- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

American Tower (AMT) Misses On Q4 Earnings, Beats Revenues

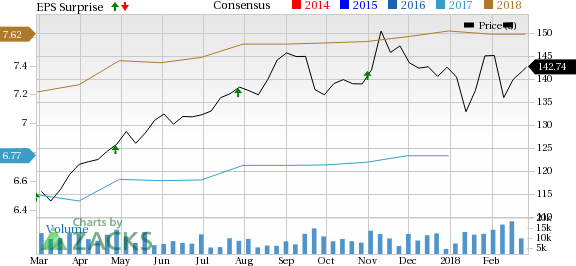

American Tower (NYSE:AMT) reported mixed results for the fourth quarter of 2017, wherein the top line outpaced the Zacks Consensus Estimate but the bottom line lagged the same.

Quarterly adjusted funds from operations (AFFO) came in at $707 million compared with $655 million in the year-ago quarter. AFFO per share came in at $1.59, which lagged the Zacks Consensus Estimate of $1.68.

Total revenues of $1,704.5 million increased 10.7% year over year, beating the Zacks Consensus Estimate of $1,692.1 million.

Operating Metrics

Adjusted EBITDA in the reported quarter was $1,031 million, up 10.2% from the prior-year quarter. Adjusted EBITDA margin was 60.5% in the reported quarter. Selling, general & administrative expenses totaled $171.1 million compared with $138.3 million in the year-earlier quarter. Operating income was $329 million compared with $489.3 million in the year-ago quarter.

Cash Flow and Liquidity

In the fourth quarter of 2017, American Tower generated $794 million of cash from operations, up 9.8% year over year. Free cash flow in the reported quarter was $548 million, up 7.2% year over year.

At the end of the reported quarter, the company had $802.1 million in cash and cash equivalents and around $19,430.3 million of outstanding long-term debt compared with $787.2 million and $18,294.7 million, respectively, at the end of December 2016.

Property Segment

Quarterly revenues grossed $1,678.3 million compared with $1,521.3 million in the year-ago quarter. Operating profit was $959 million and operating profit margin was 63% in the reported quarter.

Within the Property segment, revenues from the United States totaled $852 million, up 2.8% year over year. Total international revenues amounted to $670 million, up 58.6% year over year. Within this, revenues from Asia totaled $270 million, up 324.9% year over year. EMEA revenues grossed $134 million, up 8.1% year over year. Latin America revenues totaled $265 million, up 13.2% year over year.

Services Segment

Quarterly revenues totaled $26.2 million compared with $18.3 million in the year-ago quarter. Operating profit was $9 million and operating profit margin was 50% in the reported quarter.

Stock Repurchases and Distributions

During the fourth quarter of 2017, American Tower repurchased a total of 0.6 million shares of its common stock for $89 million under its stock repurchase program. The company repurchased a total of 6.1 million shares of its common stock for a total of $766 million during 2017. The company has $2.3 billion remaining under its existing stock repurchase programs.

In addition, the company paid $19 million in preferred stock dividends during the quarter under review and $91 million during 2017.

Outlook for 2018

For 2018, American Tower anticipates property revenues in the range of $6,930 to $7,120 million, reflecting growth of 7% at the midpoint. Net income is expected between $1,390 million and $1,470 million, reflecting growth of 16.7% at the midpoint. Adjusted EBITDA is anticipated in the range of $4,300-$4,400 million, reflecting midpoint growth of 6.4%. Consolidated AFFO is expected in the range of $3,160-$3,260 million, reflecting midpoint growth of 10.6%.

Zacks Rank

American Tower competes with some major wireless tower operators like Crown Castle International (NYSE:CCI) and SBA Communications (NASDAQ:SBAC) in the global wireless tower market. Currently, it is a Zacks Rank #4 (Sell) stock.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Release

Investors interested in the broader Finance sector are keenly awaiting earnings reports from key players, including Getty Realty Corp. (NYSE:GTY) , which is scheduled to report its fourth-quarter 2017 results on Feb 28.

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp (NYSE:FMC). and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2018 today >>

American Tower Corporation (REIT) (AMT): Free Stock Analysis Report

Crown Castle International Corporation (CCI): Free Stock Analysis Report

SBA Communications Corporation (SBAC): Free Stock Analysis Report

Getty Realty Corporation (GTY): Free Stock Analysis Report

Original post

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.