- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Beacon (BECN) Buys Crabtree, Expands Tennessee Presence

Beacon Roofing Supply (NASDAQ:BECN), Inc. BECN has acquired a wholesale distributor of residential exterior building materials — Crabtree Siding and Supply. This takeover has further strengthened Beacon’s presence in Tennessee. Yet, the financial terms of the transaction are not yet disclosed.

Shares of Beacon — the largest distributor of residential and non-residential roofing materials in the United States and Canada — gained 1.06% on Dec 31, 2021.

Buyout Benefits

Crabtree, generating revenues of $1 million annually, provides a wide range of complementary products to contractors and homebuilder customers. Its Cookeville, TN, location is strategically situated in the growing market between Nashville and Knoxville and has a solid repute for profitable relationships with customers and suppliers.

Munroe Best, president, South Division Beacon, said, “We are pleased to welcome Crabtree to Beacon’s team. Their history of excellent customer service and supplier relations, combined with a superior location, will allow us to further grow Beacon’s presence in Tennessee, particularly this important but underserved area of the state.”

Strategic Efforts: a Boon

Beacon has undertaken several strategic initiatives to drive its long-term ambition of growing and enhancing customer experience, expanding the top line and margin as well as boosting value for customers, suppliers, employees, and shareholders.

On Nov 1, 2021, the company acquired Midway Sales & Distributing, Inc., a leading Midwest distributor of residential and commercial exterior building and roofing supplies, including a broad offering of complementary products to contractors, homebuilders, and retail customers. The buyout deepened Beacon’s strong presence in the Midwest.

On Feb 10, it completed the divesture of Interior Products to Foundation Building Materials (NYSE:FBM) Holding Company LLC for approximately $850 million in cash. The divestment helped Beacon to return to its legacy position as a focused leader with an exterior building products distribution.

Meanwhile, the company’s board decided to change its fiscal year end from Sep 30 to Dec 31 (effective Jan 1, 2022) for the year ending Dec 31, 2022. It feels that the change will be extremely beneficial via the promotion of internal efficiencies and better external comparability.

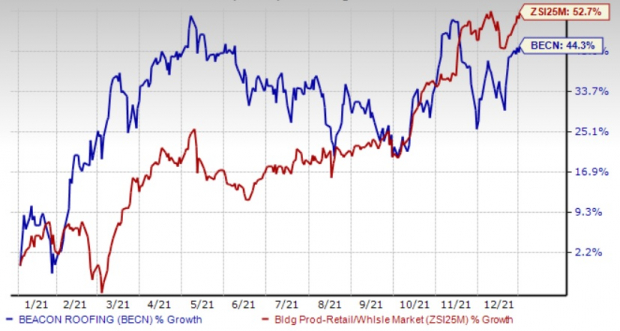

Shares of Beacon have gained 44.3% over the past year compared with the industry’s 52.7% rally. Nonetheless, earnings estimates for this year have increased 6.2% over the past 60 days to $4.83 per share. This depicts analysts’ optimism over the company’s growth potential.

A solid residential backdrop, exceptional operating cost management and cash flow, focus on the e-commerce platform, new OTC (On-Time and Complete) Delivery Network, and a newly-designed website will drive growth.

Zacks Rank

Beacon currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Top-Ranked Stocks From the Broader Retail-Wholesale Sector

Builders FirstSource, Inc. BLDR presently has a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 71.5%, on average. Shares of BLDR have gained 115.2% over the past year.

The Zacks Consensus Estimate for Builders FirstSource’s sales and earnings per share for the current financial year suggests an improvement of 129.1% and 207.6%, respectively, from the year-ago period.

GMS (NYSE:GMS) Inc. GMS presently has a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 24.9%, on average. Shares of GMS have gained 105.2% over the past year.

The Zacks Consensus Estimate for GMS’ sales and earnings per share for the current financial year suggests an improvement of 36.6% and 87.9%, respectively, from the year-ago period.

Fastenal Company (NASDAQ:FAST) FAST presently has a Zacks Rank #2. The company has a trailing four-quarter earnings surprise of 2%, on average. Shares of FAST have gained 34.4% over the past year.

The Zacks Consensus Estimate for FAST’s sales for the current financial year suggests an improvement of 5.7% from the year-ago period.

Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2022?

From inception in 2012 through November, the Zacks Top 10 Stocks gained an impressive +962.5% versus the S&P 500’s +329.4%. Now our Director of Research is combing through 4,000 companies covered by the Zacks Rank to handpick the best 10 tickers to buy and hold. Don’t miss your chance to get in on these stocks when they’re released on January 3.

Be First To New Top 10 Stocks >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fastenal Company (FAST): Free Stock Analysis Report

Beacon Roofing Supply, Inc. (BECN): Free Stock Analysis Report

Builders FirstSource, Inc. (BLDR): Free Stock Analysis Report

GMS Inc. (GMS): Free Stock Analysis Report

To read this article on Zacks.com click here.

Related Articles

Investors are on edge about what tariff policy means for markets Coming off a strong Q4 earnings season, fresh February corporate sales figures can help assess the macro...

Broadcom stock is in a dynamic rebound phase. Markets seem optimistic ahead of the earnings release. Let's take a deep dive into what to expect from the report. Get the...

Consumers are feeling the pinch from inflation every time they go to the grocery store. Money is a zero-sum game; as disposable income and buying power erodes, consumers are...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.