- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

ArcelorMittal Consortium In Talks With EC For Ilva Buyout

ArcelorMittal (NYSE:MT) recently said that the European Commission (EC) has started a Phase II review of AM Investco Italy Srl’s proposed acquisition of Ilva S.p.A. ArcelorMittal will continue to work closely with the EC to elucidate the dynamics of the steel industry, the rationale of the proposed acquisition and its benefits to customers, industry, the local economy and the environment.

ArcelorMittal and its partner Marcegaglia, in June, announced that AM Investco has reached a binding agreement with the Italian government regarding the lease and obligation to purchase Ilva S.p.A.

The transaction details of AM Investco’s plans for Ilva include a purchase price of €1.8 billion, with annual leasing costs of €180 million, which will be paid in quarterly installments. The assets of Ilva’s will be primarily leased by AM Investco against the purchase price, with rental payments qualifying as down payments. The period of lease is minimum two years, which is expected to begin by the end of 2017, subject to regulatory approvals.

Per the deal, investments of €2.4 billion will be made over a period of seven years, including industrial capital expenditure (CAPEX) of €1.3 billion, environmental CAPEX of €1.1 billion. This will ensure Ilva’s compliance with the Integrated Environmental Authorisation (AIA), as recommended by the Italian government.

The deal will systematically increase finished steel shipments to 9.5 million tons by 2023 and crude steel production will be limited to 6 million tons per year, until AIA provisions are complied. The production of crude steel will be supplemented by imported hot rolled coil and slabs to maximize usage of Ilva’s finished steel facilities.

ArcelorMittal believes Ilva would prove to be a good investment without compromising on the strength of its balance sheet. It will provide an opportunity to expand leadership and product offering in Italy, the second-largest steel producing and consuming market in Europe.

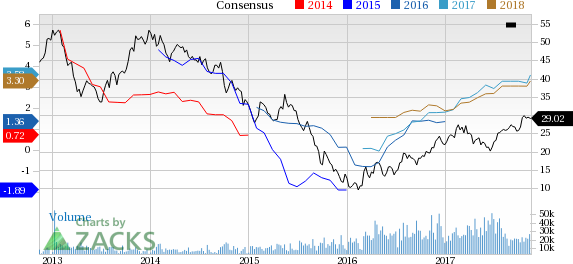

ArcelorMittal’s shares have moved up 13.2% in the past three months, outperforming the industry’s 3.4% growth.

ArcelorMittal logged net income of $1,205 million or $1.18 per share in third-quarter 2017, up from net earnings of $680 million or 67 cents recorded a year ago. Earnings per share topped the Zacks Consensus Estimate of 86 cents.

Revenues went up 21.5% year over year to $17,639 million in the quarter on the back of higher average steel selling prices, higher steel shipments, higher market-priced iron ore shipments and higher seaborne iron ore prices. Sales however, trailed the Zacks Consensus Estimate of $17,895 million.

According to ArcelorMittal, market conditions are favorable and demand environment remains positive along with healthy steel spreads. The company continues to expect global apparent steel consumption to grow in the range of 2.5-3% for 2017.

Zacks Rank & Other Stocks to Consider

ArcelorMittal currently sports a Zacks Rank #1 (Strong Buy).

Some other top-ranked stocks in the basic materials space are Sociedad Quimica y Minera S.A. (NYSE:SQM) , BHP Billiton (LON:BLT) PLC (NYSE:BBL) and Westlake Chemical Corporation (NYSE:WLK) . All three stocks flaunt a Zacks Rank #1. You can see the complete list of today’s Zacks Rank #1 stocks here.

Sociedad Quimica has an expected long-term earnings growth rate of 32.5%.

BHP Billiton has an expected long-term earnings growth rate of 5.3%.

Westlake Chemical has an expected long-term earnings growth rate of 8.4%.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

Westlake Chemical Corporation (WLK): Free Stock Analysis Report

Sociedad Quimica y Minera S.A. (SQM): Free Stock Analysis Report

BHP Billiton PLC (BBL): Free Stock Analysis Report

ArcelorMittal (MT): Free Stock Analysis Report

Original post

Related Articles

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

The big US stocks dominating markets and investors’ portfolios just finished another earnings season. They reported spectacular collective results including record sales, profits,...

“Quality” stocks with strong fundamentals tend to be rewarding places to stash hard-earned money. Since 2009, investing in a basket of quality stocks over a standard index has...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.