- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

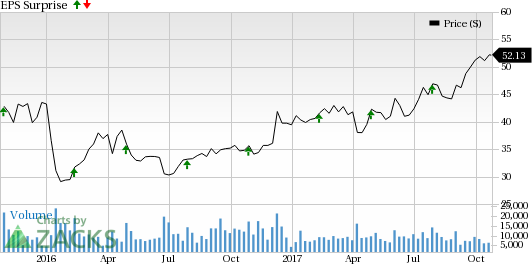

BorgWarner (BWA) To Report Q3 Earnings: What's In Store?

BorgWarner Inc. (NYSE:BWA) is set to release third-quarter 2017 results, before the market opens on Oct 26.

Last quarter, the company delivered a positive earnings surprise of 7.9%. In fact, the company delivered a positive earnings surprise in each of the trailing four quarters, with an average beat of 4.7%.

Let’s see how things are shaping up for the upcoming announcement.

Factors at Play

BorgWarner expects third-quarter 2017 earnings per share in the range of 84-87 cents, higher than 78 cents earned in third-quarter 2016. Organic net sales growth for the quarter is projected in the 3-6% band.

For 2017, the company projects net sales of around $9.28-$9.38 billion compared with the previous expectation of $8.81-$9.04 billion, reflecting an organic growth rate of 6.5-7.5%. The company expects a $100 million negative impact from foreign currencies due to depreciation of the euro, yuan and pound.

A healthy balance sheet and ample cash flow will help BorgWarner return capital to its shareholders. These efforts are likely to positively impact its earnings per share. Also, the company is poised to benefit from its expansion strategy.

Earnings Whispers

Our proven model does not conclusively show that BorgWarner will beat estimates this quarter, as it does not have the right combination of two key ingredients.

Zacks ESP: BorgWarner has an Earnings ESP of 0.00% as both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at 87 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: BorgWarner currently carries a Zacks Rank #2 (Buy). Note that stocks with a Zacks Rank #1 (Strong Buy), 2 or 3 (Hold) have a significantly higher chance of an earnings beat.

Conversely, Sell-rated stocks (Zacks Rank #4 or 5) should never be considered going into an earnings announcement.

Stocks to Consider

Here are a few other stocks in the auto industry you may consider as our model shows that they have the right combination of elements to post an earnings beat this quarter.

Dorman Products, Inc. (NASDAQ:DORM) has an earnings ESP of +3.05% and carries a Zacks Rank #3. The company is expected to report third-quarter 2017 financial results on Oct 27. You can see the complete list of today’s Zacks #1 Rank stocks here.

Horizon Global Corporation (NYSE:HZN) has an earnings ESP of +5.82% and carries a Zacks Rank #3. The company’s third-quarter 2017 results are expected to release on Oct 31.

Magna International Inc. (NYSE:MGA) has an earnings ESP of +1.91% and carries a Zacks Rank #2. The company’s third-quarter 2017 financial results are expected to release on Nov 9.

Today’s Stocks from Zacks’ Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

BorgWarner Inc. (BWA): Free Stock Analysis Report

Magna International, Inc. (MGA): Free Stock Analysis Report

Horizon Global Corporation (HZN): Free Stock Analysis Report

Dorman Products, Inc. (DORM): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.