- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

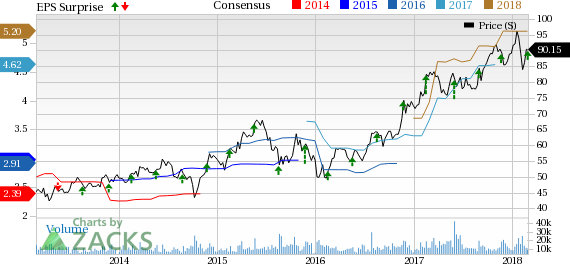

Analog Devices (ADI) Q1 Earnings Beat, Guidance Impressive

Analog Devices Inc. (NASDAQ:ADI) reported first-quarter fiscal 2018 adjusted earnings of $1.42 per share, beating the Zacks Consensus Estimate by 13 cents. Although the bottom line surged 51.1% year over year, it declined 2.1% sequentially. However, the figure surpassed the guided range of $1.20-$1.36.

Revenues of $1.52 billion topped the consensus mark of $1.50 billion and came close to the higher end of the guided range of $1.44-$1.54 billion. Moreover, the top line surged 54.3% year over year but declined 1.5% sequentially.

The strong year-over-year growth was driven by a robust performance from industrial, automotive and communications end-markets.

Revenues by End Markets

Industrial (49% of total revenues) revenues soared 87.4% year over year and 4% sequentially to $743.6 million.

Communications (18.7% of total revenues) revenues surged 63% year over year and 4.1% sequentially to $284.3 million.

Automotive (16.6% of total revenues) revenues jumped 76.4% from the year-ago quarter and 5.1% from the previous quarter to $252.2 million.

Consumer (15.7% of total revenues) revenues declined 11.8% year over year and 23.8% sequentially to $238.5 million.

Operating Details

Non-GAAP gross margin expanded 500 bps on a year-over-year basis and 20 bps sequentially to 71%.

Adjusted operating expenses as percentage of revenues declined 180 bps from the year-ago quarter but increased 110 bps sequentially to 29.4%.

Non-GAAP operating margin expanded 670 bps on a year-over-year basis but contracted 90 bps sequentially to 41.7%.

Balance Sheet & Cash Flow

Analog Devices exited the first quarter with cash and short-term investments of approximately $827.6 million, down from $1.05 billion at the end of the prior quarter.

Long-term debt was approximately $7.38 billion, down from $7.55 billion at the end of the previous quarter.

Net cash provided by operations was $388.7 million, significantly down from $707.4 million reported in the preceding quarter.

Guidance

For the second quarter of fiscal 2018, Analog Devices expects revenues between $1.43 billion and $1.51 billion. The Zacks Consensus Estimate stands at $1.45 billion.

On a non-GAAP basis, the company estimates gross margin in the range of 71-71.5%. Operating expenses are anticipated between $430 million and $440 million.

Analog Devices projects interest and other expense of approximately $60 million.

Earnings are expected in the band of $1.30-$1.44 per share. The consensus mark for the same is pegged at $1.24.

Zacks Rank & Stocks to Consider

Analog Devices holds a Zacks Rank #3 (Hold).

Better-ranked stocks in the broader technology sector include NVIDIA (NASDAQ:NVDA) , Intel (NASDAQ:INTC) and ON Semiconductor (NASDAQ:ON) . While NVIDIA sports a Zacks Rank #1 (Strong Buy), both Intel and ON Semiconductor has Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for NVIDIA, Intel and On Semiconductor is projected at 10.25%, 8.42% and 12.23%, respectively.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Intel Corporation (INTC): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Analog Devices, Inc. (ADI): Free Stock Analysis Report

ON Semiconductor Corporation (ON): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Nvidia is scheduled to release its Q4 earnings report at 4:20PM ET on Wednesday. A call with CEO Jensen Huang is set for 5:00PM ET. The chipmaker’s results will serve as a...

Warren Buffett has always critiqued airline stocks for being overly capital-intensive, exhibiting low growth, and relying heavily on cyclical consumer travel patterns—further...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.