- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

AZZ's Divestiture Of Nuclear Logistics To Aid Core Business

AZZ Inc. (NYSE:AZZ) announced on Mar 2 that it completed the divestiture of its Nuclear Logistics LLC to Paragon Energy Solutions, LLC. The terms of the divestment were kept under wraps.

The aforementioned transaction was initially announced in February 2020. Notably, AZZ’s shares gained 1.5% yesterday, ending the trading session at $37.44.

Paragon Energy is primarily engaged in providing products and services for customers in the nuclear industry. Its offerings include reverse engineered products, supply-chain solutions, repair of I&C equipment, nuclear inventory management solutions and others.

Inside the Headlines

As noted, AZZ expects to record divestment-related charges (non-recurring and non-cash) in fiscal 2020 (ended February 2020, results not yet released). However, the impact of the charges will be partially offset by related-tax gains.

The divestment will likely help release capital and enable AZZ to invest the same in more relevant metal coating businesses. It is worth mentioning here that the company’s Metal Coatings segment accounted for 46.1% of revenues generated in the first nine months of fiscal 2020 (ended Nov 30, 2019).

Concurrent with the divestment news, the company reaffirmed its projections for fiscal 2020 and fiscal 2021 (ending February 2021). For fiscal 2020, it expects revenues of $1,020-$1,060 million and earnings per share of $2.60-$2.90.

For fiscal 2021, revenues are expected to be $970 million to $1.06 billion. Earnings per share will likely be $2.65-$3.15.

Inorganic Activities of AZZ

In addition to divestment, the company believes in making acquisitions to strengthen its business portfolio.

In September 2019, it acquired privately-owned Preferred Industries, Ltd. The latter specializes in providing e-coating and powder solutions. The products are mainly used in plastics, marine, automotive, HVAC, industrial, transportation, medical and transportation. Also, AZZ acquired NuZinc, LLC in August 2019 and K2 Partners, Inc. in April.

Zacks Rank, Estimates and Price Performance

With a market capitalization of nearly $968 million, AZZ currently carries a Zacks Rank #4 (Sell). In the past three months, the company’s shares have declined 2.3% compared with the industry’s fall of 6.2%.

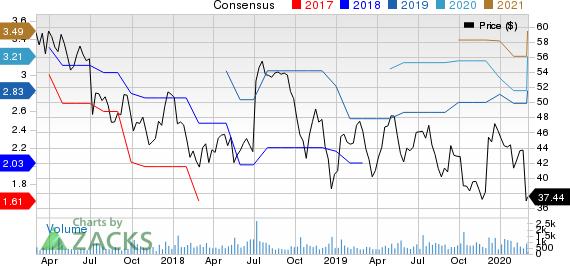

In the past 60 days, earnings estimates for AZZ have moved down. The Zacks Consensus Estimate for its earnings is pegged at $2.69 for fiscal 2020 and $2.83 for fiscal 2021, suggesting declines of 3.6% and 4.7% from the respective 60-day-ago figures.

AZZ Inc. Price and Consensus

Emerson Electric Co. (EMR): Free Stock Analysis Report

Regal Beloit Corporation (RBC): Free Stock Analysis Report

AZZ Inc. (AZZ): Free Stock Analysis Report

Schneider Electric SE (SBGSY): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.