- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Bank Stocks Up On Expected Trading Revenues Rebound In Q1

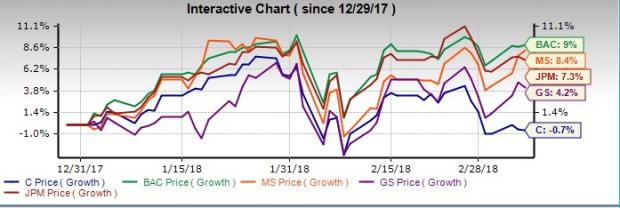

With the S&P 500 rising just around 2% year to date, major banks, including JPMorgan (NYSE:JPM) , Bank of America (NYSE:C) , Morgan Stanley (NYSE:MS) and Goldman Sachs (NYSE:GS) , have witnessed significant price performance. Shares of JPMorgan, BofA, Morgan Stanley and Goldman have spiked 7.3%, 9%, 8.4% and 4.2%, respectively, year to date. However, shares of Citigroup (NYSE:C) declined slightly.

Notably, low client activities and less volatility across capital markets, which resulted in weak trading revenues for banks in 2017, are expected to rebound this year. Rising volatility at the very beginning of 2018 is expected to break the trading revenues slump.

Banks’ Outlook

At the RBC Capital Markets 2018 Financial Institutions Conference earlier this week, Citigroup’s chief financial officer — John Gerspach — announced the company’s latest outlook for the first quarter. The bank expects first-quarter 2018 trading revenues to be up by a "low-to-mid" single digit on a year-over-year basis.

The bank expects equities business to record revenues more than $1 billion in Q1, last recorded in 2015. However, management believes investment banking might go down as compared with the prior-year quarter.

Moreover, focused on digitization, this banking giant aims to launch a national digital consumer bank over the next three years. “I am not making an announcement right now, but I would be really disappointed if it was anything close to being three years away,” CFO John Gerspach said at the investor conference. “We really are laying the groundwork for having a national digital bank,” he further added.

Similarly, last week, at the annual Investors’ Day conference, JPMorgan’s management discussed the current macroeconomic backdrop and the path the company is taking to enhance profitability over the medium term, which also included the first-quarter trading outlook.

Management projects first-quarter market revenues to increase in mid-to-high single-digit rate on a year-over-year basis, based on the market conditions. Further, investment banking is anticipated to remain stable or be up slightly year over year.

Notably, both banks hinted at rebound in trading activities, particularly due to solid revenues in foreign exchange, emerging markets and equities trading.

Conclusion

Last year, despite several political and geopolitical developments, and hike in interest rates, which could have incited volatility, subdued inflation in the United States and marginal increase in long-term interest rates, along with absence of specific catalysts, have been a drag on volatility.

Nonetheless, this dismal operating backdrop seems to have ended with the increased volatility recorded year to date on strong gains in emerging markets and equities benefiting banks’ financials.

Among the above-mentioned stocks, Citigroup and Morgan Stanley carry a Zacks Rank #2 (Buy), while BofA, JPMorgan and Goldman have a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

JPMorgan Chase & Co. (JPM): Free Stock Analysis Report

Citigroup Inc. (C): Free Stock Analysis Report

Bank of America Corporation (NYSE:BAC): Free Stock Analysis Report

Morgan Stanley (MS): Free Stock Analysis Report

The Goldman Sachs Group, Inc. (GS): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Stocks fell sharply, with the S&P 500 leading the decline, finishing the day down almost 1.6% at 5,860. Meanwhile, the Nasdaq 100 dropped nearly 2.75%, closing at 20,550. This...

The stock market has hit a rough patch lately, with the benchmark SPDR S&P 500 (NYSE:SPY) sliding nearly 3% in a single week. Most sectors have followed the downward trend,...

Regimes are changing in the market, and this could mean a few things, but today, it means that volatility is back. Whenever these shifts come, specifically to the S&P 500...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.