- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Lincoln Electric Downgraded To Hold On Lingering Concerns

On Jun 16, Lincoln Electric Holdings Inc. (NASDAQ:LECO) was downgraded to a Zacks Rank #3 (Hold).

Why the Downgrade?

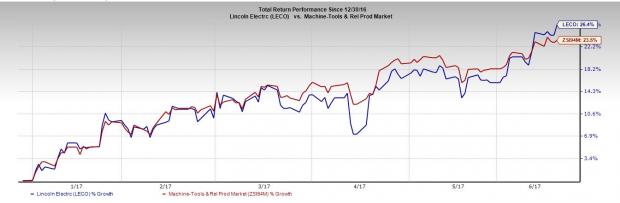

Year to date, Lincoln Electric has outperformed the Zacks categorized Manufacturing - Tools & Related Products subindustry. The stock has yielded 26.4%, ahead of the subindustry’s gain of 23.5%.

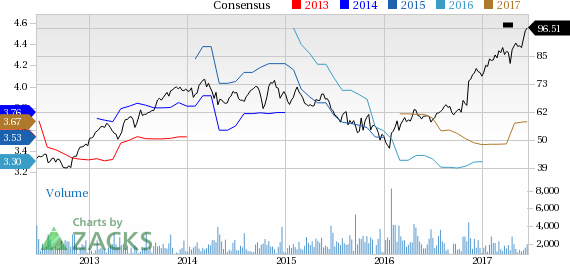

However, the company’s stretched valuation is a concern. Lincoln Electric’s trailing 12-month price earnings (P/E) ratio is 28.3, while the Zacks categorized Machine -Tools and Related Products industry’s average trailing 12-month P/E ratio is pegged lower at 23.54. This implies that the stock is overvalued.

A stronger U.S. dollar will continue to affect the company’s exports. Persistent weakness in industrial production also remains a concern. Further, the ongoing declines in the energy and heavy fabrication sectors will continue to impact results.

Given its focus on innovation as a key value proposition, Lincoln Electric continued to increase investment in product development with higher year-over-year R&D spending. Though this has long-term benefits, it will impede margins in the near term.

Nevertheless, Lincoln Electric has been consistently investing in welding automation which is on growth path owing to the shortage of welding labor and new, low-cost welding robots that provide productivity savings to customers. In the past five years, the company acquired welding automation companies for approximately $320 million. On Mar 2, Lincoln Electric entered into exclusive negotiations with Air Liquide (PA:AIRP) to acquire its France-based subsidiary, Air Liquide Welding. The proposed acquisition is subject to a definitive agreement between the parties, and customary conditions as well as other provisions. Air Liquide Welding is an important player in the manufacturing of welding and cutting technologies, and had a turnover of around €350 million ($427 million) in 2016.

Lincoln Electric Holdings, Inc. Price and Consensus

Rockwell Automation, Inc. (ROK): Free Stock Analysis Report

Lincoln Electric Holdings, Inc. (LECO): Free Stock Analysis Report

Caterpillar, Inc. (CAT): Free Stock Analysis Report

AGCO Corporation (AGCO): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Nvidia is scheduled to release its Q4 earnings report at 4:20PM ET on Wednesday. A call with CEO Jensen Huang is set for 5:00PM ET. The chipmaker’s results will serve as a...

Warren Buffett has always critiqued airline stocks for being overly capital-intensive, exhibiting low growth, and relying heavily on cyclical consumer travel patterns—further...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.