- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Atlas Financial (AFH) Earnings Beat, Revenues Miss In Q3

Atlas Financial Holdings, Inc. (NASDAQ:AFH) reported third-quarter 2017 operating income of 63 cents per share that beat the Zacks Consensus Estimate by 50%. The bottom line also improved 21% year over year on higher revenues.

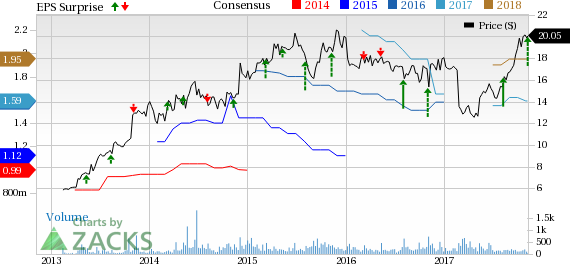

Atlas Financial Holdings, Inc. Price, Consensus and EPS Surprise

Behind the Headlines

Atlas Financial’s revenues surged 26.7% year over year to $57 million on higher net premiums earned (up 29.2%) and a significant rise in other income (up 125.5%). A 36% year-over-year decline in net investment income limited the upside. The top line also missed the Zacks Consensus Estimate by 4.2%.

The company’s total expenses increased 36.3% year over year to $49.6 million due to a rise in net claims incurred, acquisition costs, interest costs and other underwriting expenses.

Atlas Financial’s underwriting income was $6.8 million, down 5.5% year over year. Combined ratio deteriorated 440 basis points (bps) year over year to 87.9%.

Financial Update

Atlas Financial exited the quarter with cash and cash equivalents of $40.2 million, up 34.4% from 2016-end level.

Total assets of Atlas Financial increased 6.3% from year-end 2016 to $450.4 million as of Sep 30, 2017.

Debt level increased 25% from year-end 2016 to nearly $24 million as of Sep 30, 2017.

Total shareholders’ equity increased 13.4% from year-end 2016 to $144.4 million.

Book value was $11.96 per share as of Sep 30, 2017, up 13.5% from year-end 2016.

Atlas Financial’s return on average common equity was 14.5% in the quarter, lower than 18.5% in the year-ago quarter.

Zacks Rank

Atlas Financial carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here..

Performance of Other Insurers

Among other players from the insurance industry that have reported third-quarter earnings so far, the bottom line of The Progressive Corporation (NYSE:PGR) , The Travelers Companies, Inc. (NYSE:TRV) and RLI Corp. (NYSE:RLI) beat the respective Zacks Consensus Estimate.

Zacks' Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but selected members of our portfolio services. Would you like to peek behind the curtain today and view them?

Starting now, for the next month, I invite you to follow all Zacks' private buys and sells in real time from value to momentum...from stocks under $10 to ETF to option movers...from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors.

Click here for Zacks' secret trade>>

RLI Corp. (RLI): Free Stock Analysis Report

The Travelers Companies, Inc. (TRV): Free Stock Analysis Report

Progressive Corporation (The) (PGR): Free Stock Analysis Report

Atlas Financial Holdings, Inc. (AFH): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Tesla (NASDAQ:TSLA) (NYSE: TSLA), the electric vehicle giant, has recently experienced a significant drop in its stock value, which has fallen nearly 45% since December. This...

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.