- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Associated Banc-Corp Outlook Upgraded To Stable By Moody's

Associated Banc-Corp’s (NYSE:ASB) ratings outlook has been upgraded to stable from negative by Moody's Investors Service, a rating arm of Moody's Corporation (NYSE:MCO) . The rating agency had lowered the outlook last year following the continued slump in energy prices.

At that time, Moody’s had downgraded ratings of BOK Financial Corp. (NASDAQ:BOKF) , Hancock Holding Co. (NASDAQ:HBHC) and Cullen/Frost Bankers for similar reasons.

Further, the ratings of Associated Banc-Corp and its subsidiaries have been affirmed. The company's senior unsecured and subordinated debt ratings have been maintained at Baa1. Moreover, long-term and short-term deposit ratings for its subsidiary — Associated Bank, N.A. — have been retained at A1 and baseline credit assessment at baa2.

Reason for the Upgrade in Outlook

Improvement in profitability supported by rise in interest rates, cost control efforts and strong credit quality led Moody’s to upgrade Associated Banc-Corp's outlook. Per the rating agency, no change in the company's liquidity or capital positions is expected in the near term.

Moody’s projects loan loss provisions to remain at low levels, mainly driven by an improved performance of Associated Banc-Corp's energy loan portfolio, given the stable oil prices and a reduced exposure to energy sector loans.

Notably, Associated Banc-Corp expects asset quality to continue improving with oil and gas allowance decreasing gradually.

Why the Ratings are Affirmed

Per Moody's, Associated Banc-Corp has a strong liquidity position, given its stable deposit base. Further, the company is focused on strengthening its commercial as well as consumer client base in Wisconsin, Illinois and Minnesota.

Additionally, improving asset quality is a positive for the company. Associated Banc-Corp’s exposure to energy loans decreased to 27% of Moody's tangible common equity as of Sep 30, 2017 from 35% last year. The rating agency expects less probability of a rise in loan loss provisions for energy exposure.

Nonetheless, Moody’s pointed that Associated Banc-Corp’s relatively high exposure to commercial real estate remains a credit negative. Also, the company’s tangible common equity/risk-weighted assets ratio compares unfavorably with its peers, though it witnessed progress based on increase in earnings and steady capital deployments.

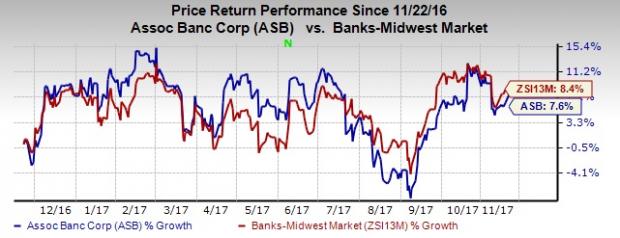

Notably, shares of Associated Banc-Corp have risen 7.6% over the past year, marginally underperforming the industry’s growth of 8.4%.

Associated Banc-Corp carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks' Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but selected members of our portfolio services. Would you like to peek behind the curtain today and view them?

Starting now, for the next month, I invite you to follow all Zacks' private buys and sells in real time from value to momentum...from stocks under $10 to ETF to option movers...from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors.

Click here for Zacks' secret trade>>

Moody's Corporation (MCO): Free Stock Analysis Report

Associated Banc-Corp (ASB): Free Stock Analysis Report

Hancock Holding Company (HBHC): Free Stock Analysis Report

BOK Financial Corporation (BOKF): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Walgreens Boots Alliance Inc. (NASDAQ:WBA) is on the brink of a significant transformation as it nears a deal with Sycamore Partners to become a private entity. The transaction,...

Using the Elliott Wave Principle (EWP), we have been successfully tracking the most likely path forward for the S&P 500 (SPX) over several months. Although there are many ways...

When looking for dividend stocks, high dividend yields are one important factor to consider. Even if a company’s dividend yield isn’t nearing double-digit percentages, finding...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.