- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

First Horizon Completes Merger Consideration Allocations

Last week, First Horizon National Corporation (NYSE:FHN) , headquartered at Tennessee, announced the final merger terms of the acquisition of Charlotte, N.C.-based Capital Bank Financial Corp. First Horizon acquired Capital Bank for a total value of $2.2 billion, forming the fourth largest regional bank in the Southeast, effective Nov 30, 2017.

Final Terms of the Deal

Per the deal, each common shareholder of Capital Bank has been converted into the right to receive either 2.1732 of First Horizon shares or $40.573 in cash for every Capital Bank share held, subject to certain conditions. The deal has been agreed upon 80% stock and 20% cash.

Following the allocation provisions, around 10.1 million shares of Capital Bank were converted into the right to receive cash amount, while the remaining shares were converted into the right to receive shares of First Horizon common stock. Notably, 42% shareholders of Capital Bank had elected for cash, while the remaining shareholders opted for share conversion or no election.

Further, shareholders who opted for cash will receive 46.12% of the merger consideration in cash and the remaining 53.88% in First Horizon common stock. Additionally, shareholders who opted for stock or made no election will receive the merger consideration only in the form of First Horizon common stock, along with cash for fractional shares, based on the closing price of $18.67 per share of First Horizon.

After Effects of the Deal

First Horizon, with $30 billion in assets, and Capital Bank, with $10 billion in assets, created the combined entity with $40 billion in assets, $32 billion in deposits and $27 billion in loans. The high potential market in North Carolina, along with the strong relationships that Capital Bank has built in the area, seems to have prompted First Horizon to opt for this acquisition. The deal certainly fortifies First Horizon’s footprint in the Southeast, with about 350 branches in Tennessee, North Carolina, South Carolina, Florida, Mississippi, Georgia, Texas and Virginia.

According to the terms of the deal, First Horizon will maintain its First Tennessee bank brand in Tennessee, while the Capital Bank name will be used for branches outside Tennessee.

Barclays (LON:BARC) Capital Inc., a unit of Barclays PLC (NYSE:BCS) and Morgan Stanley & Co. LLC, a unit of Morgan Stanley (NYSE:MS) acted as financial advisors for First Horizon.

Bottom Line

We believe the latest acquisition is a befitting one which will support the future prospects of First Horizon, which, amid the financial crisis, was adversely affected as a result of its exposure to national mortgage and construction lending. The company decided to exit these business lines and focus on growing the core Tennessee banking franchise.

The company’s repositioning and restructuring efforts, which are still underway, help it reallocate capital into core markets. Also, its focus on cost control and efforts to boost long-term profitability are anticipated to augur well.

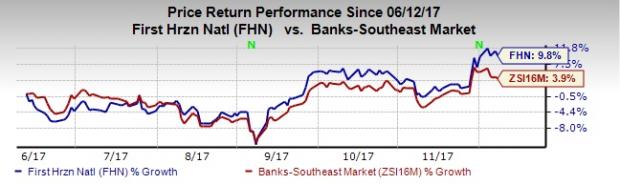

Such moves have caused investors to become optimistic about First Horizon's growth opportunities. Notably, the company's share price rose nearly 9.9% over the last six months as compared with 3.9% growth recorded by the industry.

Currently, First Horizon carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

A better-ranked company is Federated Investors Inc. (NYSE:FII) which has been witnessing upward estimate revisions for the last 30 days. The company’s share price has been up around 26.5% in six months’ time. It carries a Zacks Rank of 2 (Buy).

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Barclays PLC (BCS): Free Stock Analysis Report

First Horizon National Corporation (FHN): Free Stock Analysis Report

Morgan Stanley (MS): Free Stock Analysis Report

Federated Investors, Inc. (FII): Free Stock Analysis Report

Original post

Related Articles

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Emini S&P March collapsed on Thursday from strong resistance at 6010/6015The low and high for the last session were 5873 - 6014.(To compare the spread to the contract you...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.