- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Banks Lead Markets To New Highs: 4 Stocks Worth Buying Now

The key stock indexes reached new highs yesterday with banking stocks being the main driving force. The rally was supported by favorable economic data, progress on tax reform bill and positive comments by Jerome H. Powell, President Trump's nominee for the Fed chairman. The Dow Jones Industrial Average and S&P 500 rose 1.1% and nearly 1%, respectively.

Powell’s comments related to lesser regulations cheered investors. While affirming the role of the Dodd-Frank Act in making the country’s financial system stronger, he advocates lesser regulatory burden for smaller domestic banks.

Also, Powell reiterated the Fed’s stance on gradual rise in interest rates and winding down of its balance sheet. Further, he said, “I think the case for raising interest rates at our next meeting is coming together.”

No significant change in the Fed’s existing interest rate move is a good sign for the banking sector.

Moreover, tax reform bill, one of the biggest election promises by Trump, got a boost as a Senate panel approved the measure amid persistent concerns from some Republican members. So, the combination of stability in the Fed's policy despite change in leadership and progress on corporate tax cuts boosted investor sentiments.

Further, encouraging economic data supported the rally. U.S. consumer confidence surged to a near 17-year high in November, largely driven by a strong labor market while house prices recorded a significant jump in September. All these point toward an improving economy.

All these favorable factors drove banking stocks higher. The KBW Nasdaq Regional Banking index jumped 3.7% yesterday.

Here are the four banking stocks that have plenty of upside left:

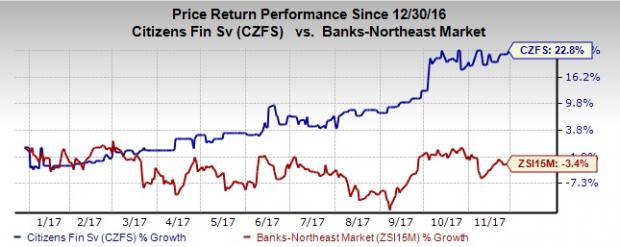

Mansfield, PA-based Citizens Financial Services, Inc. (OBB:CZFS) has gained 22.8% so far this year as against industry’s decline of 3.4%. Further, the Zacks Consensus Estimate for the current year earnings moved 1.5% upward over the past month to $4.09. The stock carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

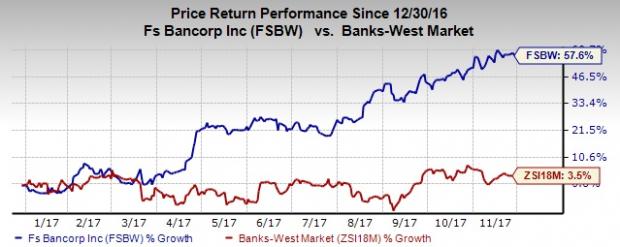

FS Bancorp, Inc. (NASDAQ:FSBW) , carrying a Zacks Rank #2, has rallied 57.6% year to date, outperforming the industry’s gain of 3.5%. Also, the Zacks Consensus Estimate for this Mountlake Terrace, WA-based bank has moved 1.7% upward over the last 30 days to $4.22.

Headquartered in Glen Head, NY, The First of Long Island Corp. (NASDAQ:FLIC) also has a Zacks Rank #2. The stock has gained 6.6% year to date as against 3.4% decline for the industry. Also, the Zacks Consensus Estimate for the current year was revised 1.4% upward over the past month to $1.50.

Eagle Bancorp, Inc. (NASDAQ:EGBN) , based in Bethesda, MD, has gained 10.3% so far this year as against industry’s decline of 3.4%. Moreover, the Zacks Consensus Estimate for the current year has moved nearly 1% upward over the past month to $3.33. The stock carries a Zacks Rank #2.

Investor Alert: Breakthroughs Pending

A medical advance is now at the flashpoint between theory and realization. Billions of dollars in research have poured into it. Companies are already generating substantial revenue, and even more wondrous products are in the pipeline.

Cures for a variety of deadly diseases are in sight, and so are big potential profits for early investors. Zacks names 5 stocks to buy now.

Click here to see them >>

Eagle Bancorp, Inc. (EGBN): Free Stock Analysis Report

The First of Long Island Corporation (FLIC): Free Stock Analysis Report

FS Bancorp, Inc. (FSBW): Free Stock Analysis Report

Citizens Financial Services Inc. (CZFS): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Early in 2025, value stocks emerged as a popular choice among investors seeking market-beating returns. However, factor-based investing strategies can be notoriously difficult to...

Mid-cap stocks don’t get the same headlines as large caps but move aggressively in both directions, creating outsized opportunities for investors. Unlike their mega-cap...

There’s no doubt it’s been a rough couple weeks for stocks: Both the S&P 500 and the tech-focused NASDAQ have wiped out most of this year’s gains, as of this writing. Stocks...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.