- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

American Axle (AXL) Banks On Business Expansion, Acquisition

On Nov 13, we issued an updated research report on American Axle & Manufacturing Holdings, Inc. (NYSE:AXL) .

On Nov 3, American Axle reported adjusted earnings per share of 86 cents for third-quarter fiscal 2017 (ended Sep 30, 2017), beating the Zacks Consensus Estimate of 64 cents. Quarterly revenues jumped 71% year over year to $1.72 billion. Also, the top line surpassed the Zacks Consensus Estimate of $1.62 billion.

For fiscal 2017, the company expects sales within the range of $6.2-$6.25 billion compared with the previous projection of approximately $6.1 billion. The raised range is also higher than $3.95 billion, recorded last year.

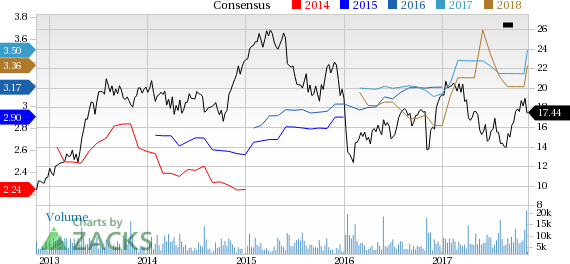

American Axle & Manufacturing Holdings, Inc. Price and Consensus

Adjusted earnings before income taxes, depreciation and amortization (EBITDA) are expected to be approximately $1.1 billion in 2017. American Axle reiterated its guidance for adjusted free cash to be approximately 5% of sales in 2017.

With an aim to generate incremental revenues, the company is undertaking various strategies to diversify its business and customer base, including its latest innovative driveline products and solutions. American Axle assumes that its driveline solutions will cater to customers’ high demand for advanced technologies, leading to greater profitable growth.

Earlier in April, the company had completed the acquisition of Metaldyne that will enable it to expand its operating scale, customer base and the end market. Further, optimization of the company’s operating structure, elimination of redundant costs and purchasing leverage advantages will help American Axle generate an estimated annual run rate cost synergies of $100-$120 million by 2018.

The stock has seen the Zacks Consensus Estimate for quarterly earnings being revised 5.6% upward to 75 cents over the last 30 days.

Price Performance

Shares of American Axle have gained 21.9% year to date, outperforming the 9.8% rise of the industry it belongs to.

Zacks Rank & Other Stocks to Consider

American Axle sports a Zacks Rank #1 (Strong Buy). A few other top-ranked companies in the auto space include Navistar International Corp. (NYSE:NAV) , AB Volvo (OTC:VLVLY) and Allison Transmission Holdings, Inc. (NYSE:ALSN) , each sporting the same bullish Zacks Rank of 1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Navistar has an expected long-term growth rate of 5%.

Volvo has an expected long-term growth rate of 15%.

Allison Transmission has an expected long-term growth rate of 10%.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

American Axle & Manufacturing Holdings, Inc. (AXL): Free Stock Analysis Report

Navistar International Corporation (NAV): Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN): Free Stock Analysis Report

Volvo Ab (VLVLY): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The big US stocks dominating markets and investors’ portfolios just finished another earnings season. They reported spectacular collective results including record sales, profits,...

“Quality” stocks with strong fundamentals tend to be rewarding places to stash hard-earned money. Since 2009, investing in a basket of quality stocks over a standard index has...

Palantir Technologies (NASDAQ:PLTR) continues to sell off. On March 6, PLTR stock fell over 10% on nearly double the daily volume, bringing its 30-day decline to over 27%. A drop...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.