- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

American Outdoor Brands (AOBC) Misses Revenue Estimates, Stock Halted After Hours

American Outdoor Brands Corporation ( (NASDAQ:AOBC) ) just released its latest quarterly financial results, posting adjusted earnings of 9 cents per share and revenues of $157.4 million.

Currently, AOBC is a Zacks Rank #4 (Sell), but that could change based on today’s results. The stock was halted in after-hours trading ahead of its earnings release.

American Outdoor Brands:

Beat earnings estimates. The company posted non-GAAP earnings of $0.09 per share, beating the Zacks Consensus Estimate of $0.08.

Missed revenue estimates. The company saw revenue figures of $157.38 million, missing our consensus estimate of $173.83 million.

Total revenues were down about 32.6% year over year. Non-GAAP earnings were down from $0.66 per share in the prior-year period. GAAP net income was $0.21 per diluted share, down from $0.57 per share in the previous year.

“Our results for the third quarter reflected a continuation of challenging market conditions in the consumer market for firearms,” said CEO James Debney. “Lower shipments in our Firearms business were driven by a reduction in wholesaler and retailer orders versus the prior year, and were partially offset by double-digit revenue growth within our Outdoor Products and Accessories segment.”

American Outdoor Brands expects revenues in the range of $162 million to $166 million for the current quarter. Non-GAAP earnings are expected to be in the range of $0.09 to $0.11 per share. Our current Zacks Consensus Estimates are calling for earnings of $0.35 per share and revenues of $203 million.

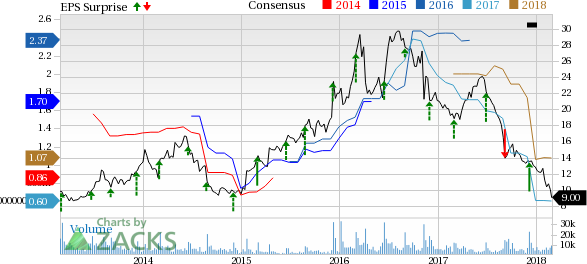

Here’s a graph that looks at AOBC’s recent earnings performance:

American Outdoor Brands Corporation is a manufacturer and seller of firearms and accessory products for the shooting, hunting and outdoor enthusiast. The company's product comprises pistols, revolvers, rifles, guns, handcuffs and firearm-related products and accessories. It sells its products under the brand name Smith & Wesson, M&P, Thompson/Centre and Performance Centre.

Check back later for our full analysis on AOBC’s earnings report!

Want more market analysis from this author? Make sure to follow @Ryan_McQueeney on Twitter!

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

American Outdoor Brands Corporation (AOBC): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Nvidia is scheduled to release its Q4 earnings report at 4:20PM ET on Wednesday. A call with CEO Jensen Huang is set for 5:00PM ET. The chipmaker’s results will serve as a...

Warren Buffett has always critiqued airline stocks for being overly capital-intensive, exhibiting low growth, and relying heavily on cyclical consumer travel patterns—further...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.