- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Arena Pharmaceuticals (ARNA) Q3 Loss Widens Y/Y, Sales Beat

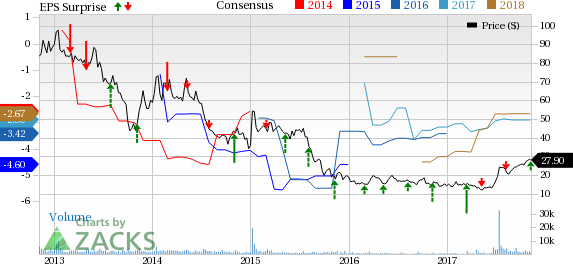

Arena Pharmaceuticals, Inc. (NASDAQ:ARNA) reported a loss of 86 cents per share in the third quarter of 2017, wider than the year-ago loss of 51 cents. The Zacks Consensus Estimate was pegged at a loss of 66 cents.

Arena’s shares were down almost 4% in after-hours trading. However, the stock has significantly outperformed the industry so far this year. While shares of the company have soared 96.5%, the industry has registered an increase of 3.4%.

Total revenues in the quarter were $7.9 million, substantially down 59% from the year-ago quarter. However, the top line beat the Zacks Consensus Estimate of $4 million. Revenues included $3.08 million in net product sales of Belviq, $2.2 million in manufacturing support payments from Japanese pharma company Eisai and $1.9 million in the form of upfront payments from collaborations with Boehringer Ingelheim and Axovant Sciences Ltd.

Belviq is the only approved product in Arena’s portfolio, launched in June 2013 and approved for chronic weight management in adult patients.

Quarter in Detail

During the third quarter of 2017, Belviq sales declined to $3.08 million from $3.3 million a year ago.

Belviq, the first obesity drug to be approved by the FDA in over a decade, is yet to impress with its performance. An extended-release version was launched in October 2016. However, sales have been lackluster so far.

Research & development (R&D) expenses declined 1.1% year over year to $17.3 million. General & administrative (G&A) expenses were $7.8 million, down 9.3% year over year.

During the quarter, the company completed a public offering and received net proceeds of $162 million from the sale of common stock under equity financing.

Pipeline Update

Arena’s pipeline consists of several early to mid-stage candidates targeting different therapeutic areas. These include ralinepag (pulmonary arterial hypertension), etrasimod (a number of autoimmune diseases) and APD371 (pain and fibrotic diseases).

The company reported positive results from a phase II study on ralinepag in July and is preparing to initiate a phase III study after discussions with the FDA.

Etrasimod is currently being evaluated in multiple phase II studies. Data from ulcerative colitis study is expected in the first quarter of 2018. The company is also enrolling patients in inflammatory bowel disease and pyoderma gangrenosum studies. The phase II trial on ulcerative colitis is likely to complete this week.

The company is also enrolling patients in phase II trial on APD371 for treatment of pain linked with Crohn’s disease with data expected by March 2018.

Zacks Rank & Key Picks

Arena carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the health care sector include Emergent Biosolutions, Inc. (NYSE:EBS) , Ligand Pharmaceuticals Inc. (NASDAQ:LGND) and Exelixis, Inc. (NASDAQ:EXEL) . While Emergent and Ligand sport a Zacks Rank #1 (Strong Buy), Exelixis carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Emergent’s earnings per share estimates have moved up from $2.42 to $2.43 for 2018 over the last 60 days. The company came up with positive earnings surprises in three of the trailing four quarters with an average beat of 15.81%. Share price of the company has rallied 18% year to date.

Ligand’s earnings per share estimates have moved up from $3.68 to $3.70 for 2018 over the last 30 days. The company delivered positive earnings surprises in two of the trailing four quarters with an average beat of 6.19%. Share price of the company has surged 44% year to date.

Exelixis’ earnings per share estimates have moved up from 62 cents to 70 cents for 2018 over the last 60 days. The company came up with positive earnings surprises in each of the trailing four quarters with an average beat of 572.92%. Share price of the company has soared 78.3% year to date.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Arena Pharmaceuticals, Inc. (ARNA): Free Stock Analysis Report

Exelixis, Inc. (EXEL): Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND): Free Stock Analysis Report

Emergent Biosolutions, Inc. (EBS): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Professional traders get paid because of one skill and one skill only: the ability to foresee what the world (or the economy, at least) might look like in six to nine months....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.