- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Amphenol (APH) Hits 52-Week High On Bullish Growth Trends

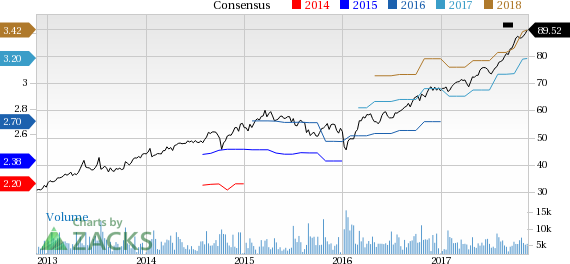

Shares of diversified electronics manufacturer Amphenol Corporation (NYSE:APH) scaled a new 52-week high of $89.72 during Friday’s trading session, before closing a tad lower at $89.52 for a healthy year-to-date return of 29.1%. Barring minor hiccups, Amphenol’s share price has steadily been on an uptrend since early July. This Zacks Rank #2 (Buy) stock has the potential for further price appreciation with long-term earnings growth expectation of 10.2%.

Growth Drivers

Amphenol’s top-line growth is benefiting from improved end-market demand, new product rollouts and market share gains. Demand continues to be strong in automotive, industrial and military markets. The diversification in end markets, with consistent focus on technology innovation and customer support through all phases of the economic cycle has enabled the company to post solid results over the past few quarters. A sustained drive for geographic and market diversification has further helped Amphenol to expand its customer base and develop new applications.

In addition, Amphenol remains encouraged by its expanding presence in the fast-growing commercial aerospace market and is well positioned to capitalize on the proliferation of electronics content in next-generation planes. These advanced electronic systems also require new higher technology interconnect solutions to enhance fuel efficiency and improve passenger experience, all of which create excellent opportunities for the company.

Despite the uncertainties prevailing in the global economy, Amphenol has bullish revenue and earnings expectations. The ongoing revolution in electronics enables the company to capitalize on the opportunities and strengthen its position in the market. It also expects to leverage on the solid growth potential of the acquired companies to drive robust performance in the future.

For 2017, Amphenol currently expects sales in the range of $6,828 million to $6,868 billion, representing a year-over-year increase of 9%. The company expects adjusted earnings per share in the range of $3.19 to $3.21, an increase of 17-18% year over year. This represents a healthy improvement from the prior guidance of $6,620 million to $6,700 million in sales and adjusted earnings of $3.06 to $3.10 per share. The ongoing revolution in electronics enables Amphenol to capitalize on the opportunities and strengthen its position in the market. It also expects to leverage on the solid growth potential of the acquired companies to drive robust performance in the future.

Such a bullish outlook with continued growth impetus and core focus perhaps boosted investors’ confidence and catapulted its share price to a new 52-week high.

Other Stocks to Consider

Some other stocks worth considering in the same space are AMETEK, Inc. (NYSE:AME) , Arrow Electronics, Inc. (NYSE:ARW) and Methode Electronics, Inc. (NYSE:MEI) , each carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AMETEK has a long-term earnings growth expectation of 11.4%. It topped estimates thrice in the trailing four quarters with an average positive earnings surprise of 4.1%.

Arrow Electronics has a long-term earnings growth expectation of 11.4%. It topped estimates twice in the trailing four quarters with an average positive earnings surprise of 0.4%.

Methode Electronics has a long-term earnings growth expectation of 15%. It topped estimates in each of the trailing four quarters with an average positive earnings surprise of 14.5%.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Amphenol Corporation (APH): Free Stock Analysis Report

Methode Electronics, Inc. (MEI): Free Stock Analysis Report

Arrow Electronics, Inc. (ARW): Free Stock Analysis Report

AMTEK, Inc. (AME): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

These stocks provide a compelling case as safe-haven stocks in the face of an escalating trade war. Each company operates within sectors that are relatively resilient to economic...

When the market narrative becomes too widely accepted, excess seems to be created in some areas of the economy as businesses prepare for what’s coming their way. Today’s stock...

Markets are bouncing back as investors bet on technical support, tariff relief, and Germany’s stimulus plans. But with ISM and NFP data ahead, Fed rate cut bets could shift,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.