- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Azul's (AZUL) Q4 Earnings Surpass Estimates, Increase Y/Y

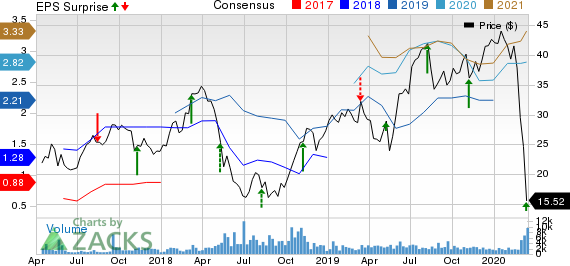

Azul’s (NYSE:AZUL) fourth-quarter 2019 earnings (excluding 94 cents from non-recurring items) of 95 cents beat the Zacks Consensus Estimate of 90 cents. Moreover, the bottom line increased more than 100% on a year-over-year basis.

Additionally, the top line came in at $790.3 that surpassed the Zacks Consensus Estimate of $735.2 million. Moreover, revenue increased 21.3% year over year.. Passenger revenues, accounting for bulk (95.3%) of the top line, rallied 32.4% year over year. Also, cargo revenues surged 34.3% in the reported quarter, mainly owing to e-commerce growth.

Operational Statistics

Consolidated revenue passenger kilometers (RPK), measuring revenues generated per kilometer per passenger, increased 31.1% year over year. The metric rose 31.9% and 28.8% on the domestic and international front, respectively.

Consolidated available seat kilometers (ASK), measuring an airline's passenger carrying capacity, increased 30.5% year over year. While domestic capacity expanded 30.2%, international capacity was up 31.2%.

Moreover, since traffic growth outpaced capacity expansion consolidated load factor (percentage of seats filled with passengers) moved up 40 basis points to 83.4% on year-over-year basis.

In the quarter under review, total revenues per ASK and passenger revenues per ASK, both inched up 1.5%, respectively, year over year. Meanwhile, cost per ASK declined 6.6% as the company added more fuel-efficient planes to its fleet as a cost-control measure. Moreover, fuel price per liter declined 10.7% in the December quarter. Moreover, CASM excluding fuel dropped 0.4% owing to 7.4% fall in other operating expenses. Average fare for the company increased 6.1% from the year-ago quarter’s figure.

Azul exited 2019 with an operating fleet size of 142 jets. The average age of the fleet is 5.8 years. Contractual fleet size was 166 (19 under finance leases and 147 under operating leases).

Liquidity

Azul, flaunting a Zacks Rank # 1 (Strong Buy), exited 2019 with total liquidity (cash, cash equivalents, short-term and long-term investments plus receivables) of R$4,273.5 million, up 5.7% year over year. However, total debt increased 35.7% to R$15,023.5 million. You can see the complete list of today’s Zacks #1 Rank stocks here.

Other Stocks to consider

Few top-ranked stocks to consider in the transportation sector are GATX Corporation (NYSE:GATX) , Ryanair Holdings plc (NASDAQ:RYAAY) and Spirit Airlines, Inc. (NYSE:SAVE) . GATX sports a Zacks Rank # 1, whereas Ryanair and Spirit Airlines carry a Zacks Rank # 2 (Buy).

Long-term expected EPS (three to five years) growth rate for GATX, Ryanair and Spirit Airlines are 15%, 16.6% and 12.5%, respectively.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >

Ryanair Holdings PLC (RYAAY): Free Stock Analysis Report

Spirit Airlines, Inc. (SAVE): Free Stock Analysis Report

GATX Corporation (GATX): Free Stock Analysis Report

AZUL SA (AZUL): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

With 2 full months of the year completed, the S&P 500 (SPY) is up +1.38% while the Barclay’s Aggregate is +2.76% YTD, leaving a 60% / 40% balanced portfolio up +1.93% YTD as...

• Trump’s trade war, U.S. jobs report, and last batch of Q4 earnings will be in focus this week. • Costco's earnings report is seen as a potential catalyst for growth, making it a...

The market has taken a turn this past month, with volatility picking up and key technical indicators signaling caution. The S&P 500, which had been trading within a...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.