- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

China Life (LFC) Q3 Earnings Up On Higher Investment Income

China Life Insurance Co. Ltd’s (NYSE:LFC) third-quarter 2017 earnings per share of 7.65 cents (RMB 0.51) increased from 1.65 cents (RMB 0.11) in the prior-year quarter.

For the first nine months of 2017, earnings per share totaled 14.1 cents (RMB 0.94) that increased 100% from 7 cents (RMB 0.47) in the prior-year period.

The company’s net profit attributable to equity holders of the company was $4 billion (RMB 26.8 billion) at the end of first nine months of 2017, reflecting 98.3% year-over-year growth. The upside was primarily driven by higher investment income.

Quarterly Operational Update

The company witnessed significant growth in its core insurance business. For the third quarter, it generated revenues from insurance business of $67.5 billion (RMB 450 billion), an increase of 19.6% year over year.

First-year regular premiums amounted to $15.3 billion (RMB 102 billion), an increase of 19.1% year over year.

During the third quarter, total operating income was $21.8 billion (RMB 145.1 billion), up 26% on higher premium income and investment income.

The company’s premium income was $15.6 billion (RMB104 billion), up 24% .

The company's investment income was $6 billion (RMB 40 billion), an increase of 39% year over year.

Other operating income totaled $170 million (RMB 1135 million), down 13% year over year.

Total operating expenses for the quarter were $19.4 billion (RMB 129.1 billion), up 15% from the prior-year quarter.

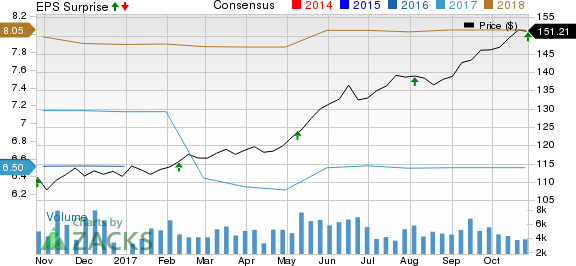

China Life Insurance Company Limited Price, Consensus and EPS Surprise

Financial Update

As of Sep 30, 2017, total assets came at $425 billion (RMB 2,833 billion), up 6.2% from year-end 2016.

As of Sep 30, 2017, total liabilities came at $377 billion (RMB 2,513 billion), up 6.3% from year-end 2016.

As of Sep 30, 2017, total shareholders’ equity came at $48 billion (RMB 320.1 billion), up 6% from year-end 2016.

As of Sep 30, 2017, the company had $7.6 billion (RMB 50.5 billion) of cash fund, down 19% from year-end 2016.

At the end of the first nine months of 2017, the company reported weighted average return on equity of 8.7%, reflecting 439 basis points year-over-year improvement.

Solvency Ratio

The company’s core solvency ratio and comprehensive solvency ratio reached 278.31% and 282.37%, respectively.

Zacks Rank and Performance of Other Multiline Insurers

China Life currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Among other insurers that have reported their third-quarter earnings so far, Brown & Brown, Inc. (NYSE:BRO) , RLI Corp. (NYSE:RLI) and The Progressive Corporation (NYSE:PGR) beat their respective Zacks Consensus Estimate.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Brown & Brown, Inc. (BRO): Free Stock Analysis Report

China Life Insurance Company Limited (LFC): Free Stock Analysis Report

RLI Corp. (RLI): Free Stock Analysis Report

Progressive Corporation (The) (PGR): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Emini S&P March collapsed on Thursday from strong resistance at 6010/6015The low and high for the last session were 5873 - 6014.(To compare the spread to the contract you...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.