- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Yandex (YNDX) Q2 Earnings Miss, Revenues Beat Estimates

Yandex N.V. (NASDAQ:YNDX) reported second-quarter 2019 adjusted earnings of 27 cents (RUB 11.03) per share missing the Zacks Consensus Estimate by 10 cents. Further, the figure was significantly down from the year-ago quarter’s figure of RUB 99.

Revenues of $656.3 million (RUB 41.4 billion) surpassed the Zacks Consensus Estimate of $605 million. The figure exhibited year-over-year growth of 40% in ruble terms.

The company’s growing advertising revenues, solid momentum in the Russian search market and robust performance by its Taxi segment drove the top line during the reported quarter. Further, well-performing Classifieds, Media Services and Experiments segments of the company contributed to the results.

Additionally, the company witnessed growth of 17% in its paid clicks during the reported quarter.

However, the deconsolidation effect of Yandex.Market continued to be a headwind throughout the second quarter. Excluding this impact, year-over-year growth in paid clicks would have been at 20%. Further, revenues would have exhibited growth of 41% on a year-over-year basis.

Additionally, net income would have declined 3% year over year instead of 90% which includes deconsolidation effect.

Following the company’s earnings release on Jul 26, the stock price has plunged 3.6%, owing to lower-than-estimated earnings.

Nevertheless, Yandex’s strong momentum across its Taxi and ride sharing business remains a major positive. Moreover, the company has raised revenue outlook for 2019, which is likely to aid it in gaining investor confidence in the near term.

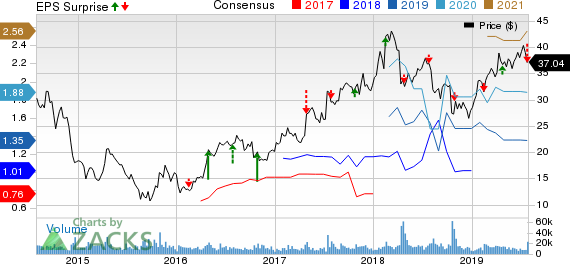

Coming to the price performance, shares of Yandex have gained 39.1% on a year-to-date basis, outperforming the industry’s rally of 4.6%.

.jpg)

Top-Line Details

Total online advertising revenues came in RUB 29.14 billion (70.4% of total revenues), exhibiting growth of 19% on a year-over-year basis.

This was primarily driven by robust performance of Yandex properties, which accounted for 78.4% of the total advertising revenues and exhibited year-over-year growth of 21.1%. Further, Advertising network revenues contributed 21.6% to advertising revenues and improved 12% from the year-ago quarter.

Excluding deconsolidation effect of Yandex.Market, the online advertising revenues would have improved 21%.

Taxi revenues of $8.8 billion (21.3% of total revenues) surged 117% on a year-over-year basis, driven by increasing number of rides.

Other revenues of RUB 3.5 billion (8.3% of total revenues) soared 207.1% from the prior-year quarter. This can be attributed to the well-performing Yandex.Drive and Media Services. Further, strong IoT initiatives remained positive.

Yandex N.V. (YNDX): Free Stock Analysis Report

Rosetta Stone (RST): Free Stock Analysis Report

Lattice Semiconductor Corporation (LSCC): Free Stock Analysis Report

Alteryx, Inc. (AYX): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Emini S&P March collapsed on Thursday from strong resistance at 6010/6015The low and high for the last session were 5873 - 6014.(To compare the spread to the contract you...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.