- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Azul (AZUL) To Report Q4 Earnings: A Beat In The Cards?

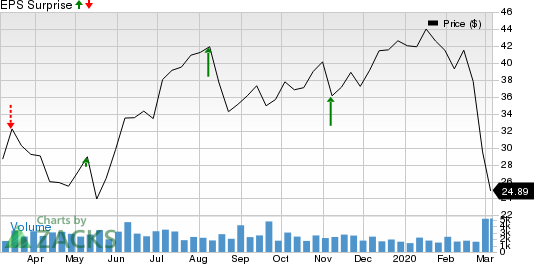

Azul S.A. (NYSE:AZUL) is slated to report fourth-quarter 2019 financial numbers on Mar 12, before the market opens.

Azul, which competes with the likes of Copa Holdings (NYSE:CPA) and Gol Linhas Aereas Inteligentes (NYSE:GOL) in the Latin American aviation space, has an impressive track record with respect to earnings per share. The carrier’s bottom line outperformed the Zacks Consensus Estimate in three of the last four quarters, missing expectations on one occasion. The average beat is above 100%.

Considering this, let’s delve into the factors that might have influenced the company’s performance in the December quarter.

Akin to the last few quarters, passenger revenues backed by impressive demand for air travel are likely to have boosted the company’s top line in the to-be-reported quarter. Load factor (% of seats filled by passengers) is also likely to have increased on higher traffic growth. Additionally, cargo revenues are likely to have risen in the fourth quarter owing to e-commerce growth. Increased fares are also likely to have driven the top line.

Further, moderate fuel costs are likely to have supported bottom-line growth in the quarter to be reported. Moreover, the addition of the highly fuel-efficient Embraer E2 jet to its fleet is likely to have aided the bottom-line improvement in the December quarter.

However, increased costs on salaries, wages and benefits are expected to get reflected in the bottom-line number. Also, depreciation of the Brazilian currency is likely to have negatively impacted the fourth-quarter performance.

What Does the Zacks Model Say?

Our proven model predicts a beat for Azul this earnings season. The combination of the following two key ingredients — a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) — increases the chances of an earnings beat. You can see the complete list of today’s Zacks #1 Rank stocks here.

Earnings ESP: Azul has an Earnings ESP of +16.13% as the Most Accurate Estimate is pegged at 90 cents, 12 cents higher than the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Azul sports a Zacks Rank of 1, currently.

Highlights of Q3 Earnings

Azul’s earnings (excluding $1.83 from non-recurring items) of 92 cents per share beat the Zacks Consensus Estimate of 61 cents. Moreover, the bottom line compared favorably with the year-ago figure of 25 cents per share. Results were aided by higher passenger revenues on solid demand for air travel. Additionally, operating revenues in the quarter increased in double digits on a year-over-year basis to $764.6 million owing to the company’s cost-control initiatives. However, the top line fell short of the Zacks Consensus Estimate of $790.7 million.

Another Stock to Consider

Investors may also consider Wheaton Precious Metals (NYSE:WPM) as it possesses the right combination of elements to beat on earnings in its upcoming release.

Wheaton Precious Metals has a Zacks Rank #2 and an Earnings ESP of +4.17% . The company is slated to report fourth-quarter earnings on Mar 11.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft (NASDAQ:MSFT) in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Gol Linhas Aereas Inteligentes S.A. (GOL): Free Stock Analysis Report

Copa Holdings, S.A. (CPA): Free Stock Analysis Report

Silver Wheaton Corp (WPM): Free Stock Analysis Report

AZUL SA (AZUL): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Using the Elliott Wave Principle (EWP), we have been tracking the most likely path forward for the Nasdaq 100 (NDX). Although there are many ways to navigate the markets and to...

Investors are on edge about what tariff policy means for markets Coming off a strong Q4 earnings season, fresh February corporate sales figures can help assess the macro...

Broadcom stock is in a dynamic rebound phase. Markets seem optimistic ahead of the earnings release. Let's take a deep dive into what to expect from the report. Get the...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.