- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

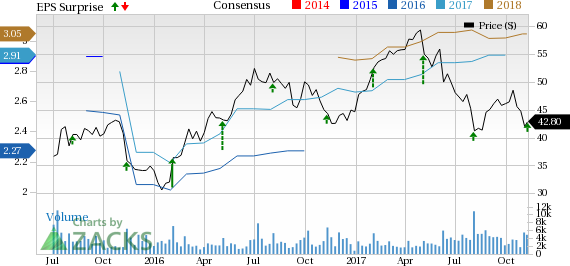

Energizer (ENR) Reports Better-Than-Expected Q4 Earnings

Energizer Holdings, Inc. (NYSE:ENR) reported strong fiscal fourth-quarter 2017 results. Adjusted earnings of 54 cents per share and revenues of $465.1 million comfortably beat the Zacks Consensus Estimate of 48 cents and $436.4 million, respectively.

The year-over-year revenue growth was boosted by increased organic net sales of 7.5% (including of hurricane volumes). Excluding hurricane volumes, organic revenues rose 3% year over year, added the company.

Quarterly Details

Batteries revenues grew 9.2% year over year to $409.4 million while revenues from Other segment fell 3% to $55.7 million.

Energizer Holdings, Inc. (ENR): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Jabil Circuit, Inc. (JBL): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.