- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Ball (BLL) Up 3.6% Since Earnings Report: Can It Continue?

A month has gone by since the last earnings report for Ball Corporation (NYSE:BLL) . Shares have added about 3.6% in that time frame.

Will the recent positive trend continue leading up to its next earnings release, or is BLL due for a pullback? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important catalysts.

Ball Corp Q4 Earnings Beat, Tax Cuts to Aid Growth

Ball Corporation reported fourth-quarter 2017 adjusted earnings of 60 cents per share, beating the Zacks Consensus Estimate of 52 cents. Earnings also jumped 36.4% year over year.

On a reported basis, the company posted earnings of 52 cents per share compared to 15 cents per share recorded in the prior-year quarter.

Total revenues increased 8.9% year over year to $2,747 million in the reported quarter. The figure also surpassed the Zacks Consensus Estimate of $2,658 million.

Operational Update

Cost of sales went up 6.3% year over year to $2,134 million. Gross profit jumped 19% year over year to $613 million. Gross margin expanded 190 basis points (bps) to 22.3%.

Selling, general and administrative expenses dropped 28.8% year over year to $116 million. Adjusted operating income increased 35.7% to $350 million from $258 million reported in the year-ago quarter. The company reported operating margin of 12.7%, up 250 bps year over year.

Segment Performance

The Beverage packaging’s North and Central America segment’s revenues went up 4.1% year over year to $998 million in the reported quarter. Operating earnings of $133 million increased 16.7% year over year.

Sales at the Beverage packaging, Europe segment came in at $536 million in the reported quarter, advancing 17.5% year over year. Operating earnings surged 53% year over year to $49 million.

The Beverage packaging South America segment’s revenues jumped 25% year over year to $547 million in the reported quarter. Operating earnings of $128 million recorded a substantial improvement from $85 million recorded in the prior-year quarter.

The Food and Aerosol Packaging segment’s sales came in at $271 million, up 4.6% year over year. Operating earnings rose 8.3% year over year to $26 million.

In the Aerospace and Technologies segment, sales went up 6.6% year over year to $257 million. Operating earnings increased 7.7% year over year to $28 million. The segment’s backlog came in at around $1.75 billion in 2017, up 25% year over year.

2017 Performance

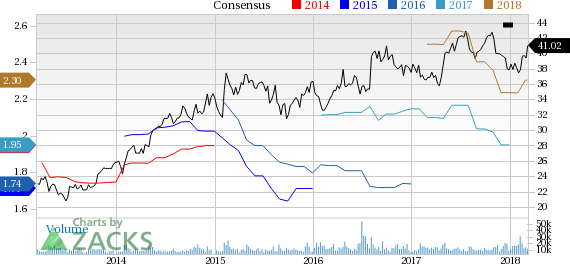

Ball Corporation reported adjusted earnings per share of $2.04 in 2017, up 17% from $1.74 per share recorded in the prior year. Earnings surpassed the Zacks Consensus Estimate of $1.95. Including one-time items, the bottom line came in at $1.12, up 38% from 81 cents recorded in 2016.

Revenues went up 21% year over year to $10.98 billion from $9.06 billion recorded in 2016. The figure also surpassed the Zacks Consensus Estimate of $10.89 billion.

Financial Condition

Ball Corporation had cash and cash equivalents of $448 million at the end of the fourth-quarter compared with $597 million recorded at the end of fourth-quarter 2016. Cash flow from operations came in at $1,478 million in 2017, a substantial improvement from $194 million recorded last year. Ball Corporation’s long-term debt decreased to $6,518 million in 2017 from $7,310 million at the end of previous year.

Outlook

Ball Corporation provided its financial goals for 2018. The company expects its free cash flow to be around $900 million and capital spending to be at least $600 million. It will execute numerous growth capital and network optimization projects to enhance customers' access to the company’s innovative specialty container portfolio while also an expanding U.S. aerospace infrastructure.

Ball Corporation’s construction of a state-of-the-art specialty beverage can-manufacturing facility in Goodyear, AZ, is right on schedule and budget, with production beginning early in the second half of 2018. Furthermore, construction continues on the company's new aluminum beverage can facility in Madrid, Spain, which is scheduled to commence production in mid-2018. It also stated that the Colorado facility expansions in Westminster and Boulder, CO, are on track for completion in fourth-quarter 2018.

Notably, Ball Corporation remains optimistic about the U.S. Tax Cuts and Jobs Act's potential which will likely benefit its end markets. The company estimates that the Act will reduce its global effective tax rate on comparable earnings from approximately 25% in 2017 to around 23% in the current year. Notably, Ball Corporation reaffirmed that its comparable EBITDA will be $2 billion and free cash flow will be in excess of $1 billion in 2019.

How Have Estimates Been Moving Since Then?

In the past month, investors have witnessed a downward trend in fresh estimates. There has been one revision higher for the current quarter compared to two lower.

Ball Corporation Price and Consensus

VGM Scores

At this time, BLL has a great Growth Score of A, though it is lagging a lot on the momentum front with a C. Charting a somewhat similar path, the stock was allocated a grade of D on the value side, putting it in the bottom 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of B. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is more suitable for growth investors than momentum investors.

Outlook

Estimates have been broadly trending downward for the stock and the magnitude of these revisions looks promising. Notably, BLL has a Zacks Rank #3 (Hold). We expect an in-line return from the stock in the next few months.

Ball Corporation (BLL): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

Bitcoin has gained legitimacy as it has achieved mainstream status these days. Even the United States Securities and Exchange Commission (SEC) has acknowledged its legitimacy with...

Stocks fell sharply, with the S&P 500 leading the decline, finishing the day down almost 1.6% at 5,860. Meanwhile, the Nasdaq 100 dropped nearly 2.75%, closing at 20,550. This...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.