- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Apple Q4 Earnings Reflect China Resurgence And India Boom

Apple Inc.’s (NASDAQ:AAPL) fiscal fourth-quarter 2017 results showed a massive reacceleration in China sales after several quarters of decline.

China Woes

Stiff competition from the likes of cheaper handsets like Oppo, Vivo and Xiaomi primarily affected Apple’s market share and revenues in the region. This sparked off investor concerns as China was (and still remains) vital to Apple’s performance.

China is the biggest market for Apple after the United States and Europe and contributes 16% to 19% of revenues

China Numbers in Details

In the fourth quarter, Apple saw improvement in iPhone, Mac, iPad and Services segment across the region, leading to a 12% increase in revenues to $9.8 billion. This represented 16% of total revenues, after Americas (44%) and Europe (25%).

This was in stark contrast to a decline of 30% witnessed in the year-ago quarter. Also, sales in the region had declined 12%, 14% and 10% in the first, second and third quarters of 2017, respectively.

In the fourth quarter, iPhone shipments registered double-digit growth (driven mostly by iPhone 8 and 8 Plus) while iPad shipments saw 25% rise. Mac and Services segment revenues from the region reached an all-time high per Apple.

Will the Momentum Continue?

We believe iPhone X sales should help to sustain the momentum. However, Chinese handset makers have already upped their ante and are coming up with their own high-end devices.

Per a report by IDC, “Apple's rebound shows there is still pent up demand for iPhones in China.” IDC said there is huge demand for iPhone X in China as it looks very different from the earlier iPhones.

India – Another Big Opportunity

Since last year, Apple has been focused on expanding its footprint in India. The country presents an attractive growth opportunity for the company over the long run, given its younger population and increasing investment in 4G networks. Apple has partnered with Reliance Jio and Bharti Airtel. Also, Apple has set up its first manufacturing unit in Bangalore, Karnataka and teamed up with Wistron Corp. from Taiwan to take care of the assembly of the iPhones, mostly SE models.

This seems to have worked. Apple said it witnessed “great momentum” in India in the fourth quarter, which led a two-fold rise in revenues. iPhone shipments increased in double digits, similar to other markets like mainland China, the Middle East, Central and Eastern Europe, Mexico. iPad unit sales grew 39% in the quarter.

Apple remains keen on India as it is predicted to become the second largest smartphone market. Apple, at present, holds only about 2% of the market and there is huge scope for expansion.

Zacks Rank & Stock Price Movement

Currently, Apple carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

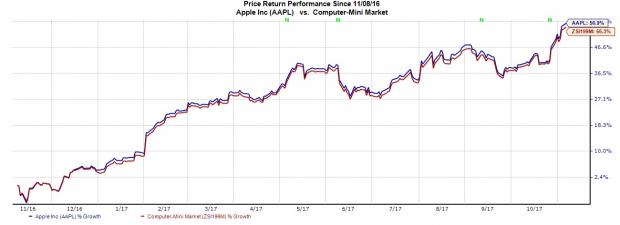

The company’s shares marginally outperformed the broader market in the past year. The stock registered growth of 56.9% compared with the industry’s gain of 55.3%.

Stocks to Consider

Top-ranked stocks in the broader technology sector include NVIDIA Corporation (NASDAQ:NVDA) Applied Materials (NASDAQ:AMAT) , and Jabil Inc (NYSE:JBL) . While NVIDIA and Jabil sport a Zacks Rank #1, Applied Materials carries a Zacks Rank#2 (Buy).

Long-term earnings growth rate for NVIDIA, Applied Materials and Jabil is currently projected to be 11.2%, 17.1% and 12%, respectively.

Zacks' Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but selected members of our portfolio services. Would you like to peek behind the curtain today and view them?

Starting now, for the next month, I invite you to follow all Zacks' private buys and sells in real time from value to momentum...from stocks under $10 to ETF to option movers...from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors.

Click here for Zacks' secret trade>>

Apple Inc. (AAPL): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Jabil Circuit, Inc. (JBL): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Tesla (NASDAQ:TSLA) (NYSE: TSLA), the electric vehicle giant, has recently experienced a significant drop in its stock value, which has fallen nearly 45% since December. This...

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.