- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Astec's (ASTE) Earnings & Revenues Miss Estimates In Q4

Astec Industries, Inc.’s (NASDAQ:ASTE) fourth-quarter 2019 adjusted earnings per share of 40 cents missed the Zacks Consensus Estimate of 44 cents by a margin of 9%. The figure also declined 34.4% from the prior-year quarter, thanks to softer market conditions in North America.

Including one-time items, the company incurred loss per share of 85 cents in the fourth quarter, 59% narrower than the loss per share of $2.08 posted in the year-ago quarter.

Astec reported revenues of $283.2 million in the quarter, down 10.7% from the year-ago quarter. Also, the top line missed the Zacks Consensus Estimate of $306 million. The company’s domestic sales decreased 15.5% year over year to $209.6 million, while international sales rose 7% year over year to $73.6 million.

Cost of sales went down 22% year over year to $248.8 million. Adjusted gross profit came in at $60.9 million, down from the year-ago quarter’s $75.9 million. Gross margin was 21.5% in the reported quarter compared with the prior-year quarter’s 24%. Selling, general, administrative and engineering (SG&A) dropped 4% year over year to $52.5 million. The company reported adjusted operating profit of $8.4 million, which slumped 60.5% from the prior-year quarter’s $21.2 million.

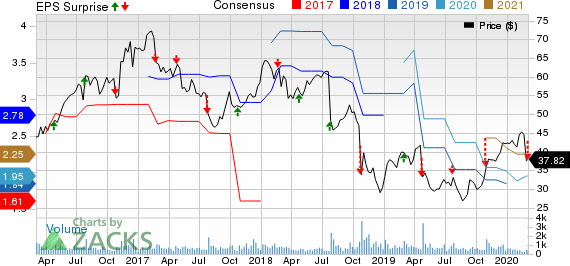

Astec Industries, Inc. Price, Consensus and EPS Surprise

Segment Performance

Revenues for the Infrastructure Group segment declined 7.4% to $115.7 million from the year-ago quarter. The segment reported an adjusted EBITDA of $9.8 million compared with the $8.1 million recorded in the prior-year quarter.

Total revenues for the Aggregate and Mining Group segment went down 20.7% year over year to $91.9 million. The segment reported an adjusted EBITDA of $4.6 million, suggesting a year-over-year drop of 66%.

The Energy Group segment’s total revenues edged down 1.1%, year over year, to $75.1 million. The segment reported an adjusted EBITDA of $9.4 million, depicting year-over-year growth of 35%.

Financial Position

Astec reported cash and cash equivalents of $48.8 million in 2019, up from the prior year’s $25.8 million. Receivables declined to $124 million at the end of 2019, from the prior-year period’s $134 million. Inventories were $279 million as of 2019-end compared with $356 million as of 2018-end.

The company’s total backlog declined around 24% year over year to $263.7 million as of Dec 31, 2019. Backlog slid 22.1%, 43.3% and 6.9% in the Energy, Aggregate and Mining Group and Infrastructure Group, respectively. Domestic backlog dropped 25.4% year over year to $194.5 million at the end of 2019, and international backlog decreased to $69.2 million from last year’s $84.2 million.

Astec is actively aligning the business to meet the current demand. The company is progressing towards its strategy for profitable growth — Simplify, Focus and Grow. The company is on track to sell its GEFCO business. This will further simplify the organization, while strengthening financial position and deploy additional capital for strategic growth opportunities. Astec has also taken vital steps for restructuring the company and streamlining its business units, in a bid to increase internal transparency and improve the decision-making process.

2019 Results

Astec reported adjusted earnings per share of $1.59 in 2019, down 46% from the prior year’s $2.94. Earnings also missed the Zacks Consensus Estimate of $1.71. Including one-time items, the company reported earnings per share of 95 cents, as against the loss of $2.64 per share posted in the previous year. Net sales were relatively flat at $1.17 billion, year over year. The top-line figure missed the Zacks Consensus Estimate of $1.19 billion.

Share Price Performance

Astec’s shares have fallen 5.3% in the past year, compared to the the industry‘s loss of 10.9%.

Zacks Rank & Stocks to Consider

Astec currently carries a Zacks Rank #5 (Strong Sell).

A few better-ranked stocks in the Industrial Products sector include Northwest Pipe Company (NASDAQ:NWPX) , Graco Inc. (NYSE:GGG) and Sharps Compliance Corp (NASDAQ:SMED) . All of these stocks sport a Zacks Rank #1 (Strong Buy), at present. You can see the complete list of today's Zacks #1 Rank stocks here.

Northwest Pipe has an expected earnings growth rate of 19.5% for the current year. The stock has appreciated 34% over the past year.

Graco has a projected earnings growth rate of 4.3% for 2020. The company’s shares have rallied 19% over the past year.

Sharps Compliance has an estimated earnings growth rate of a whopping 767% for the ongoing year. In a year’s time, the company’s shares have gained 39%.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Astec Industries, Inc. (ASTE): Free Stock Analysis Report

Graco Inc. (GGG): Free Stock Analysis Report

Sharps Compliance Corp (SMED): Free Stock Analysis Report

Northwest Pipe Company (NWPX): Free Stock Analysis Report

Original post

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.