- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

ArcelorMittal (MT) Extends $1-Billion MCB Conversion Date

ArcelorMittal (NYSE:MT) recently declared extension of the conversion date for the $1-billion privately placed mandatory convertible bond (MCB) issued on Dec 28, 2009, by one of its fully-owned subsidiaries located in Luxembourg. The MCB is mandatorily convertible into preferred shares of such subsidiary.

The amendment to the MCB was executed on Dec 14, 2017. The mandatory conversion date of the bond has been extended to Jan 29, 2021. The bond is not listed and was privately placed with Credit Agricole (PA:CAGR) Corporate and Investment Bank.

According to ArcelorMittal, the subsidiary has simultaneously executed amendments providing for the extension of outstanding notes into which it invested the proceeds of the bond issuance. These are linked to shares of the listed companies, China Oriental Group Company Limited and Eregli Demir Va Celik Fab. T. AS of Turkey, both of which are held by subsidiaries of ArcelorMittal.

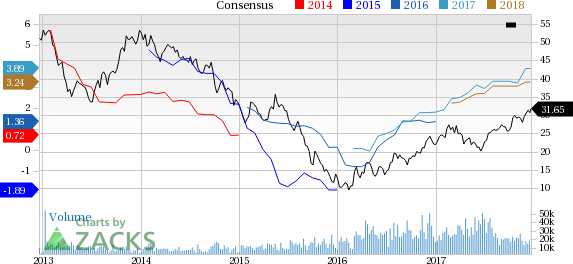

Shares of ArcelorMittal have gained 17.9% in the past three months, outperforming the industry’s 6.6% growth.

ArcelorMittal, during third-quarter earnings call, said that market conditions are favorable and demand environment remains positive along with healthy steel spreads. The company continues to expect global apparent steel consumption to grow in the range of 2.5-3% for 2017.

ArcelorMittal is poised to gain from its efforts to reduce debt. It also remains on track with its cost-reduction actions under Action 2020 program that includes plans to optimize costs and increase steel shipment volumes.

The company is also expanding its global portfolio of automotive steels by launching a new generation of advanced high strength steels. The launch of these steels is in sync with the company’s Action 2020 program that aims to achieve targeted financial improvements for the company by 2020.

Zacks Rank & Stocks to Consider

ArcelorMittal currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Westlake Chemical Corporation (NYSE:WLK) , Daqo New Energy Corp. (NYSE:DQ) and Kronos Worldwide Inc. (NYSE:KRO) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Westlake Chemical has an expected long-term earnings growth rate of 10.6%. Its shares have moved up 84.5% year to date.

Daqo New Energy has an expected long-term earnings growth rate of 7%. Its shares have surged a whopping 160.4% year to date.

Kronos Worldwide has an expected long-term earnings growth rate of 5%. Its shares have rallied 117.3% year to date.

Zacks Editor-in-Chief Goes "All In" on This Stock

Full disclosure, Kevin Matras now has more of his own money in one particular stock than in any other. He believes in its short-term profit potential and also in its prospects to more than double by 2019. Today he reveals and explains his surprising move in a new Special Report.

Download it free >>

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Westlake Chemical Corporation (WLK): Free Stock Analysis Report

DAQO New Energy Corp. (DQ): Free Stock Analysis Report

ArcelorMittal (MT): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Nvidia is scheduled to release its Q4 earnings report at 4:20PM ET on Wednesday. A call with CEO Jensen Huang is set for 5:00PM ET. The chipmaker’s results will serve as a...

Warren Buffett has always critiqued airline stocks for being overly capital-intensive, exhibiting low growth, and relying heavily on cyclical consumer travel patterns—further...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.