- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Aon Plc's (AON) Q3 Earnings Beat Estimates, Increase Y/Y

Aon plc’s (NYSE:AON) third-quarter 2017 adjusted operating earnings of $1.29 surpassed the Zacks Consensus Estimate by 1.6%. Earnings also increased 18% from the year-ago quarter.

Adjusted margin, adjusted for certain items, increased 170 basis points to 20.3%.

Operational Update

Aon’s total revenues grew 6% to $2.3 billion in the third quarter and also surpassed the Zacks Consensus Estimate by 0.4%. The year-over-year increase in revenues was supported by 2% organic revenue growth and a 3% increase related to acquisitions, net of divestitures and 1% favorable impact from foreign currency translation.

Operating expenses increased 13% year over year to $2.1 billion in the third quarter. The deterioration stemmed primarily from $102 million of restructuring costs, $62 million rise in operating expenses related to acquisitions, net of divestitures, $54 million of accelerated amortization related to trade names, a $16 million unfavorable impact from foreign currency translation, $10 million of transaction related costs associated with recent acquisitions and an increase in expense related to the organic revenue growth. These factors were partially offset by $55 million of savings related to restructuring and other operational improvement initiatives.

Organic Revenue Drivers

Commercial Risk Solutions: Organic revenues decreased 1% year over year due to a decline across the Americas, particularly in U.S. retail and Latin America owing to certain unfavorable timing. This was, however, partially offset by solid growth across the EMEA and Pacific regions.

Reinsurance Solutions: Organic revenues increased 7% from the prior-year quarter on the back of solid growth across all the major product lines, especially in treaty placements driven by record new business generation. The improvement was partially offset by a modest unfavorable market impact in the Americas.

Retirement Solutions: Organic revenues grew 5% from the prior-year period, driven by continued improvement in investment consulting and growth in Aon’s talent practice for compensation surveys and benchmarking services

Health Solutions: Organic revenues rose 2% year over year owing to solid growth globally in health & benefits brokerage, especially in the United States and Latin America. The upside was partially offset by a decline in project related work in the healthcare exchange business.

Data & Analytic Services: Organic revenues climbed 3% from the prior-year period driven by strong growth across Affinity, particularly in the United States.

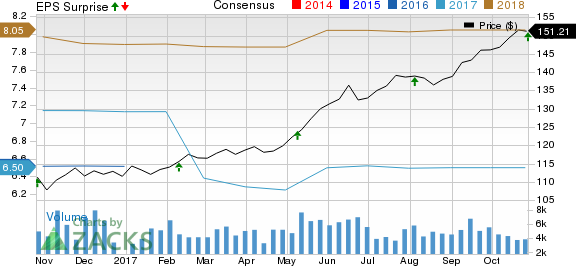

Aon plc Price, Consensus and EPS Surprise

Financial Position

Cash flow from operations for the first nine months of 2017 decreased 75% to $289 million year over year. The decline primarily reflects cash tax payments related to the divestiture of its outsourcing businesses in the second quarter, $199 million of cash restructuring charges and $45 million of transaction related costs, partially offset by operational improvement.

Free cash flow decreased 84% to $164 million for the first nine months of 2017 compared with the prior-year period, reflecting a decline in cash flow from operations and a $18 million increase in capital expenditures.

Share Repurchase and Dividend Update

Weighted average diluted shares outstanding decreased 13% year over year to 257.3 million in the third quarter.

The company repurchased 5.4 million Class A Ordinary shares for approximately $750 million in the quarter.

In October 2017, the company declared a quarterly cash dividend of 36 cents per share payable on Nov 15, to shareholders on record as of Nov 1.

Business Update

Aon has inked a deal to acquire The Townsend Group which is a leading global real estate and investment management firm. The buyout is likely to bring greater depth of expertise in real estate assets. It will strengthen Aon's distribution scale and increase its ability to provide more attractive alternative private market assets to clients.

The company has also signed an agreement to take over Unirobe Meeùs Groep in the Netherlands. This acquisition is expected to bolster Aon's position as the leading insurance broker and risk advisor in all business-to-business market segments in the country.

Zacks Rank and Performance of Other Insurers

Aon presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Among other insurers that have reported their third-quarter earnings so far, Brown & Brown, Inc. (NYSE:BRO) , RLI Corp. (NYSE:RLI) and The Progressive Corporation (NYSE:PGR) beat their respective Zacks Consensus Estimate.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Aon PLC (AON): Free Stock Analysis Report

Brown & Brown, Inc. (BRO): Free Stock Analysis Report

RLI Corp. (RLI): Free Stock Analysis Report

Progressive Corporation (The) (PGR): Free Stock Analysis Report

Original post

Related Articles

Since the Robotaxi event on October 11th, Tesla (NASDAQ:TSLA) stock is up 38%, currently priced at $291.60 per share This is a return to the early November 2024 price level. But...

The Q4 2024 earnings season tapers off from here, with S&P 500® EPS growth surpassing 17%, the highest in 3 years Large cap outlier earnings dates this week include:...

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.