- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Ball Corporation (BLL) Down To Strong Sell On Dismal Trends

On Nov 15, Ball Corporation (NYSE:BLL) was downgraded to a Zacks Rank #5 (Strong Sell) due to a number of concerns, including damages caused by the U.S. hurricanes, and spike in freight and fuel rates. Demand volatility in the EMEA (Europe, Middle East and Africa) region and elevated expenses also remain headwinds.

Going by the Zacks model, companies holding a Zacks Rank #5 have strong chances of underperforming the broader market.

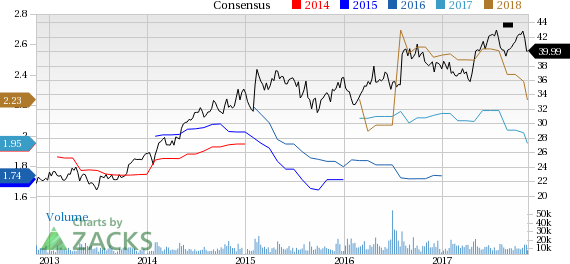

Also, Ball Corporation’s share price movement has not been much impressive. Over the past year, its shares have gained just 4.7% compared with 7.9% growth recorded by the industry it belongs to.

Why the Downgrade?

Ball Corporation’s third-quarter 2017 performance was adversely impacted by hurricanes, earthquakes and recent fires near the Fairfield California facility. It faced seven days of lost production due to lack of orders in two of its largest North American regions and lower cans sales. The company predicts that its fourth-quarter results will be also affected by the adverse weather conditions.

Notably, Ball Corporation witnessed significant rise in freight rates, and out-of-pattern freight across the Southern and lower Atlantic plant network after the hurricanes. The company believes freight and fuel rates will continue to flare up.

Further, its performance will be marred by political and economic unrest in Turkey and Egypt. In addition, the 50% carbonation tax in Saudi Arabia remains an issue as it has been thwarting consumer demand in the region.

Ball Corporation is also facing tight supply and demand situation in the global aluminum aerosol business. Moreover, increase in interest and additional expenses related to Recklinghausen plant closure will affect earnings.

Also, analysts have become increasingly bearish on the stock over the past 30 days, with estimates moving downward. The Zacks Consensus Estimate for 2017 earnings declined 3.5% to $1.95. In addition, the Zacks Consensus Estimate for the next year moved down 5.1% to $2.24 during the same time frame.

Furthermore, the stock carries a VGM Score of F. We note a weak Style Score robs the stock of much of its upside potential over the next 30 days. So, if a stock carries a Style Score of D or F, it’s better to sell that stock and switch to the one with a score of A or B.

Stocks to Consider

Some better-ranked stocks in the industry are Caterpillar Inc. (NYSE:CAT) , Terex Corporation (NYSE:TEX) and Komatsu Ltd. (OTC:KMTUY) . All these stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Caterpillar has an expected long-term earnings growth rate of 10.3%. Its shares have rallied 48.3% year to date.

Terex has an expected long-term earnings growth rate of 11.3%. Year to date, its shares have moved up 35.9%.

Komatsu has an expected long-term earnings growth rate of 16.2%. Its shares have gained 44.6% during the same time frame.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Ball Corporation (BLL): Free Stock Analysis Report

Terex Corporation (TEX): Free Stock Analysis Report

Caterpillar, Inc. (CAT): Free Stock Analysis Report

Komatsu Ltd. (KMTUY): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Defense stocks took a tumble heading into 2025 as President Trump returned to the White House for his second term. Trump has stated his intent as a peacemaker to bring the wars in...

Using the Elliott Wave Principle (EWP), we have been tracking the most likely path forward for the Nasdaq 100 (NDX). Although there are many ways to navigate the markets and to...

Investors are on edge about what tariff policy means for markets Coming off a strong Q4 earnings season, fresh February corporate sales figures can help assess the macro...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.