- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Home Improvement Stocks' Q3 Earnings On Oct 26: LEG & MHK

The Consumer Discretionary sector, which covers major home furnishing companies, is likely to see a 1.7% drop in earnings this quarter compared to 4.7% growth last quarter. Revenues are expected to rise 2.9%, lower than last quarter’s 8.8%.

This sector, which is ranked among the bottom 38% (10 out of 16) of all Zacks sectors, has been facing challenges like volatile commodity prices, changing consumer spending patterns and adverse currency fluctuations. Nevertheless, rising consumer confidence on the back of a steady housing sector is a major positive.

Notably, home furnishing companies like Home Depot Inc (NYSE:HD) , Lowe’s Companies, Inc. (NYSE:LOW) and Lumber Liquidators Holdings Inc’s (NYSE:LL) have seen a rally in their shares post the hurricane mayhem. As home owners have faced damaged properties, rebuilding efforts have ramped up. This in turn has driven demand for home-improvement equipment and materials.

However, the hurricanes might adversely affect results of such companies in the third quarter owing to disruptions in demand and supply chains. Nevertheless, increased demand of home improvement products will largely benefit these companies.

All said, let’s see what awaits the following stocks that are queued up for third-quarter 2017 earnings release on Oct 26.

Leggett & Platt, Incorporated (NYSE:LEG) is exposed to substantial volatility in raw material prices, with steel being one of the company’s key raw materials and the market for the same being cyclical in nature. Incidentally, the company’s bottom line has declined year over year for three straight quarters now, owing to inflation in raw material price. In the last quarter, earnings and EBIT fell 3% and 7.4% year over year, respectively, due to higher steel price.

The current Zacks Consensus Estimate for the quarter under review is pegged at 62 cents, which represents an 8.1% decline from the year-ago figure. Earnings estimates have been stable over the last 30 days. Further, analysts polled by Zacks expect revenues of $1,010 million, up 6.5% from the year-ago quarter.

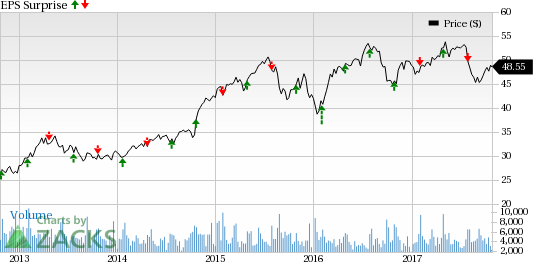

Leggett & Platt, Incorporated Price and EPS Surprise

The company’s third-quarter performance is likely to be affected by the recent hurricanes, which have resulted in considerable demand and supply disruption. Also, increased raw material costs, start-up expenses and currency headwinds continue to raise concerns.

For the third quarter, the Zacks Consensus Estimate for earnings stands at $3.74, reflecting an increase of 6.7% year over year. The Zacks Consensus Estimate for revenues is pegged at $2.46 billion, up 6.4% from the year-ago quarter.

(Read more: Will Hurricanes Dent Mohawk’s Q3 Earnings Performance?)

Zacks' Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but selected members of our portfolio services. Would you like to peek behind the curtain today and view them?

Starting now, for the next month, I invite you to follow all Zacks' private buys and sells in real time from value to momentum...from stocks under $10 to ETF to option movers...from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors.

Click here for Zacks' secret trade>>

Home Depot, Inc. (The) (HD): Free Stock Analysis Report

Lowe's Companies, Inc. (LOW): Free Stock Analysis Report

Lumber Liquidators Holdings, Inc (LL): Free Stock Analysis Report

Leggett & Platt, Incorporated (LEG): Free Stock Analysis Report

Mohawk Industries, Inc. (MHK): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Emini S&P March collapsed on Thursday from strong resistance at 6010/6015The low and high for the last session were 5873 - 6014.(To compare the spread to the contract you...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.