- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Apple Kicks Off New Year on Wrong Foot: Can iPhone 16, Vision Pro Turn the Tide?

- Apple's stock had a strong 2023 but faced challenges in the new year with a 3.58% drop triggered by Barclays' downgrade and patent disputes affecting Apple Watch sales.

- Despite underwhelming iPhone sales, Apple maintains a solid fundamental position, with effective resource utilization.

- Technical analysis suggests a critical support level at $180 and resistance at $195-$200. A break below the former level can trigger a move toward $165.

- Looking to beat the market in 2024? Let our AI-powered ProPicks do the leg work for you, and never miss another bull market again. Learn More »

In 2023, Apple (NASDAQ:AAPL) stock had a strong performance, finishing the year at $192.53, marking a significant 48% gain from 2022.

However, it's important to note that this boost in stock value wasn't entirely backed by the company's financial performance throughout the year.

Now, as other more punctual problems come together with the Cupertino-California giant's performance, the question preying on investors' minds is: Can the company keep outperforming in 2024?

Let's take a deep dive into its financials to better understand where we stand.

New Year Brings New Troubles for Apple

The onset of the new year brought a decline in AAPL share value, spurred by unfavorable comments about the company. On the first trading day of the year, Apple stock experienced a 3.58% drop, triggered by Barclays' pessimistic remarks.

Barclays downgraded the company, expressing concerns about decelerating iPhone 15 sales in China and forecasting further weakening sales with minimal advancements expected in the upcoming iPhone 16 release.

Adding to Apple's challenges, a patent dispute emerged, questioning whether the blood oxygen sensor in Apple's Apple Watch infringed on Masimo's (NASDAQ:MASI) patented technology.

The International Trade Commission, in a recent development, advocated for a ban on importing the watches, leading to the removal of the products from shelves.

However, the Federal Court of Appeals somewhat alleviated the crisis by permitting Apple to continue selling the watches.

Returning to concerns regarding iPhone sales, recent quarterly results indicate that the iPhone constitutes 49% of Apple's overall sales.

With lackluster iPhone sales in 2023 and pessimistic expectations for 2024, apprehensions about the company facing a challenging year ahead have started to mount.

Fundamental View

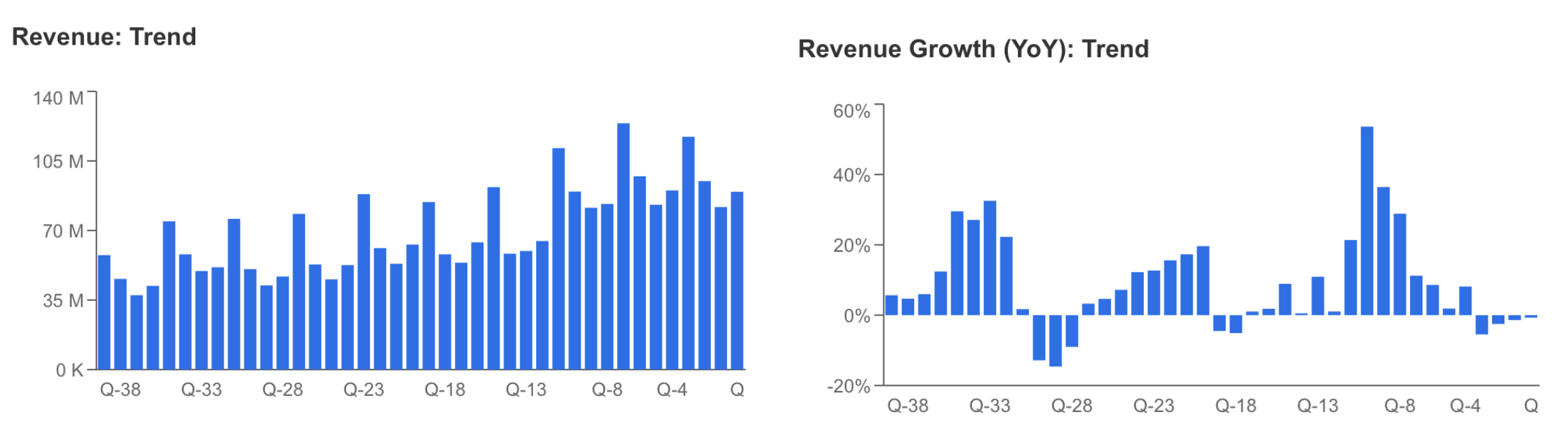

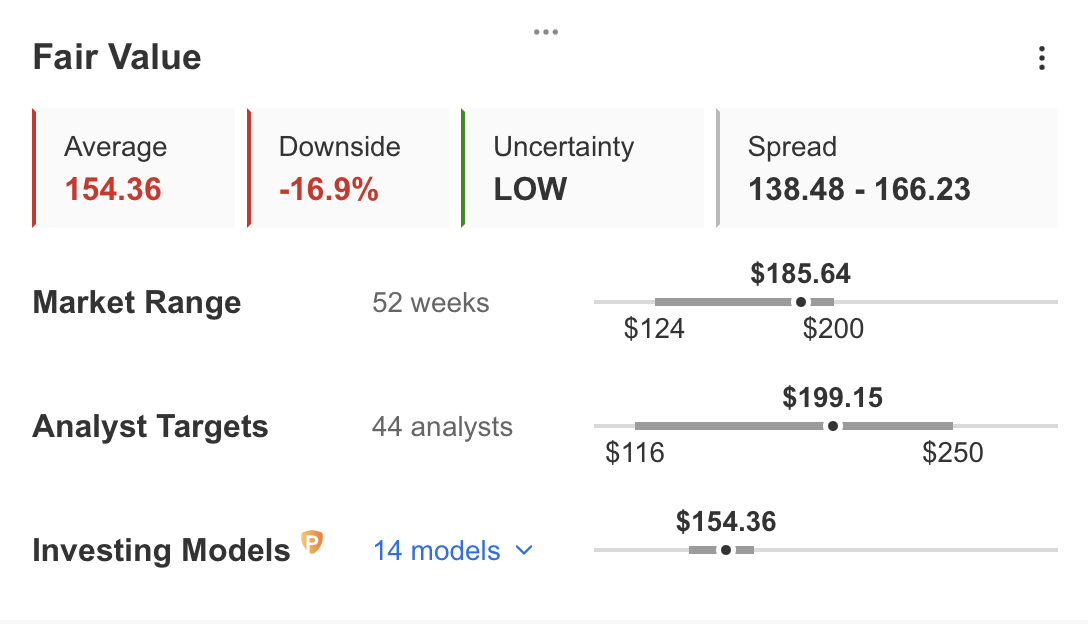

The underperformance of Apple's iPhone in meeting sales expectations throughout 2023 hurt revenue, resulting in a decline across the quarters of the year.

Throughout 2023, Apple's service products contributed to revenue, but not as much as expected as this segment accounted for only a quarter of total revenue. So how did the nearly 3% year-over-year decline in revenue affect profits?

The company managed to utilize its resources effectively throughout the year while maintaining its gross margin. Accordingly, earnings per share were $6.12 for the year, according to the latest quarterly report.

Source: InvestingPro

Thus, Apple managed to maintain the EPS amount of $ 6.11 in 2022. Nevertheless, there is a risk that the lack of revenue growth in 2024 will also negatively affect profitability.

So much so that the reaction to Barclays' rating can be considered an important indicator of this.

Source: InvestingPro

Vision Pro, iPhone 16 to Turn Things Around?

However, Apple, the world's largest company, may be back on the offensive as a technology giant with the potential to reverse expectations in 2024.

This could start with Vision Pro, which Apple plans to launch in February. If Vision Pro takes off, the company will be at the forefront of the next generation of computing devices.

On the other hand, the resurgence of iPhone sales will also have a significant impact on Apple.

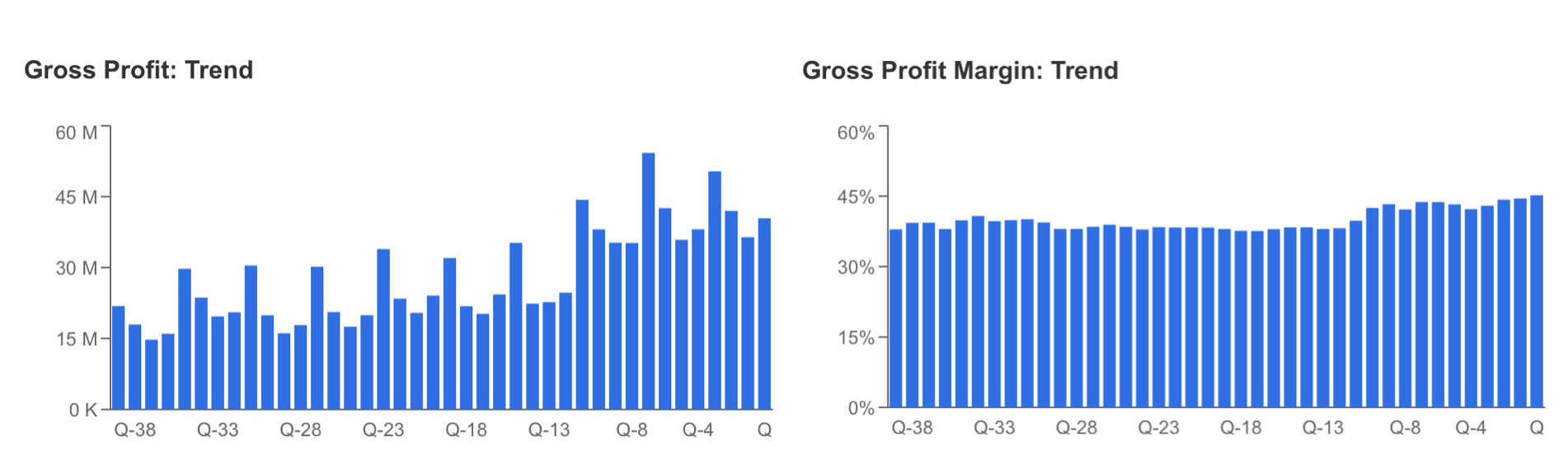

Before the financial earnings report expected to be announced on January 25th, it is expected that EPS will be announced as $ 2.1, down 6%, and quarterly revenue is expected to be announced as $ 118.2 billion, down 10% compared to last year.

13 analysts revised their forecast for Apple downwards, while 12 analysts revised it upwards. This shows that investors have mixed thoughts about Apple.

Source: InvestingPro

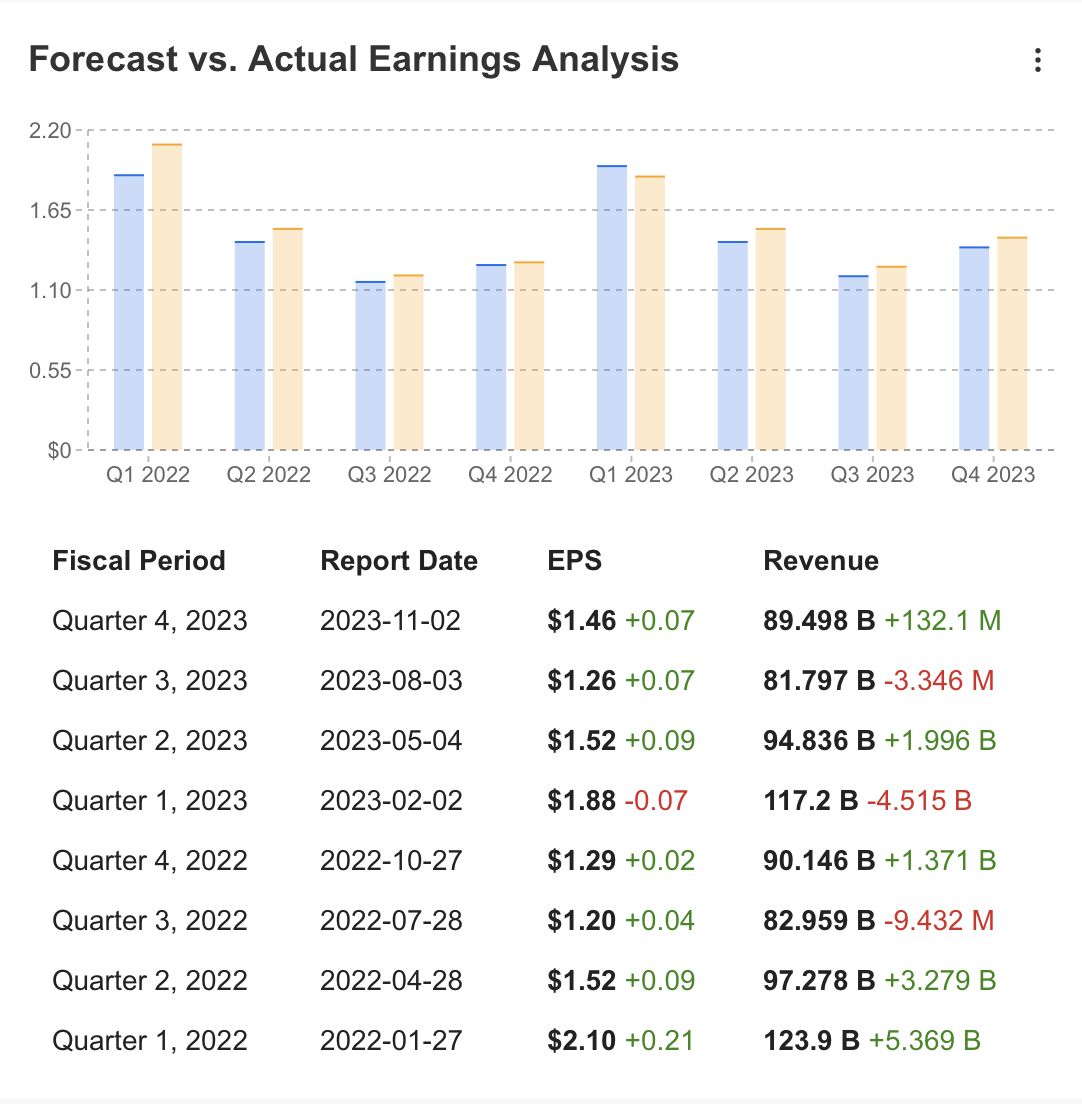

If we check the fair value of AAPL stock according to the latest financial data, we can talk about the negative impact of financial results on the price forecast.

So much so that InvestingPro fair value analysis shows that AAPL could see a 16.4% correction during the year, dropping as low as $154, according to a calculation based on 14 financial models.

The consensus estimate of 44 analysts is that the stock could reach a value close to $ 200.

Source: InvestingPro

This result can be interpreted as the preservation of the expectation that the company can take off again in 2023 despite the below-expected performance.

According to the latest data of the company, we can also examine its financial health through InvestingPro.

When we look at it, we can see that while profitability continues in very good condition, growth, and cash flow items remain in good condition with the price momentum of the stock.

Technical View

After gaining a significant upward momentum in the first quarter of 2023, AAPL stock followed a volatile course in the second half of the year.

Source: InvestingPro

AAPL stock experienced a correction in the July-October period, retracing partially and establishing a technically bullish outlook for the future, finding support in the $160 range.

Based on the 2023 price action, during the last recovery, the stock faced resistance in the $190-$200 range. With recent negative developments, a retest to the support zone in the $180-$185 range ensued.

If the support zone holds this week, the resistance area of $195-$200 could resurface in the coming days.

A successful breach might propel AAPL towards targets of $210-$220-$237 in the first half of the year. Conversely, weekly closes below $180 could shift the outlook negatively, potentially pulling the share price back to the main support point at $165.

Examining the weekly chart, the Stochastic RSI indicator is on the verge of generating a bearish signal, descending from the overbought zone. Therefore, maintaining the $180 support level is crucial to impede an acceleration in the decline.

***

In 2024, let hard decisions become easy with our AI-powered stock-picking tool.

Have you ever found yourself faced with the question: which stock should I buy next?

Luckily, this feeling is long gone for ProPicks users. Using state-of-the-art AI technology, ProPicks provides six market-beating stock-picking strategies, including the flagship "Tech Titans," which outperformed the market by 670% over the last decade.

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.

Related Articles

The big US stocks dominating markets and investors’ portfolios just finished another earnings season. They reported spectacular collective results including record sales, profits,...

“Quality” stocks with strong fundamentals tend to be rewarding places to stash hard-earned money. Since 2009, investing in a basket of quality stocks over a standard index has...

Palantir Technologies (NASDAQ:PLTR) continues to sell off. On March 6, PLTR stock fell over 10% on nearly double the daily volume, bringing its 30-day decline to over 27%. A drop...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.