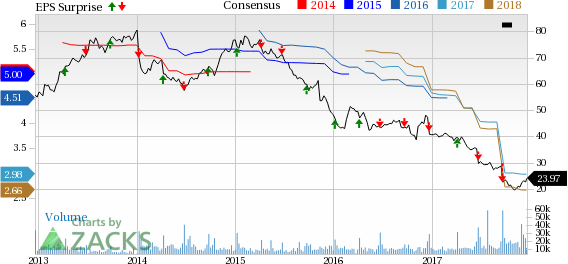

Here’s a graph that looks at Bed Bath & Beyond’s earnings surprise history:

Bed Bath & Beyond Inc. is a retailer offering a wide selection of domestics merchandise and home furnishings. The company operates a robust ecommerce platform consisting of various websites and applications. The company also operates an established retail store base under the names of Bed Bath & Beyond, Christmas Tree Shops, Harmon, Harmon Face Values or Face Values, buybuy BABY, World Market, Cost Plus World Market or Cost Plus.

Check back later for our full analysis on BBBY’s earnings report!

Want more stock market analysis from this author? Make sure to follow @Ryan_McQueeney on Twitter!

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

Bed Bath & Beyond Inc. (BBBY): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.