- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Bear Of The Day: Rogers Corporation (ROG)

Rogers Corporation (ROG) is a Zacks Rank #5 (Strong Sell) that is a global leader in engineered materials to power, protect and connect the world. The company delivers high-performance solutions that enable clean energy, internet connectivity, safety applications and other technologies.

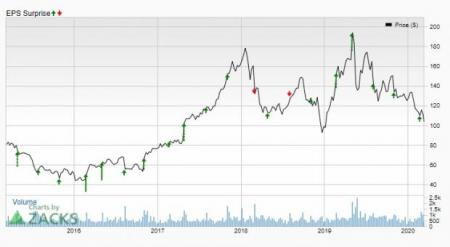

Stock Off 50% since May

Everything was going right for Rogers early last year. The momentum in the markets helped carry the stock over $200. However, a string of earnings that barely beat the bottom-line number helped bring in selling. The when the Coronavirus fears hit, Rogers exposure to the global economy helped the stock even lower, over 50% from highs.

Earnings slowing

Early in 2019, Rogers was seeing earnings beats in the double digits. However, the last three quarters the company hasn’t been able to get much more then a 10% beat to the upside. While a beat is always better than a miss, the slowing of earnings growth has caused the stock to sell off after the big run.

Estimates Headed Lower

Perhaps the biggest issue with the stock is how drastic the analyst’s estimates are falling. Over the last month, Rogers has seen the current quarter’s estimates fall from $1.26 to $0.85, a 32% fall. Additionally, the current year has seen a 19% drop over the same time frame.

If these numbers continue to fall, I would expect the stock to follow suit.

In Summary

Rogers has two things working against the stock bouncing back. First, we have earnings estimates falling across the all-time frames. Until these numbers improve, investors will be net sellers. Additionally, the Coronavirus is attacking global companies and their ability to business. If the virus continues to spread, Rogers stock will continue to fall.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Rogers Corporation (ROG): Free Stock Analysis Report

Original post

Related Articles

Two weeks ago, the rumor mill ramped up again about the potential restructuring of Intel Corporation (NASDAQ:INTC). The probing balloons centered around Taiwan Semiconductor...

More than a century ago, then-Representative William McKinley pursued an aggressive tariff strategy that sought to protect American industry and reduce reliance on foreign...

Early in 2025, value stocks emerged as a popular choice among investors seeking market-beating returns. However, factor-based investing strategies can be notoriously difficult to...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.