- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

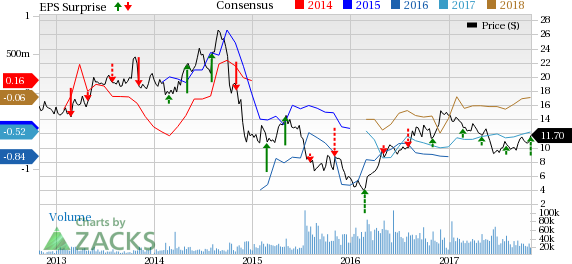

WPX Energy (WPX) Q3 Loss Narrower Than Expected, '17 View Up

Independent oil & gas operator, WPX Energy Inc. (NYSE:WPX) incurred a loss of 10 cents per share in the third quarter of 2017, narrower than the Zacks Consensus Estimate of a loss of 13 cents. The quarterly figure was also narrower than the year-ago quarter loss of 17 cents.

Total Revenues

WPX Energy’s quarterly revenues of $224 million lagged the Zacks Consensus Estimate of $330 million by 32.3%. Further, total revenues declined 10.8% from $251 million in the year-ago quarter.

Highlights of the Release

Total production in the third quarter was 112,000 barrels per oil equivalent per day, up 33.3% year over year. Total liquids accounted for nearly 69.7% of the total production, reflecting the company’s increasing focus on oil.

Oil production was 64,800 barrels per day, nearly 67% higher than the year-ago quarter level of 38,900 barrels per day.

Total expenses were $291 million, down 47.3% from $552 million in the year-ago quarter.

Interest expenses in the reported quarter were $48 million, down 2.1% from $49 million in the prior-year quarter.

Realized Prices & Hedges

Realized oil prices in the quarter were $43.34 per barrel, up 11.9% from the year-ago quarter.

Realized natural gas prices were $2.06 per thousand cubic feet (Mcf), up 4.6%. Realized prices for natural gas liquids were up a whopping 104.9% to $23.57 per barrel.

For the rest of 2017, the company has 50,638 barrels per day of oil hedged at a weighted average price of $50.23 per barrel. Further, WPX Energy has 170,000 million British thermal unit (MMBtu) per day of natural gas hedged at a weighted average price of $3.02 per MMBtu.

For 2018, WPX Energy has 55,500 barrels per day of oil hedged at a weighted average price of $52.69 per barrel. The company also has 140,000 MMBtu per day of natural gas hedged at a weighted average price of $2.97 per MMBtu.

Financial Update

WPX Energy had $10 million of cash and cash equivalents as of Sep 30, 2017 compared with $496 million at the end of 2016.

Long-term debt as of Sep 30, 2017 was $2,859 million, up from 2016 end levels of $2,575 million.

Net cash from operating activities in the first nine months of 2017 was $228 million compared with $114 million in the year-ago period. For the same period, capital expenditure was $855 million compared with $440 million in the year-ago period.

Guidance

WPX Energy has reiterated its capital budget for 2017of $990-$1,070 million. More than half of the capital is targeted for the development in the Delaware Basin.

The company expects cash operating expenses to range from $9.50 to $11.00 in 2017.

The company raised its 2017 total production to 106-117 thousand barrel of oil equivalents per day (MBoe/d) from 105-116 MBoe/d. Moreover, it raised its 2017 oil production to 59-62 thousand barrels per day (Mbbl/d) from 57-60 Mbbl/d.

The company targets a rise of 40-45% in its oil production in 2018 from 2017 levels. WPX Energy expects total production in 2018 in the range of 132-143 Mboe/d, including 82-88 Mbbl/d of oil.

Our View

WPX Energy's third-quarter performance was better than expected due to strong production from its oil assets and recovery in the commodity prices from the year-ago level.

The company continues to work on its strategy of increasing oil production, which is evident from the rising liquid mix in total production. Production from the Delaware Basin increased substantially during the third quarter with the help of assets the company acquired during the first quarter.

We believe WPX Energy's exposure in the Delaware, Williston and San Juan basins will enable it achieve its new goal of higher oil generation in 2018.

The company currently carries a Zacks Rank #3 (Hold). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Peer Releases

Anadarko Petroleum Corp. (NYSE:APC) reported third-quarter 2017 adjusted loss of 77 cents per share, wider than the Zacks Consensus Estimate of a loss of 56 cents.

Devon Energy Corp. (NYSE:DVN) reported third-quarter 2017 adjusted earnings per share of 46 cents, beating the Zacks Consensus Estimate of 39 cents by 17.9%.

Noble Energy, Inc. (NYSE:NBL) incurred adjusted loss of 2 cents per share for the third quarter of 2017, narrower than the Zacks Consensus Estimate of a loss of 13 cents.

Zacks’ Best Private Investment Ideas

While we are happy to share many articles like this on the website, our best recommendations and most in-depth research are not available to the public.

Starting today, for the next month, you can follow all Zacks' private buys and sells in real time. Our experts cover all kinds of trades… from value to momentum . . . from stocks under $10 to ETF and option moves . . . from stocks that corporate insiders are buying up to companies that are about to report positive earnings surprises. You can even look inside exclusive portfolios that are normally closed to new investors.

Click here for Zacks' private trades >>

Devon Energy Corporation (DVN): Free Stock Analysis Report

Noble Energy Inc. (NBL): Free Stock Analysis Report

Anadarko Petroleum Corporation (APC): Free Stock Analysis Report

WPX Energy, Inc. (WPX): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Emini S&P March collapsed on Thursday from strong resistance at 6010/6015The low and high for the last session were 5873 - 6014.(To compare the spread to the contract you...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.