- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Fed Questions Deutsche Bank (DB) For 'Bad Bank' Proposal

Per a Financial Times article, Deutsche Bank (DE:DBKGn) (NYSE:DB) is being questioned by the U.S. regulators related to the impact on the German Bank’s U.S. operations after implementation of its “bad bank” proposal. The U.S. Federal Reserve officials demand details of the bank’s strategic plan which involves cutting down its investment banking operations.

Notably, following the failure of the annual stress test last year, the U.S. unit of the German bank is deprived off providing any payments to its parent company in Germany without Fed permission. For failure of the test, Fed said “widespread and critical deficiencies” in the bank’s capital planning.

Though Deutsche Bank’s U.S. arm has cleared the first round of stress tests 2019, the second round results to be reported later this week will decide the rescinding of restrictions on the bank.

The Expected Proposal

Under the proposals, Deutsche Bank is mulling to make cutbacks in the U.S. equities trading business, including prime brokerage and equity derivatives. The bank would create a ‘bad bank’, a measure used by failed U.K. banks post the 2008 financial crisis.

The newly-formed unit would hold tens of billions of Euros of assets worth around €50 billion as the bank’s chief executive officer (CEO) Christian Sewing is trimming its investment banking division. This includes Sewing’s plans to shrink or shut down the equity and rates trading businesses outside continental Europe completely, and focus on the core transaction banking and private wealth management business.

The German bank’s planned divestiture of the assets is unlikely to hit its profit or capital due to the non-toxic nature. However, better-performing bond trading business and currency-trading operation will be retained by the bank.

The proposed changes are expected to be announced with the bank’s six-month results in the second half of July.

“As we said at the AGM on 23 May, Deutsche Bank is working on measures to accelerate its transformation so as to improve its sustainable profitability. We will update all stakeholders if and when required,” Deutsche Bank noted in an e-mailed statement.

Our Viewpoint

Deutsche Bank is under pressure to trim its investment banking division, following the collapse of merger talks with domestic rival Commerzbank (DE:CBKG). Though Deutsche Bank’s restructuring efforts, including cost-saving measures, look encouraging, it is difficult to determine how much the bank will gain, considering the prevalent headwinds. Furthermore, dismal revenue performance is another concern.

Deutsche Bank currently carries a Zacks Rank #4 (Sell).

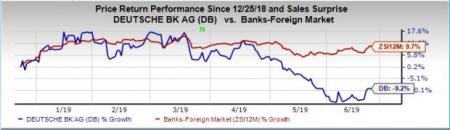

Shares of Deutsche Bank have lost around 9.2% on the NYSE, in the last six months, as against the industry’s growth of 9.7%.

Stocks to Consider

HSBC Holdings (LON:HSBA) plc (NYSE:HSBC) has been witnessing upward estimate revisions for the past 60 days, with the company’s shares surging nearly 1.8% on the NYSE, in six months’ time. It sports a Zacks Rank of 1 (Strong Buy), at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

DBS Group Holdings Ltd (OTC:DBSDY) has been witnessing upward estimate revisions for the past 60 days. Over the past six months, this Zacks #1 Ranked company’s shares have been up more than 12% on the NYSE.

Banco Latinoamericano de Comercio Exterior, S.A. (NYSE:BLX) has been witnessing upward estimate revisions for the past 60 days. In the past six months, this Zacks Rank #1 company’s shares have been up more than 27% on the NYSE.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>>

HSBC Holdings plc (HSBC): Free Stock Analysis Report

DBS Group Holdings Ltd (DBSDY): Free Stock Analysis Report

Deutsche Bank Aktiengesellschaft (DB): Free Stock Analysis Report

Banco Latinoamericano de Comercio Exterior, S.A. (BLX): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Emini S&P March collapsed on Thursday from strong resistance at 6010/6015The low and high for the last session were 5873 - 6014.(To compare the spread to the contract you...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.