- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Apple's (AAPL) IPhone X Records Robust Black Friday Sales

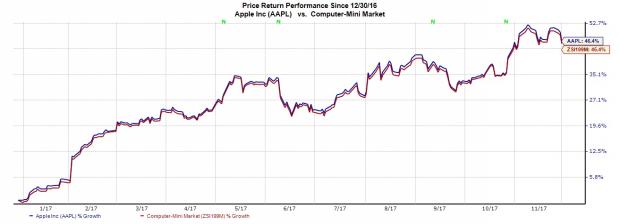

We have always maintained that the power of Apple Inc.’s (NASDAQ:AAPL) loyal customer base should not be underestimated.

StreetInsider has cited a recent report by Rosenblatt China Technology wherein analyst Jun Zhnag said that Apple sold 6 million units of the pricey iPhone X model over the Black Friday weekend alone. Since its launch, iPhone X has sold over 15 million units, added the report.

Moreover, the demand for 256 GB iPhone X, priced at $1,150, was double that of the 64 GB model that costs $1K. The hefty price tag was a concern for many analysts but it seems that is it not going to be a deterrent for consumers. iPhone X production is also ramping up with 3 million units per week produced currently and is expected to increase by another one million by December, per the report.

HP Inc. (HPQ): Free Stock Analysis Report

Groupon, Inc. (GRPN): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Activision Blizzard, Inc (ATVI): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

• Trump’s trade war, U.S. jobs report, and last batch of Q4 earnings will be in focus this week. • Costco's earnings report is seen as a potential catalyst for growth, making it a...

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.