- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Aussie Extends Losses, Consumer Confidence Next

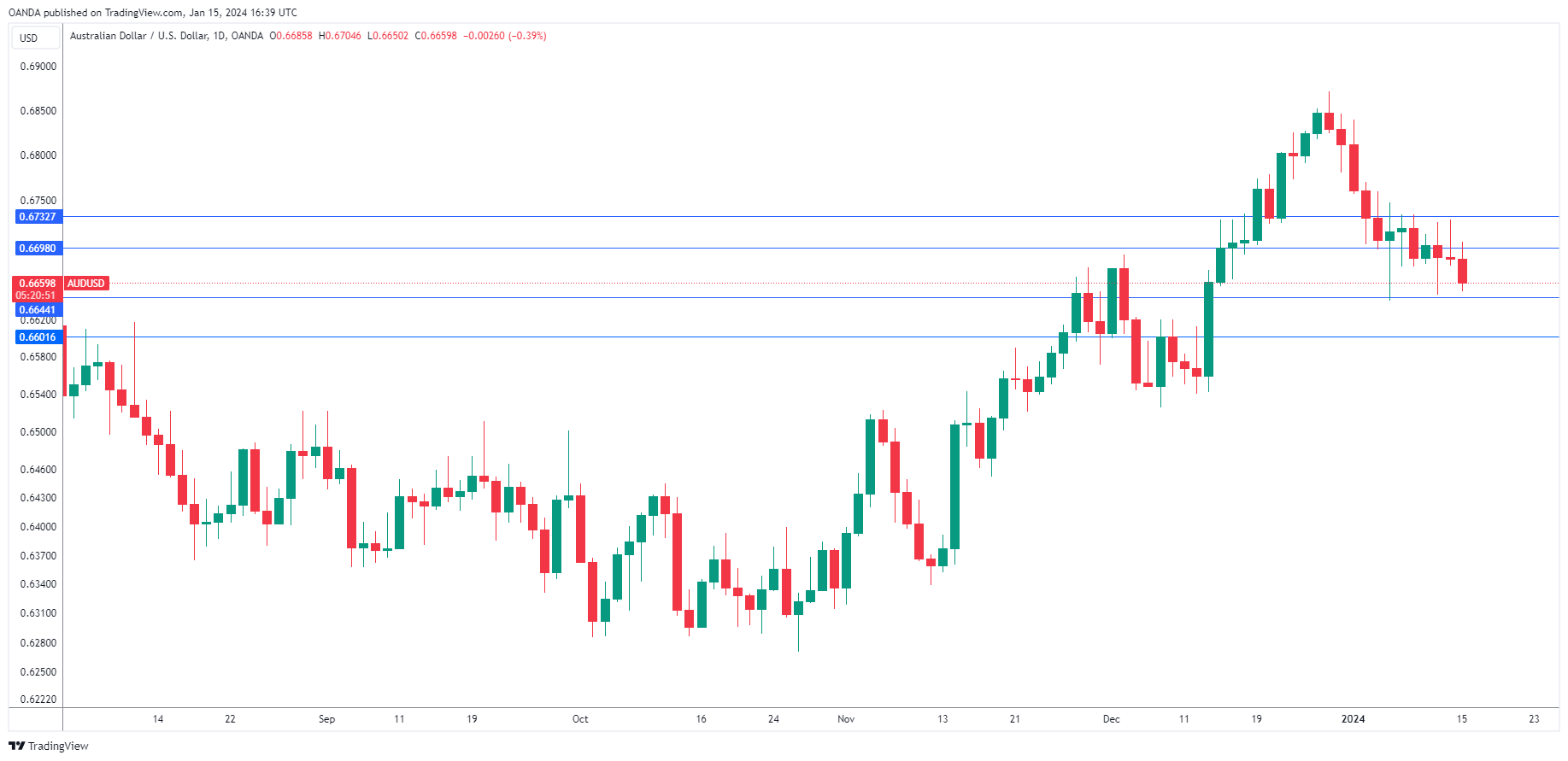

The Australian Dollar continues to lose ground. In the European session, AUD/USD is trading at 0.6657, down 0.43%.

In Australia, consumers remain pessimistic about the economy. The Westpac Consumer Sentiment index for January will be released on Tuesday. The index rebounded in December with a 2.7% gain, but the 82.1 reading was the nineteenth consecutive month below the neutral 100 level, pointing to prolonged pessimism. Consumer mood improved in December due to the Reserve Bank of Australia’s decision to maintain rates at last month’s meeting, but consumers continue to be squeezed by high rates and the cost of living crisis.

Aussie can’t find its footing

The Australian dollar touched a 10-month high on Christmas Day at 0.6871. Since then, however, it’s been all downhill for the Australian currency, which is down 2.2% in January. The US dollar has posted strong gains against most of the major currencies, getting a boost from stronger-than-expected US employment and inflation reports. This has weighed on risk appetite as the markets have trimmed expectations of a March rate cut.

The Fed is on board for rate cuts this year but has left investors frustrated as it hasn’t provided any details as to the timing of a first cut. With a recession considered unlikely, the Fed is not in any rush to cut rates and Fed members have pushed back against expectations of a March cut.

The strong nonfarm payrolls and CPI reports have reinforced the belief that the Fed might not trim rates before mid-2024. Atlanta Fed President Bostic said last week that he expected two rate cuts in 2024, a far cry from the six cuts that the market has priced in. On Sunday, the Financial Times reported that Bostic expressed concern that if the Fed eases up on rates too quickly, inflation could rise again which would be a “bad outcome”.

AUD/USD Technical

Related Articles

The US dollar fell last week due to Trump's inconsistent trade policies and signs of a slowing economy. February's non-farm payroll data disappointed, with unemployment...

Forex Strategy is Bearish: USD/JPY is currently at 146.76 in a 5th fractal wave in a channel. We are looking for a continuation to the ATR target at the 146.10 area, with a...

The Canadian dollar is steady at the start of the week. USD/CAD is trading at 1.4385, up 0.06% on the day. The Canadian dollar declined 0.50% on Friday after Canada’s job report...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.