- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Validus Holdings Projects Q3 Cat Loss Estimates Of $378.9M

Validus Holdings, Ltd. (NYSE:VR) recently announced pre-tax catastrophe loss estimates emanating from inclement weather events in third-quarter 2017. The company projects catastrophe loss of about $378.9 million.

The catastrophe losses constitute $146.4 million from Hurricane Harvey, $163.2 million from Irma, $57.7 million from Maria and $11.6 million from the Mexican tremors.

The Zacks Consensus Estimate for the third quarter is currently pegged at 73 cents per share, reflecting a year-over-year slump of 28.9%. The company is scheduled to report third-quarter results on Oct 26.

Our proven model does not conclusively show that Validus Holdings is likely to beat on earnings this quarter. This is because the company’s current Zacks Rank #4 (Sell) lowers the predictive power of ESP, which further combined with an Earnings ESP of -10.35% makes surprise prediction difficult.

Last quarter, Validus Holdings had incurred net losses amounting to $3 million in the property lines at Western World segment from major disasters like 14 U.S. weather-related events, Colorado floods and the tropical storm Cindy. Nonetheless, sustained growth and portfolio diversification helped it generate 51.3% loss ratio. Exposure to huge cat loss is anticipated to weigh heavily on the bottom line in the soon-to-be-reported quarter.

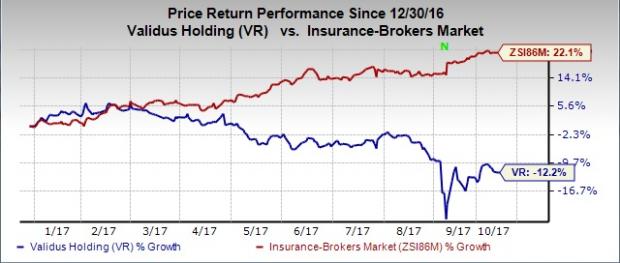

Shares of Validus Holdings have lost 12.3% year to date, underperforming the industry's 22.1% rally. Catastrophes affecting underwriting results will possibly be a drag on the share price.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recently, American Financial Group, Inc. (NYSE:AFG) calculates catastrophe loss of about $105 million or 95 cents per share post-tax. Chubb Limited (NYSE:CB) expects $200 million post-tax cat losses from Maria, $24 million from Mexican earthquakes, $520 million from Harvey and between $640 million and $760 million from Irma. HCI Group, Inc. (NYSE:HCI) projects loss between $100 million and $300 million.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

Validus Holdings, Ltd. (VR): Free Stock Analysis Report

D/B/A Chubb Limited New (CB): Free Stock Analysis Report

HCI Group, Inc. (HCI): Free Stock Analysis Report

American Financial Group, Inc. (AFG): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Emini S&P March collapsed on Thursday from strong resistance at 6010/6015The low and high for the last session were 5873 - 6014.(To compare the spread to the contract you...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.