- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Caterpillar (CAT) Surges On Q3 Earnings Beat & Guidance Hike

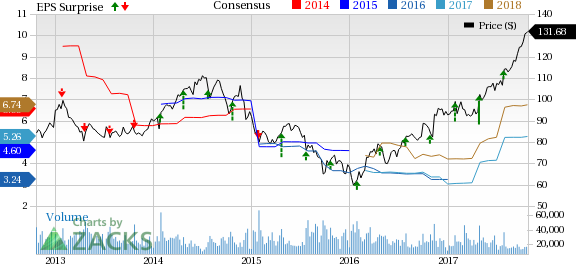

Caterpillar Inc.’s (NYSE:CAT) shares advanced 6.47% in pre-market trading as it delivered another upbeat quarter with adjusted earnings per share surging 129% year over year to $1.95 in third-quarter 2017. Earnings also beat the Zacks Consensus Estimate of $1.22 by a wide margin of 60%. The better-than-expected performance can be attributed to surprisingly strong demand for its construction equipment in North America, robust sales in China as well as improvement in other markets and disciplined cost-control efforts. The mining and construction equipment behemoth also hiked 2017 guidance, citing strength in a number of industries and regions.

Including one-time items, Caterpillar reported earnings per share of $1.77 in the quarter, up 269% from 48 cents in the prior-year quarter.

Revenues

Revenues improved 24.6% year over year to $11.4 billion in the quarter, surpassing the Zacks Consensus Estimate of $10.6 billion. The company witnessed higher sales volume owing to improved end-user demand, favorable changes in dealer inventories and favorable price realization. The improvement in end-user demand was noted across all regions and most end markets. The favorable change in dealer inventories was primarily due to a decrease during the prior-year quarter.

In Machinery Energy & Transportation, Caterpillar witnessed a 31% rise in Asia Pacific driven by increase in construction equipment sales particularly in China resulting from increased infrastructure and residential investment. Revenues increased 27% in North America (Caterpillar’s biggest market) on the back of higher end-user demand for both equipment and aftermarket parts, as well as favorable changes in dealer inventories. Sales in Latin America rose 24% thanks to improved end-user demand as a result of stabilizing economic conditions in several countries in the region. Sales in EAME surged 22% owing to favorable impact of changes in dealer inventories.

Costs & Operating Profit

In the reported quarter, cost of sales increased 17% year over year to $7.6 billion. Gross profit rose 44% to $3.8 billion. Selling, general and administrative (SG&A) expenses increased 25% to $1.24 billion. Research and development (R&D) expenses remained flat at $455 million.

Variable manufacturing costs were lower in the quarter due to the favorable impact from cost absorption as inventory rose in third-quarter 2017 due to higher production volumes. Notably, it was near flat in the prior-year quarter. Increases in steel prices drove higher material costs Period costs were higher primarily due to higher short-term incentive compensation expense.

Adjusted operating profit improved 76% year over year to $2.09 billion. Higher sales volume, favorable price realization and lower variable manufacturing costs were offset by higher period costs.

The ME&T segment reported an operating profit of $1.51 billion, a massive 312% jump from the year-ago quarter. At the Energy & Transportation segment, operating profit improved 31% to $750 million due to higher sales volume and lower variable manufacturing costs, partially offset by higher period costs.

The Resource Industries reported operating profit of $226 million in the quarter compared with the $366 million loss incurred in the prior-year quarter thanks to higher sales volume and lower variable manufacturing costs. Construction Industries’ profit soared 171% to $884 million due to favorable price realization and higher sales volume, that were somewhat offset by unfavorable period costs.

Financial Products’ revenues inched up 3% to $774 million. Financial Products' profit was $185 million in the quarter up from $183 million in the prior-year quarter.

Financial Position

Caterpillar ended the third quarter with cash and short-term investments of $9.59 billion, up from $7.17 billion at 2016 end. The debt-to-capital ratio at ME&T was 36.1% as of Sep 30, 2017, lower than 38.6% as of Jun 30, 2017, and within the company’s target range of 30-45%. Operating cash flow at ME&T was at $600 million in the quarter.

Backlog

At the end of third-quarter 2017, Caterpillar’s backlog was at $15.4 billion, up from $14.8 billion at second quarter end. The $600 million sequential increase was driven by a $500 million increase in backlog in Construction Industries, a $300 million rise in Resource Industries that were offset by a $200 million decline in Energy & Transportation's backlog. On a year-over-year basis, order backlog improved by about $3.8 billion driven by improvement across all segments, particularly in Construction and Resource Industries.

Guidance

Given the upbeat third-quarter performance, Caterpillar has hiked revenue guidance to the range of $44 billion from the prior range of $42-$44 billion. The company now projects earnings per share of $6.25 compared with previous guidance of $5.00 per share. In 2017, restructuring costs will be around $1.3 billion, up from the prior expectation of $1.2 billion.

Caterpillar noted strength across a number of industries and regions, including construction in China, on-shore oil and gas in North America. Further, increased capital investments by mining customers also bode well. The company is now increasing production levels to satisfy customer demand for those markets that have improved.

Year to date, the Caterpillar stock has outperformed the industry it belongs to. The company has delivered a return of 42%, while the industry gained 40.5%.

Zacks Rank & Other Key Picks

Caterpillar currently carries a Zacks Rank #2 (Buy).

Other top-ranked stocks worth considering in the same sector include Barnes Group Inc. (NYSE:B) , Graco Inc. (NYSE:GGG) and Lakeland Industries, Inc. (NASDAQ:LAKE) . All three stocks flaunt a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Barnes Group has an expected long-term earnings growth rate of 9%.

Graco has an expected long-term earnings growth rate of 10.5%.

Lakeland Industries has an expected long-term earnings growth rate of 10%.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Caterpillar, Inc. (CAT): Free Stock Analysis Report

Graco Inc. (GGG): Free Stock Analysis Report

Barnes Group, Inc. (B): Free Stock Analysis Report

Lakeland Industries, Inc. (LAKE): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Emini S&P March collapsed on Thursday from strong resistance at 6010/6015The low and high for the last session were 5873 - 6014.(To compare the spread to the contract you...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.