- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Newell Loses 22% YTD: Can Its Transformation Plan Aid Stock?

Newell Brands Inc. (NASDAQ:NWL) has been losing investor confidence mainly due to its soft core sales trend for the past few quarters now. This, along with foreign currency headwinds, has been weighing on the company’s sales, which lagged the Zacks Consensus Estimate in four of the last five quarters. Also, the exit of 60 Yankee Candle retail outlets hurt its top line in the first quarter of 2019.

Additionally, Newell issued soft earnings and sales guidance for the second quarter. Normalized earnings per share are anticipated to be 34-38 cents, significantly down from 82 cents earned in the year-ago quarter. Core sales are expected to be flat to down 2%. Foreign currency translations are likely to hurt sales by roughly 150 basis points (bps). It also expects normalized operating margin between flat and down 60 bps.

Moreover, an anticipated shift in back-to-school orders for some customers from June last year to July this year is projected to hurt results in the second quarter.

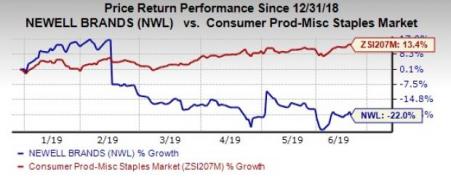

Driven by all such factors, shares of this consumer products manufacturer have lost 22% year to date against the industry’s rally of 13.4%.

Can Transformation Plan Drive Stock Performance?

Despite these odds, Newell has been progressing well with the execution of Accelerated Transformation Plan through market share gains, point of sale growth, innovation, e-commerce improvement and cost-saving plans.

Key aspects of the plan are restructuring the company into a global consumer product entity, valued at more than $9 billion. Apparently, it plans to offload non-core businesses, constituting nearly 35% of sales; utilize $10 billion of after-tax proceeds from divestitures and free cash flow to lower debt and make share repurchase; and retain its investment grade rating and an annual dividend of 92 cents per share through 2019, targeting 30-35% payout ratio.

Impressively, execution of the plan will lead to simplification of the company’s operations, which is likely to reduce number of manufacturing facilities by 66%, distribution centers by 55%, brands by 45% and number of employees by 39% as well as reduce above 30 ERP systems to two by the end of 2019.

Management will also focus on rightsizing the cost structure for anticipated smaller net sales, remove stranded corporate expenses and recover the synergies lost through divestitures. These efforts will help improve operational performance and enhance shareholder value amid a rapidly changing retail backdrop.

As part of the progress, Newell recently agreed to divest the United States Playing Card Company to Cartamundi Group — a leading maker of playing cards and board games. Earlier, the company concluded divestitures of Process Solutions, Rexair businesses, Pure Fishing and Jostens businesses. Last year, Newell generated more than $5 billion of after-tax proceeds from divestitures.

Proceeds from the sale of these assets were utilized to lower debt and make share repurchases. Notably, the company remains on track to improve leverage as it targets a leverage ratio of about 3.5 by the end of 2019.

That said, we expect Newell’s robust Transformation Plan to address hurdles and position it for growth. Currently, the company carries Zacks Rank #3 (Hold).

3 Better-Ranked Consumer Staples Stocks

General Mills, Inc. (NYSE:GIS) delivered average trailing four-quarter positive earnings surprise of 11.1%. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Colgate-Palmolive Company (NYSE:CL) outpaced earnings estimates in the trailing four quarters, the average surprise being 0.7%. The company presently has a Zacks Rank #2 (Buy).

Medifast, Inc. (NYSE:MED) , also a Zacks Rank #2 stock, pulled off average positive earnings surprise of 9.1% in the last four quarters.

Radical New Technology Creates $12.3 Trillion Opportunity

Imagine buying Microsoft (NASDAQ:MSFT) stock in the early days of personal computers… or Motorola (NYSE:MSI) after it released the world’s first cell phone. These technologies changed our lives and created massive profits for investors.

Today, we’re on the brink of the next quantum leap in technology. 7 innovative companies are leading this “4th Industrial Revolution” - and early investors stand to earn the biggest profits.

See the 7 breakthrough stocks now>>

Newell Brands Inc. (NWL): Free Stock Analysis Report

MEDIFAST INC (MED): Free Stock Analysis Report

General Mills, Inc. (GIS): Free Stock Analysis Report

Colgate-Palmolive Company (CL): Free Stock Analysis Report

Original post

Related Articles

Since the Robotaxi event on October 11th, Tesla (NASDAQ:TSLA) stock is up 38%, currently priced at $291.60 per share This is a return to the early November 2024 price level. But...

The Q4 2024 earnings season tapers off from here, with S&P 500® EPS growth surpassing 17%, the highest in 3 years Large cap outlier earnings dates this week include:...

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.