- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Applied Industrial Gains From Buyouts Despite Market Woes

We have issued an updated research report on Applied Industrial Technologies, Inc. (NYSE:AIT) on Mar 27.

The company is one of the leading distributors of value-added industrial products — including engineered fluid power components, specialty flow control solutions and miscellaneous industrial supplies. Applied Industrial, with $1.7-billion market capitalization, currently carries a Zacks Rank #3 (Hold).

Factors Favoring Applied Industrial

Acquired Assets: The company has been investing in acquisitions over time. It acquired Sentinel Fluid Controls in March 2017, while bought FCX Performance in February 2018 and Fluid Power Sales in November 2018. Also, Applied Industrial bought MilRoc Distribution and Woodward Steel in March 2019. It acquired Olympus Controls in August 2019.

Notably, acquired assets had a positive impact of 3.2% on the company’s sales in second-quarter fiscal 2020 (ended December 2019). On a segmental basis, buyouts boosted Fluid Power & Flow Control’s sales by 7.6%, and that of Service Center-Based Distribution by 1.2%.

The company expects acquisitions to increase revenues by 2% in fiscal 2020 (ending June 2020).

Rewards to Shareholders: Applied Industrial believes in rewarding shareholders handsomely through dividend payouts. In the first half of fiscal 2020 (ended December 2019), the company distributed dividends of $24 million, reflecting growth of 3.1% from the year-ago period.

It is worth mentioning here that the company announced a hike of 3.2% or one cent per share in its quarterly dividend rate to 32 cents in January 2020. We believe that healthy cash flow will support it to return more value to shareholders in the quarters ahead.

Long-Term Tailwinds: Focus on value-added services, enhancing operational excellence, cost-saving measures and solidifying product lines will benefit Applied Industrial in the long run.

It expects to generate revenues of $4.5 billion by fiscal 2023 (ending June 2023). Organic sales are predicted to grow in mid-single digits, while acquired assets are likely to benefit by $100 million annually.

Factors Working Against Applied Industrial

Top and Bottom-Line Headwinds: The company expects industrial demand to be soft in the near term. It predicts sales to be down 2% to flat in fiscal 2020. Earlier, the company had estimated a decline of 2% to growth of 2% in sales. Organically, sales are estimates to be down 3-5% versus a 1-5% decline mentioned earlier.

Also, the company tweaked its earnings projections to $4.20-$4.40 per share from the previously stated $4.20-$4.50. The new projection suggests a decline from $4.41 reported in fiscal 2019.

High Debts & Forex Woes: High debts increase financial obligations and in turn, hurt profitability. Applied Industrial’s long-term debts increased 46.9% (CAGR) in the last three fiscal years (2017-2019). Exiting second-quarter fiscal 2020, the metric stood at $874.4 million, suggesting a 1.8% increase from the previous quarter’s reported figure. Interest expenses, net, in the quarter were $9.6 million.

For fiscal 2020, the company expects interest expenses at the higher-end of the previously mentioned $37-$38 million.

Additionally, its international presence has exposed it to geopolitical issues, macroeconomic challenges and unfavorable movements in foreign currencies. Forex woes had adverse impacts of 0.1% in the first quarter of fiscal 2020, while were neutral in the second quarter.

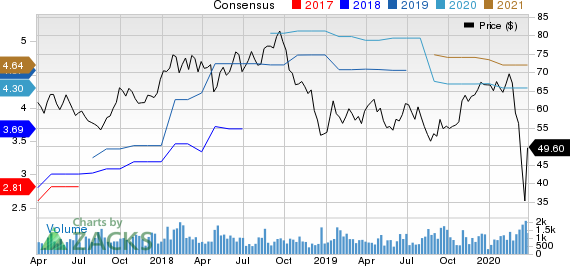

Share Price Performance and Earnings Estimate Revision: Market sentiments have been against Applied Industrial for quite some time now. Its stock price has decreased 25.8% in the past three months compared with the industry’s decline of 24.4%.

Furthermore, the Zacks Consensus Estimate for the company’s earnings has been unchanged at $4.30 for fiscal 2020 in the past 60 days. The estimate reflects a year-over-year decline of 2.5%.

Applied Industrial Technologies, Inc. Price and Consensus

Applied Industrial Technologies, Inc. (AIT): Free Stock Analysis Report

Graco Inc. (GGG): Free Stock Analysis Report

Tennant Company (TNC): Free Stock Analysis Report

Broadwind Energy, Inc. (BWEN): Free Stock Analysis Report

Original post

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.