- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

American Eagle (AEO) Quiet Logistics Buyout Bolsters Logistics

American Eagle Outfitters (NYSE:AEO), Inc. AEO has successfully concluded the acquisition of one of the leading logistics companies, namely Quiet Logistics, and other strategic investments for $360 million in cash. Quiet Logistics has fulfillment centers in Boston, Chicago, Los Angeles, Dallas, St. Louis, and Jacksonville, which are likely to improve inventory efficiencies as well as generate cost benefits. Also, its affordable same-day and next-day delivery facilities bode well.

With this acquisition, Quiet Logistics will become a fully-owned subsidiary of American Eagle but operate its business independently. This move is part of its efforts to transform the supply chain and help expand AEO’s customer base as well as drive growth, particularly in its online channel. Prior to this, the company acquired logistics start-up AirTerra, which offers faster delivery at lower costs.

Speaking of the online platform, AEO has been witnessing strong digital demand on the back of expanded omnichannel capabilities. American Eagle’s digital revenues were up 10% year over year, while the same rose 42% from third-quarter fiscal 2019. It expanded same-day delivery services and customer self-checkout to more regions, boosted its virtual selling tool AE Live, and enhanced its e-gifting option.

What’s More?

American Eagle has been gaining from robust online demand and strength in the Aerie brand. It is progressing well with the Real Power, Real Growth value-creation plan. The plan is driving profitability through real estate and inventory optimization efforts, omni-channel and customer focus, and investments to improve the supply chain. This has led to impressive third-quarter fiscal 2021 results, wherein both earnings per share and revenues not only beat the Zacks Consensus Estimate but also improved year over year. This marked the sixth straight quarter of an earnings beat.

The Aerie brand has long been serving as a growth driver for American Eagle. Sales rose 28% year over year to $315 million for Aerie in third-quarter fiscal 2021 and surged more than 70% on a two-year basis. This marked the 28th consecutive quarter of double-digit growth for Aerie, driven by strong demand and higher full-price sales. The brand witnessed continued momentum across all categories, particularly for its new activewear brand OFFLINE. Robust demand in the legging business, which is one of its best-margin categories, along with strength in core intimates bralettes and apparel bodes well.

Management launched its largest integrated marketing campaign, Voices of AerieREAL. The company also opened 29 stand-alone and side-by-side Aerie stores, with a quarter of them being OFFLINE stores. Going ahead, the brand remains on track to reach the next brand milestone of $2 billion in sales, out of which it has already achieved $1 billion.

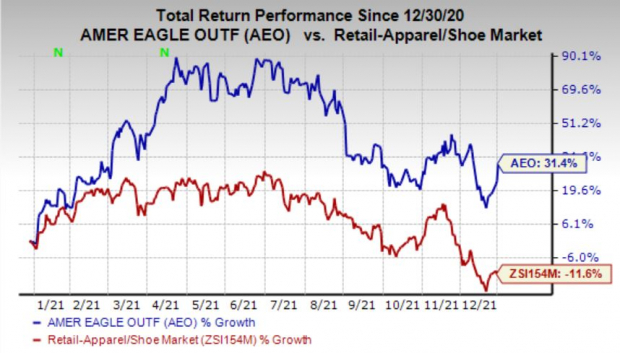

Driven by the above-mentioned factors, shares of the Zacks Rank #3 (Hold) company have gained 31.4% over a year against the industry’s 11.6% decline.

Yet, AEO continues to witness higher store payroll, store openings and rising advertising costs. In addition to this, elevated freight costs remain concerning. It expects $70-$80 million of freight-related expenses to impact fiscal fourth-quarter performance.

Here’s How Other Stocks Fared

We have highlighted three better-ranked stocks in the Retail - Wholesale sector, namely Boot Barn (NYSE:BOOT) Holdings BOOT, Tractor Supply Company (NASDAQ:TSCO) TSCO and Capri Holdings (NYSE:CPRI) CPRI.

Boot Barn Holdings — the lifestyle retailer of western and work-related footwear, apparel and accessories — currently sports a Zacks Rank #1 (Strong Buy). Shares of BOOT have skyrocketed 193.5% over a year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Boot Barn Holdings’ sales and earnings per share (EPS) for the current financial year suggests growth of 54.4% and 183.3%, respectively, from the year-ago reported figures. BOOT has a trailing four-quarter earnings surprise of 35.3%, on average.

Capri Holdings, which operates membership warehouses, presently flaunts a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 1024.9%, on average. Shares of CPRI have rallied 46.9% in the past year.

The Zacks Consensus Estimate for Capri Holdings’ sales and EPS for the current financial year suggests respective growth of 12.6% and 1.2% from the year-ago period’s reported figures. CPRI has an expected EPS growth rate of 56.4% for three-five years.

Tractor Supply, a rural lifestyle retailer in the United States, currently carries a Zacks Rank #2 (Buy). The company has a trailing four-quarter earnings surprise of 22.8%, on average. Shares of TSCO have surged 63.7% over a year.

The Zacks Consensus Estimate for Tractor Supply’s sales and EPS for the current financial year suggests growth of 19% and 23.9%, respectively, from the year-ago reported numbers. TSCO has an expected EPS growth rate of 9.6% for three-five years.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix (NASDAQ:NFLX) did to Blockbuster and Amazon (NASDAQ:AMZN) did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Eagle Outfitters, Inc. (AEO): Free Stock Analysis Report

Tractor Supply Company (TSCO): Free Stock Analysis Report

Boot Barn Holdings, Inc. (BOOT): Free Stock Analysis Report

Capri Holdings Limited (CPRI): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Related Articles

Investors are on edge about what tariff policy means for markets Coming off a strong Q4 earnings season, fresh February corporate sales figures can help assess the macro...

Broadcom stock is in a dynamic rebound phase. Markets seem optimistic ahead of the earnings release. Let's take a deep dive into what to expect from the report. Get the...

Consumers are feeling the pinch from inflation every time they go to the grocery store. Money is a zero-sum game; as disposable income and buying power erodes, consumers are...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.