- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

AMD's Processors To Power Microsoft Azure Virtual Machines

Advanced Micro Devices, Inc. (NASDAQ:AMD) recently announced that its second generation EPYC processors and Radeon Instinct MI25 GPUs have been adopted by Microsoft’s (NASDAQ:MSFT) Azure division to power its NVv4 virtual machines (VMs).

AMD’s hardware will enable Azure to provide customers with a cloud based virtual desktop capable of handling memory and graphics intensive as well as high-performance computing workloads.

Notably, Azure is one of the most popular cloud platforms in the industry. Per Canalys data, the platform had a market share of 17.6% as of fourth-quarter 2019, trailing only AWS, which dominates the market with share of 32.4%.

As a result, the deal win is expected to boost AMD’s revenues in the coming days and strengthen its position against likes of Intel (NASDAQ:INTC) and NVIDIA (NASDAQ:NVDA) in the highly competitive computer hardware market.

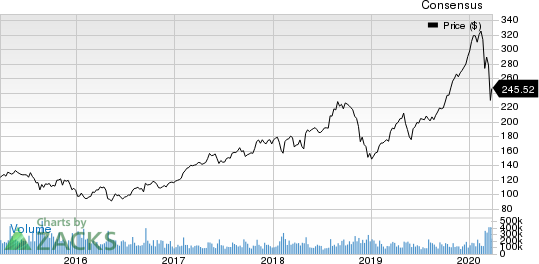

Advanced Micro Devices, Inc. Price and Consensus

Client Wins to Drive Top-Line Growth

AMD has witnessed robust adoption of its EPYC processors in the past few years. Notably, the company already has a deal with Amazon (NASDAQ:AMZN) to power the AWS’ Elastic Compute Cloud (EC2) instances.

More recently, the company’s Zen 4 architecture based EPYC CPUs and Instinct GPUs were adopted by the Lawrence Livermore National Laboratory to be implemented in its El Capitan exascale class supercomputer.

Moreover, Google (NASDAQ:GOOGL) cloud recently announced that the beta of its N2D VMs on the Google Compute Engine will be powered by AMD’s EPYC CPUs.

These major deal wins highlight a positive trend for the company’s processors and GPUs and are expected to drive top-line growth in the days ahead.

Notably, the company’s revenues grew 50% in the fourth quarter of 2019 and the trend is likely to continue, driven by rapid growth in the cloud computing market, which is expected to witness a CAGR of 30.6% by 2024 per MarketWatch data.

Wrapping Up

AMD is well poised to benefit from accelerated adoption of its products in the PC, gaming and data center industries. Moreover, the growing clout of GPUs driven by increasing adoption of AI techniques and ML tools in industries like automotive and blockchain remains a tailwind.

However, growing uncertainty in the market due to the global coronavirus pandemic could turn out to be a roadblock for AMD’s growth. Also, increasing expenses on product development are expected to keep margins under pressure.

Zacks Rank

AMD currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.5% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Microsoft Corporation (MSFT): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Intel Corporation (INTC): Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Nvidia is scheduled to release its Q4 earnings report at 4:20PM ET on Wednesday. A call with CEO Jensen Huang is set for 5:00PM ET. The chipmaker’s results will serve as a...

Warren Buffett has always critiqued airline stocks for being overly capital-intensive, exhibiting low growth, and relying heavily on cyclical consumer travel patterns—further...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.