- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Analog Devices (ADI) And Wal-Mart (WMT): Growth & Income Stocks

Analog Devices (NASDAQ:ADI) has had an impressive year as they beat both top and bottom line expectations for the 13th consecutive quarter. But this most recent quarter was one of the most impressive as revenues grew by +54% year over year with EPS growth of +38%. Further, the company now controls about +10% of the $40 billion world’s market share in the analog segment.

Outside of internal innovation, the company has recently made two key acquisitions that have already begun to positively impact both the top and bottom lines. In June, Analog acquired Hittite Microwave Corp (HITT) to complement its Radio Frequency (RF) and signal conversion expertise. Then in July, management announced the acquisition of Linear Technology (NASDAQ:LLTC) to increase its presence and portfolio of products in the industrial, communications infrastructure, and automotive sectors.

In order to integrate these two new companies within Analog, the board of directors hired a new CFO, Prashanth Mahendra-Rajah. Prashanth has a solid track record in finance and integration experience. Outside of the integration, he has stated that he is also focused on both operational and spending discipline especially within the engineering segment.

Mr. Mahendra-Rajah’s leadership has already begun to pay dividends for the company and its shareholders, as management increased both earnings and revenue estimates for the next quarter, and is now expecting long-term EPS growth between 8-15%. Another tailwind for the company is the continuation of high demand for semiconductors and analog devices.

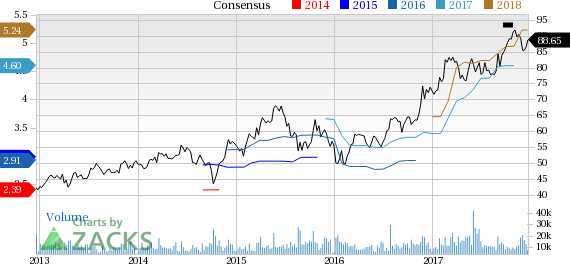

This sustained success can be seen in the company’s Price and Earnings Consensus graph below. As you can see the stock price has been on an uptick since the beginning of 2016, and annual earnings estimates have risen as well.

Wal-Mart Stores, Inc. (WMT): Free Stock Analysis Report

Analog Devices, Inc. (ADI): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.