- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Are U.S. Governmen and Business The Real Economic Drivers?

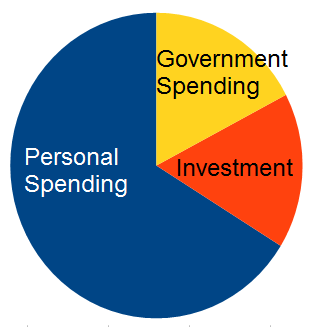

A consumer economy describes an economy driven by consumer spending as a percent of its gross domestic product, as opposed to the other major components of GDP (gross private domestic investment, government spending, and imports netted against exports).

Follow up:

Using Gross Domestic Product, the economy looks this way - and is driven by consumers (66% consumer driven).

US GDPGDP starts with cash flow data, separates income from expenditures, determines whether the spending meets the definition of included elements in GDP, and then must determine the FINAL spender of the money so the money is placed in the correct pocket.

And the final conclusion is that the USA has a consumer driven economy.

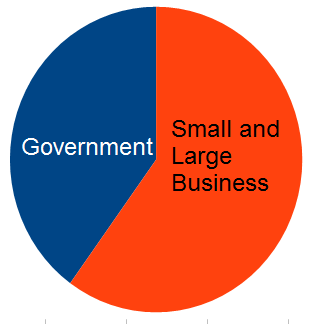

Really? Does the consumer drive the economy? It does if you focus on GDP. If one looks at initial expenditures instead of final, the economy looks like this before, or in parallel to, any income is transferred to the consumer:

Small & Large BusinessThe federal government takes money in from business (employees have tax money removed by business and sent directly to government), spends some - then transfers the majority to state governments and individuals in the form of social security et al. The USA federal, state and local governments handle 40% of GDP before transfer payments reduce this number to 17%.

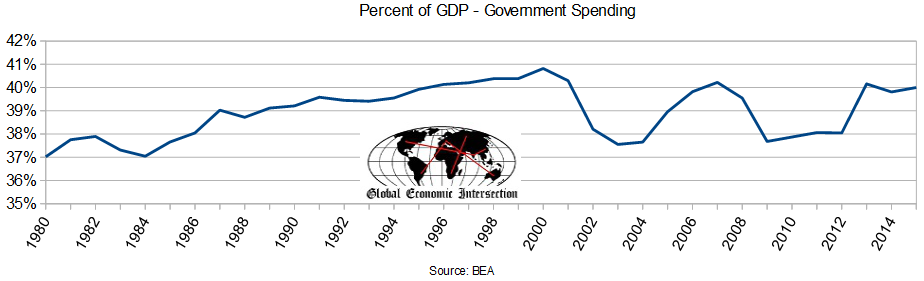

The chart below shows the ratio of government money expenditures to GDP since 1980. [Note that Federal Government transfer payments to state governments, and state transfer payments to local governments, have been removed so government expenditures are counted only once.]

It is interesting what happens to government spending during recessions. Note the dip during the Great Recession despite stimulus. Also note that the government was accelerating spending until 2000. Was the Clinton economic miracle in the 90s due to increased government spending / transfer payments? This is a subject for a later post.

The consumer gets literally all their income either through employment, running its own business, or from the government. Only a consumer running its own business is directly generating initial expenses. Being an employee is an expense for a business - is the real first economic entry coming from selling products / services? Employees and materials are costs to the economy - not the drivers per se. [This argument runs afoul of who is actually BUYING the products - an economy needs buyers and sellers.] The premise here is that sellers MAY be more important than buyers - and the Federal Government and the Federal Reserve in their actions are validating this is true.

Is thinking that the USA is a government/business driven economy any more correct than believing it is a consumer driven economy? Buying and selling is a symbiotic relationship - and convincing ourselves that buying is more important than selling (as the GDP model implies) is factually incorrect.

The consumer may not be so important in the scheme of things as history shows they spend or save all their paycheck. Saving money does not help the economy. Could it be the economy works more efficiently if wages are kept to a level where consumers must spend all of their pay? The Federal Reserve's concentration on business (and lack of sympathy towards the consumer) can be understood if one views the economy as government / business driven. Of course, if pay to consumers is repressed, then savings is reduced and something's got to give in old age. Either government makes sufficient transfer payments or people must work until they die. Or both.

Other Economic News this Week:

The Econintersect Economic Index for September 2016 is showing better growth for the second month in a row - but the rate of growth outlook remains weak. The index remains near the lowest value since the end of the Great Recession. There remain recession warning flags in some of the data we are reviewing..

Bankruptcies this Week: Light Tower Rentals

Click here to view the scorecard table below with active hyperlinks

Weekly Economic Release Scorecard:

Weekly Economic Scorecard

Related Articles

Markets have been through another week where tariffs have been the driving force behind market moves. The PCE data which I had thought would be the major event for the week failed...

NFP take center stage amid DOGE layoffs ECB decides monetary policy after CPI data Canada jobs report and RBA minutes also on tap Will DOGE layoffs weigh on NFP? The US dollar...

US Dollar's Strength Triggers a Sell-Off in Gold The gold (XAU/USD) price plunged by more than 1.3% on Thursday as the US Dollar Index (DXY) moved sharply higher after a strong US...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.