- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Gilead's (GILD) HBV Drug Vemlidy Receives Approval In Canada

Gilead Sciences Inc. (NASDAQ:GILD) announced that hepatitis B virus (HBV) drug Vemlidy has been approved in Canada.

Health Canada granted a Notice of Compliance (NOC) for Vemlidy 25mg tablets, a once-daily treatment for adults with chronic HBV infection with compensated liver disease.

The approval was supported by positive data from the 48-week data from two international phase 3 studies among treatment-naïve and treatment-experienced adult patients with chronic HBV infection.

Vemlidy showed antiviral efficacy similar to and at a dose less than one-tenth that of Gilead's other HBV drug, Viread. The data also showed that Vemlidy has greater plasma stability and delivers tenofovir to hepatocytes more efficiently compared to Viread. As a result, it can be administered at a lower dose, resulting in less tenofovir in the bloodstream which in turn leads to better renal and bone laboratory safety parameters compared to Viread.

Both studies met their primary endpoint of non-inferiority to Viread. The study was based on the percentage of patients with chronic hepatitis B with plasma HBV DNA levels below 29 IU/mL at 48 weeks of therapy. Moreover, patients in the Vemlidy arm also experienced numerically higher rates of normalization of blood serum alanine aminotransferase (ALT) levels.

We note that the European Commission granted marketing authorization to Vemlidy in Jan 2017. The drug was also approved by the FDA in Nov 2016.

The approval will strengthen Gilead’s HBV portfolio which comprises Viread and Hepsara.

However, Gilead’s HBV portfolio faces competition from Bristol-Myers Squibb’s (NYSE:BMY) Baraclude and Novartis’ (NYSE:NVS) Tyzeka/Sebivo.

We note that Gilead is a leading player in both the HIV and HCV markets. However, the HCV franchise has been under pressure for a while now due to competitive pressure. This in turn has led to a sharp decline in share price.

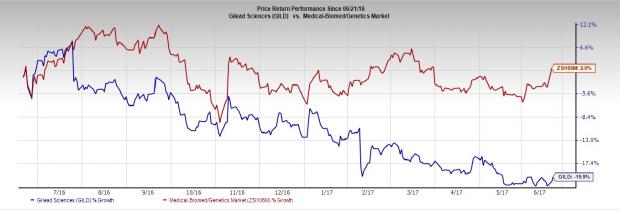

Shares of Gilead have underperformed the Zacks classified Medical-Biomedical and Genetics industry in the last year, with the stock losing 19.9% during this period, compared with the industry’s gain of 2.0%.

The HIV franchise of Gilead is performing well and should help the company combat the persistent decline in HCV franchise.

Zacks Rank & Key Pick

Gilead currently carries a Zacks Rank #3 (Hold).

A better-ranked stock in the healthcare sector worth considering is VIVUS, Inc. (NASDAQ:VVUS) which currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

VIVUS’ loss per share estimates narrowed from 50 cents to 39 cents for 2017 over the last 30 days. The company posted positive earnings surprises in each of the trailing four quarters, with an average beat of 233.69%.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Bristol-Myers Squibb Company (BMY): Free Stock Analysis Report

Novartis AG (NVS): Free Stock Analysis Report

VIVUS, Inc. (VVUS): Free Stock Analysis Report

Gilead Sciences, Inc. (GILD): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Since the Robotaxi event on October 11th, Tesla (NASDAQ:TSLA) stock is up 38%, currently priced at $291.60 per share This is a return to the early November 2024 price level. But...

The Q4 2024 earnings season tapers off from here, with S&P 500® EPS growth surpassing 17%, the highest in 3 years Large cap outlier earnings dates this week include:...

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.